Affordable price and tax advice

Automated reports, convenient adding of income and expense

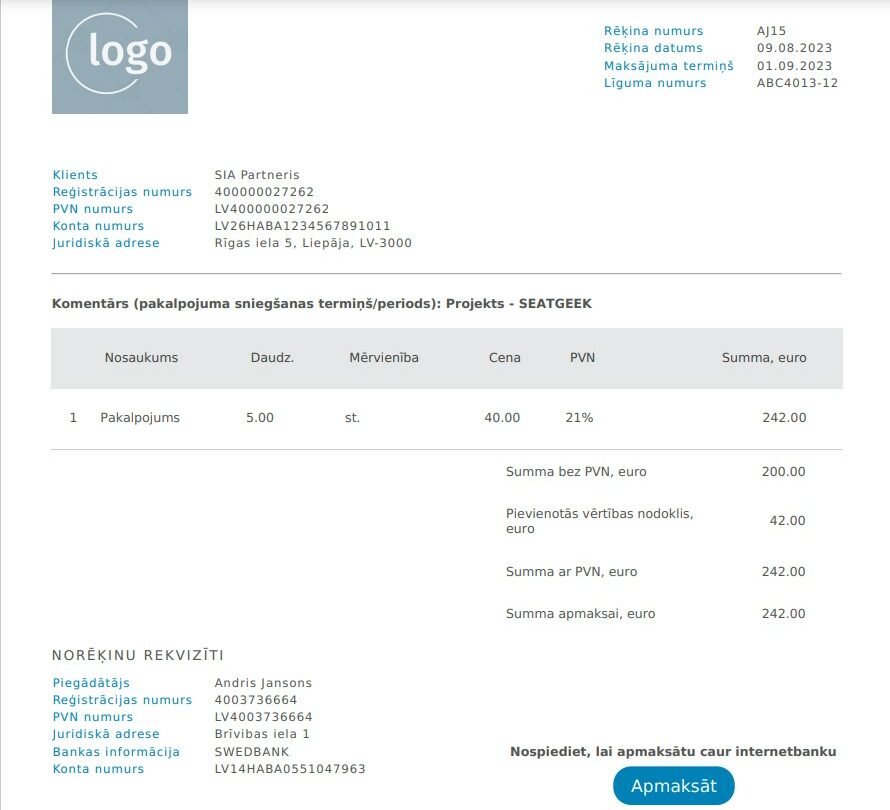

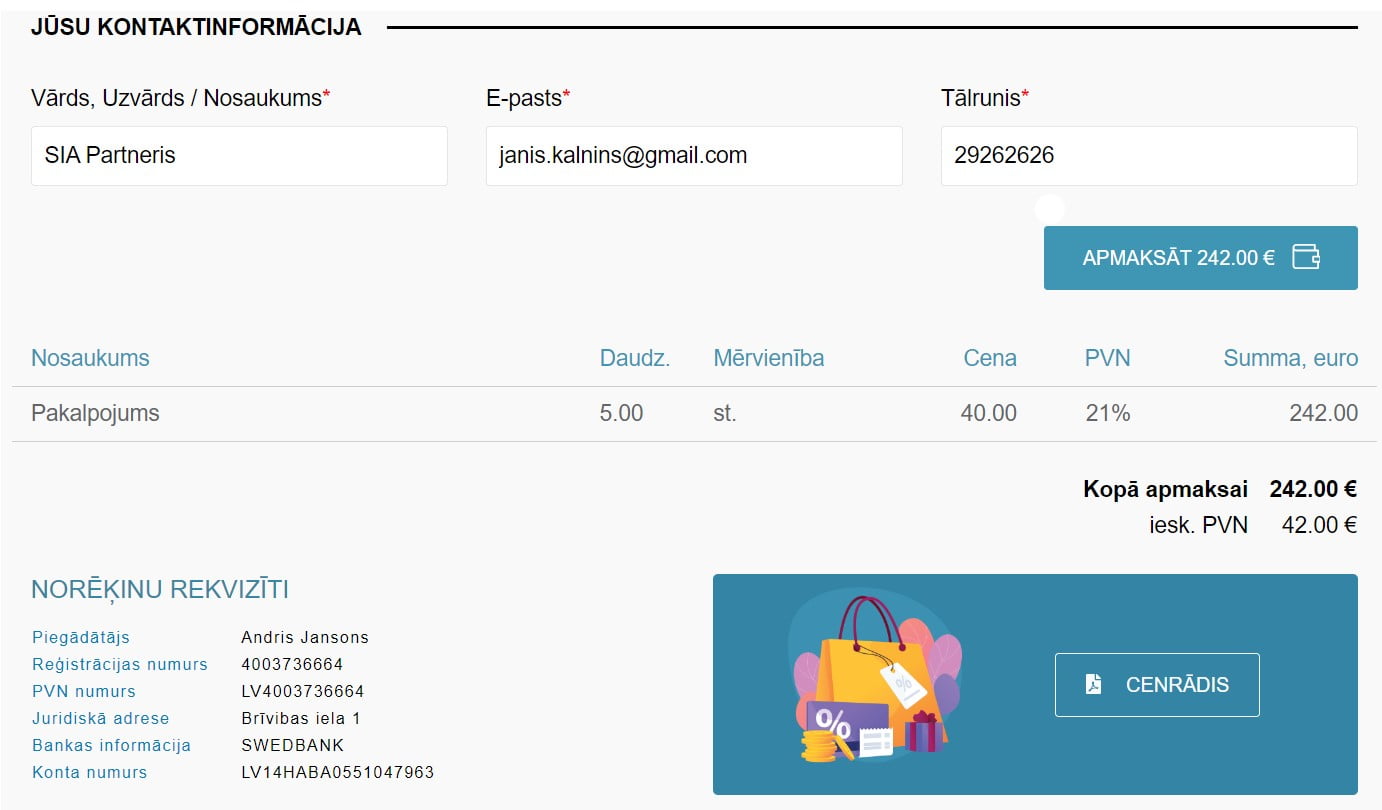

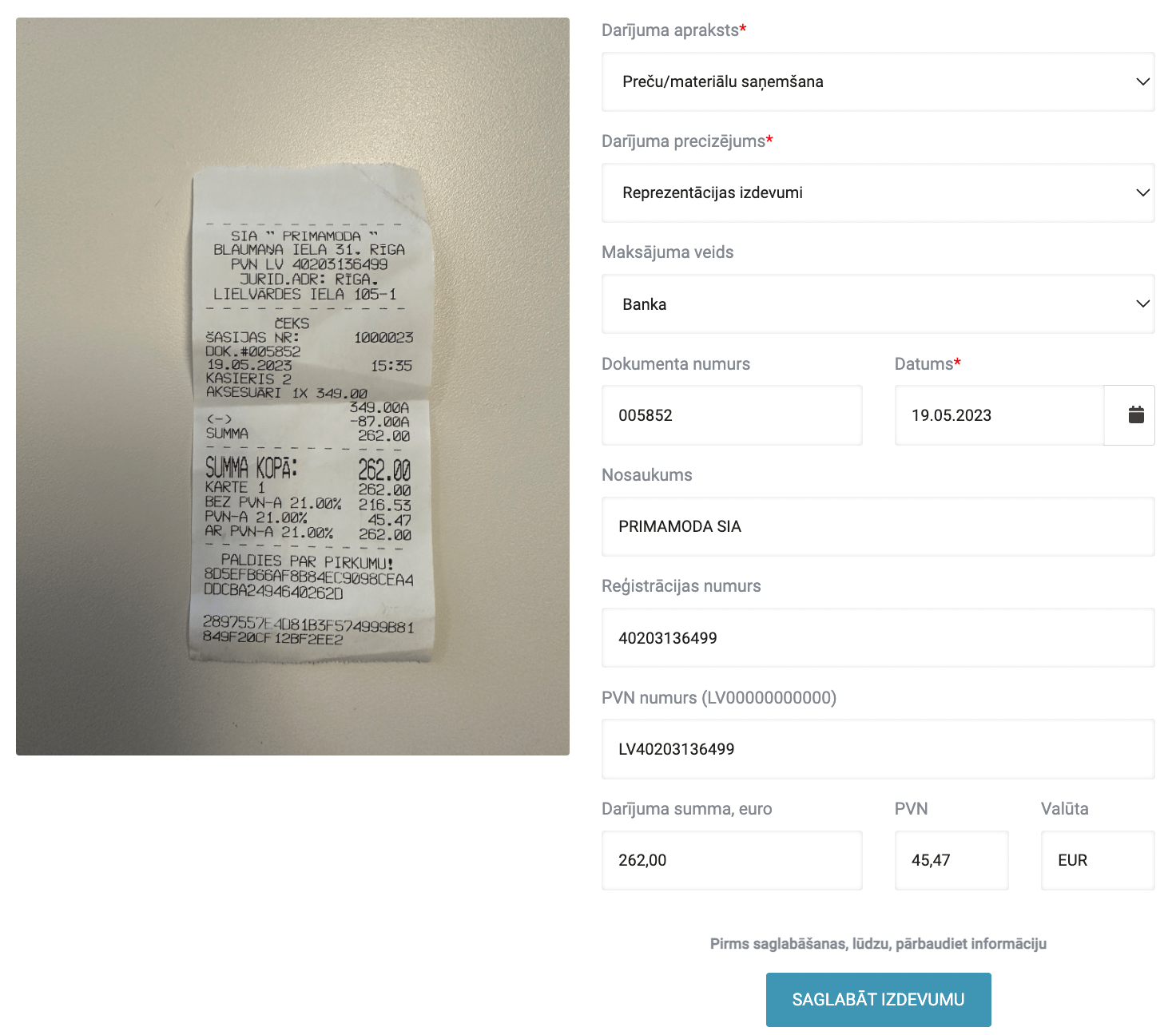

Issue invoices, photograph your receipts, connect to the bank

Issue invoices, photograph your receipts, connect to the bank

Automated reports, convenient adding of income and expense

Affordable price and tax advice

Paldies par Jūsu darbu un produktu! Jūs pat iedomāties nevarat, cik ļoti atvieglojat manu dzīvi un nervu sistēmu ar PATS.LV. Paldies, ka esat!

"Pats.lv has a good interface and the reports for the EDS, which I don’t need to prepare manually. And the economic activity journal, which is filling in automatically. I like it so much that I can send a bill straight from the system, and I can import bank data from file."

"Accounting seemed to be out of space for me, and where one can find a good accountant who will explain everything to me. But then I saw an ad on Instagram about Pats.lv, and that was one big punch to start my own business, I realised I can do everything myself!"

