Līdzīgi raksti

Car as an Expense for Self-Employed

A car may be one of the most popular expenses for self-employed person’s economic activity. Get all the essential information to correctly categorize car expenses as business expenditures!

12. October, 2023

Read

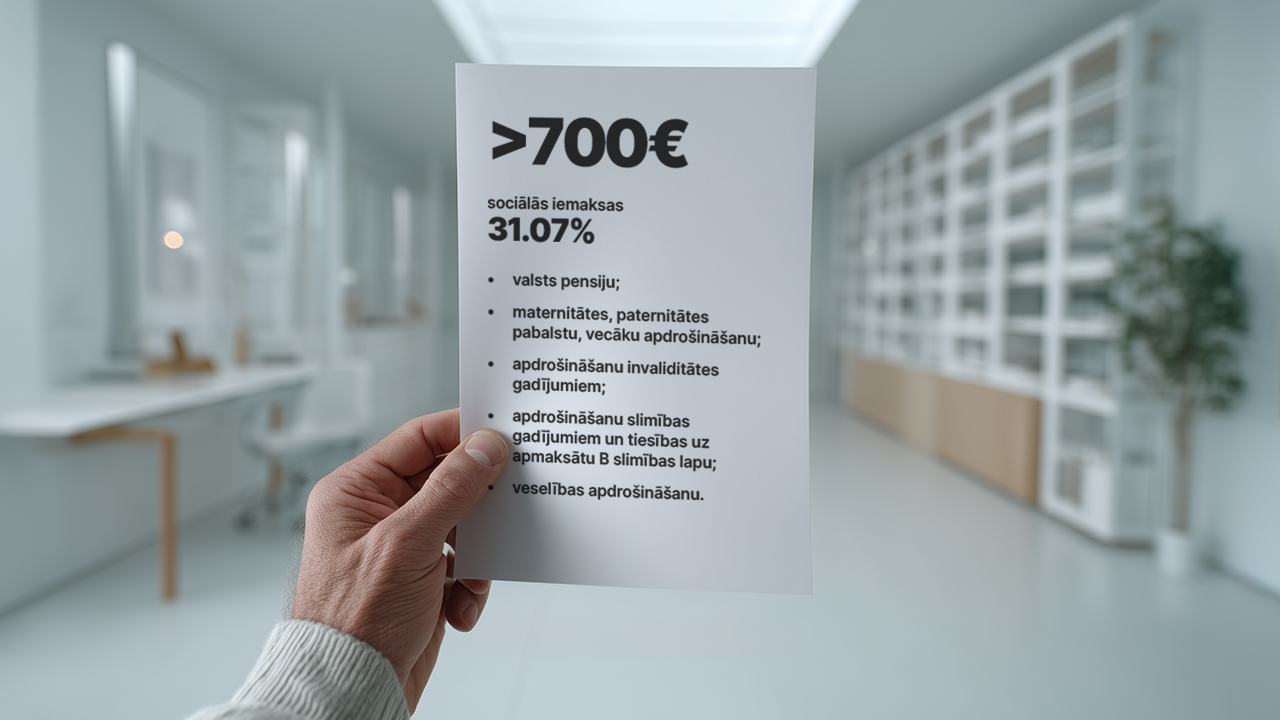

Amendments in Taxation Policies for 2025: What Self-Employed and Micro-Enterprise Tax Payers Need to

The new year will bring a series of significant tax changes that will also affect entrepreneurs – self-employed individuals and micro-enterprise tax (MUN) payers. We have compiled the most important information – take a look and be ready for 2025!

10. December, 2024

Read

Can a Self-Employed Receive Unemployment Benefits?

There are various situations in which a self-employed might need unemployment benefits. For example, in the early stages of entrepreneurial activity, a self-employed may not have a stable income or may have no income at all, leading to thoughts about applying for unemployment benefits. There are also cases where a self-employed individual recently ended an employment relationship, applied for unemployment benefits, and simultaneously wants to start a business. Can a self-employed receive benefit

11. September, 2024

Read

Is VAT Registration Required When Importing Goods?

Reader asks:

An individual – a self-employed person who is a personal income tax payer – makes jewelry.

They purchase the necessary materials (beads, hooks, and threads) from online platforms such as Temu.com and Etsy.com.

In such a case, is it necessary to register as a value-added tax (VAT) payer?

Is VAT registration required in Latvia if the materials are purchased from countries outside the European Union (EU)?

21. August, 2024

Read

How can a courier register as a self-employed?

Are you already working or planning to work as a food delivery courier via online platforms? Then this article is for you! We’ve gathered all the essential information about the requirements that must be met to work legally as a food delivery courier.

13. June, 2025

Read