“Periodā, kad man bija ļoti daudz darba, jutos nogurusi, ieraudzīju Pats.lv ierakstu un nolēmu, ka varbūt tomēr jāpamēģina. Izmēģināju 7 dienas, tad paņēmu lētāko komplektiņu – ja nu tomēr ilgtermiņā nenoderēs. Šobrīd varu teikt – man patīk, ka visu izrēķina manā vietā. Es arī redzu, ka šī programma manā vietā varētu izdarīt vairāk, tāpēc plānoju drīzumā pāriet uz Pro komplektu, lai ietaupītu vēl vairāk sava laika.”

"Even though I like numbers, I have no clue about the accounting. So, choosing Pats.lv, which helps to solve the problem at a cost of a cup of coffee per month, was a natural step I could not avoid."

"The accounting is easy, you just need to take one consultation with an accountant about the receipts, etc., and prepare the reports in pats.lv system. You have made it all so simple there, and that support chat really eases my life. And a special THANKS for the blog!"

“Pirmo reizi bija iespēja izmēģināt , kā darbojas portāls PATS.LV, ņemot vērā, ka iepriekš visas atskaites VID sniedza grāmatvedis, līdz ar to saprašanas par savas saimnieciskās darbības atskaišu izgatavošanu un finanšu pārvaldību īsti nebija. Sistēma ir viegli saprotama un darboties tajā un vadīt datus man grūtības nesagādāja. Patīk , ka sistēmā viss ir pārredzams un visa vajadzīga finanšu plūsmas informācija ir viegli izsekojama, tas ir, visi ienākumi un izdevumi, kā arī peļņa ir redzami savā profilā . Datu ievadīšana ir vienkārša , atskaišu sagatavošana – dažu “klikšķu” attālumā, kā arī rēķinu izrakstīšana ir pieejama uzreiz sistēmā. Viens no lielākajiem plusiem ir tas, ka sistēmai var piekļūt no jebkuras pasaules vietas, vajadzīgs ir tikai internets. Šāda veida sistēmu iepriekš nekur nebiju redzējusi, tas ir liels atvieglojums tādiem pašnodarbinātajiem, kuriem nav laika ilgi sēdēt pie datora. Šī sistēma noteikti atvieglo un saīsina iztērēto laiku, līdz ar to, varam iegūt vairāk laika savai saimnieciskajai darbībai un radošajiem projektiem. Noteikti iesaku vismaz pamēģināt!”

“Mani patīkami pārsteidza jaunumi PATS.LV, ka tagad es varu nofotografēt čeku un sistēma automātiski to ievadīs saimniecības darbības žurnālā. Tas ir ļoti ērti, jo man ir daudz čeku, ko es varu norakstīt.”

“PATS.LV sistēma ir devusi man krietni lielāku izpratni par to, kā pārvaldīt sava biznesa finanses un tām sekot līdzi, ņemot vērā valsts nodokļu sistēmu. Sistēma ir ļoti pārdomāta. Man personīgi visvairāk uzrunā tas, ka ir pieejamas atskaites un visi gada mēneši, kur ir atzīmētas nepieciešamās nodokļu apmaksas. Sistēma rada man skaidrību par to kas, kad un cik ir jāapmaksā nodokļos. Protams, pati rēķinu izrakstīšanas, ieņēmumu un izdevumu ievades sistēma ir ļoti skaidra un saprotama. Pats.lv sistēma man personīgi ir ļoti atvieglojusi darbu ikdienā, kā arī šī sistēma ļoti labi sadarbojas kopā ar manu grāmatvedi, arī viņai atvieglojot darbu. No sirds pateicos!”

Register of transactions starting from current month

Issuing 5 invoices total

Scanning 5 receipts per month

5 invoices and payment requests total

Adding transaction history starting from 2019

Generating unlimited number of invoices

Scanning unlimited number of receipts

5 invoices and payment requests total

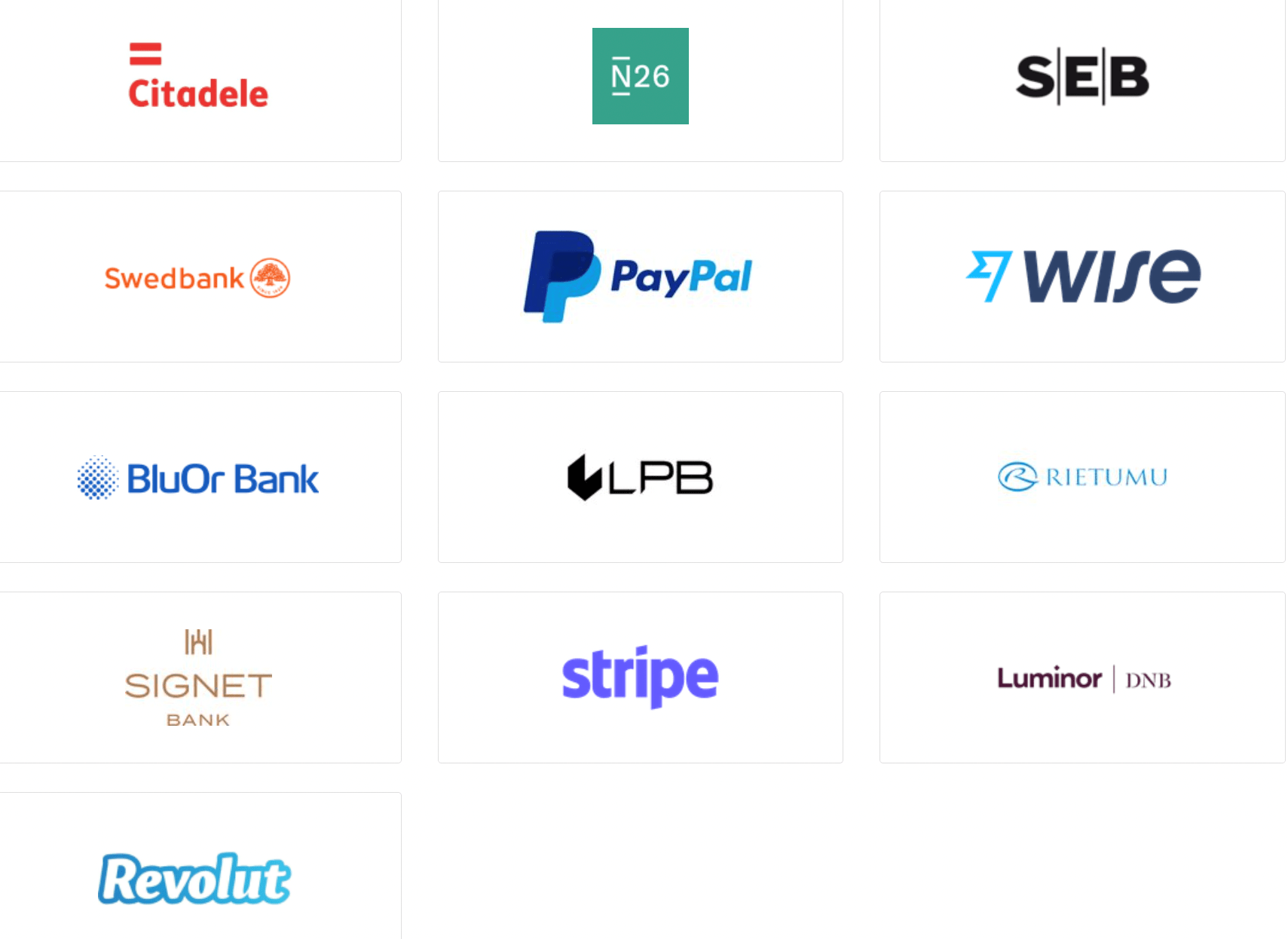

Linked bank account for automated upload of bank statements

Depreciation of fixed assets

Analytical tips for writing off expenses

Adding transaction history starting from 2019

Generating unlimited number of invoices

Scanning unlimited number of receipts

40 bills and payment requests per month

Linked bank account for automated upload of bank statements

Depreciation of fixed assets

Analytical tips for writing off expenses

Questions to an expert

Register of transactions starting from current month

Issuing 5 invoices total

Scanning 5 receipts per month

5 invoices and payment requests total

Adding transaction history starting from 2019

Generating unlimited number of invoices

Scanning unlimited number of receipts

5 invoices and payment requests total

Linked bank account for automated upload of bank statements

Depreciation of fixed assets

Analytical tips for writing off expenses

Adding transaction history starting from 2019

Generating unlimited number of invoices

Scanning unlimited number of receipts

40 bills and payment requests per month

Linked bank account for automated upload of bank statements

Depreciation of fixed assets

Analytical tips for writing off expenses

Questions to an expert

Adding transaction history starting from 2019

Generating unlimited number of invoices

Scanning unlimited number of receipts

5 invoices and payment requests total

Linked bank account for automated upload of bank statements

Depreciation of fixed assets

Analytical tips for writing off expenses

Register of transactions starting from current month

Issuing 5 invoices total

Scanning 5 receipts per month

5 invoices and payment requests total

Adding transaction history starting from 2019

Generating unlimited number of invoices

Scanning unlimited number of receipts

40 bills and payment requests per month

Linked bank account for automated upload of bank statements

Depreciation of fixed assets

Analytical tips for writing off expenses

Questions to an expert

Adding transaction history starting from 2019

Generating unlimited number of invoices

Scanning unlimited number of receipts

5 invoices and payment requests total

Linked bank account for automated upload of bank statements

Depreciation of fixed assets

Analytical tips for writing off expenses

Register of transactions starting from current month

Issuing 5 invoices total

Scanning 5 receipts per month

5 invoices and payment requests total

Adding transaction history starting from 2019

Generating unlimited number of invoices

Scanning unlimited number of receipts

40 bills and payment requests per month

Linked bank account for automated upload of bank statements

Depreciation of fixed assets

Analytical tips for writing off expenses

Questions to an expert

Based on the information entered by the user, the system automatically accounts the amounts of the mandatory state social insurance contributions, VAT, as well as prepares the necessary tax reports – quarterly reports of the self-employed, VAT declarations, microenterprise tax declarations, as well as generates the journal of the income and expenses of the economic activity.

All the important information about the taxes is available on our website – in videos and blog articles. However, Individual training and tax assistance are able to receive at Premium rate.

Should you have any questions or problems using PATS.LV system, do not hesitate to message us on [email protected] or in Facebook live chat. We respond as soon as the question is reviewed, usually it takes no more than one business day.

New users are offered an individually generated PROMO code upon registration, which can be used until the end of the day to purchase a subscription with a 25% discount in the Subscriptions page.

In accordance with the effective version of the Terms of Use of the system, should the user fail to pay for the use of the system, then the user’s access to the system’s functions will be limited, leaving only the possibility to log in, make the payment and access the information already entered before the restrictions came into force (reading, editing, exporting the information).

This set of functions will be available to the user for 90 days after the grace period or the subscription ends. The user should make the payment for the service during this period.

Should the user fail to pay for the service within the said period, their profile will be available for such user for another 90 calendar days, but solely for purchasing the subscription and paying for it. If the user does not renew their subscription within these 90 calendar days, their profile will be blocked after the said deadline and the contractual relationships with this user shall be terminated, and after another 10 calendar days the user’s profile will be deleted.

After the profile is deleted, all data contained within will be deleted as well.

One cannot register as a legal entity, but one can register as an accountant who provides services to self-employed. Please click on this link:

PATS.LV system is designed for various forms of registered economic activity:

– pašnodarbinātām personām kas reģistrējās VID

– individuāliem komersantiem, kas reģistrējās UR

– saimnieciskās darbības veicējiem (gan pašnodarbinātiem, gan IK) ar MUN statusu.

Yes, you can connect the system to your bank account.

Unfortunately, there is currently no such connection, but it is known that the SRS is currently actively working on creating such an opportunity. Currently, you have to manually download the report from the system and upload it into the EDS system.

The data will remain there even after the trial period ends. Please note that after the trial period, you will be able to correct these historical transactions only after a new payment has been made.

Yes, there is.