Analytics, based on data from over

1 million transactions helps you

make timely decisions

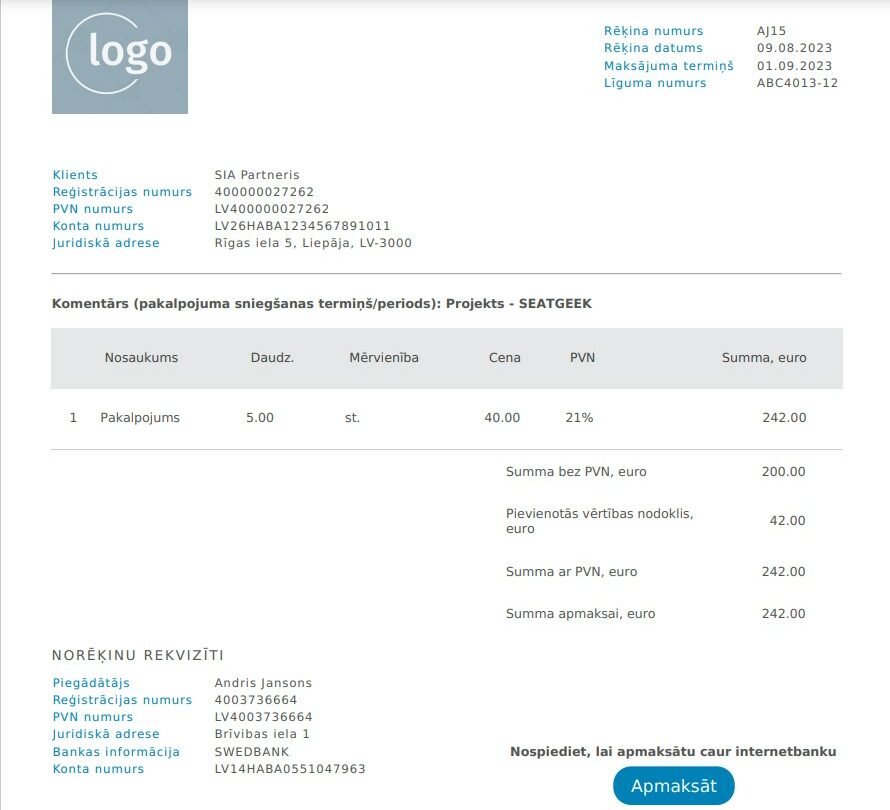

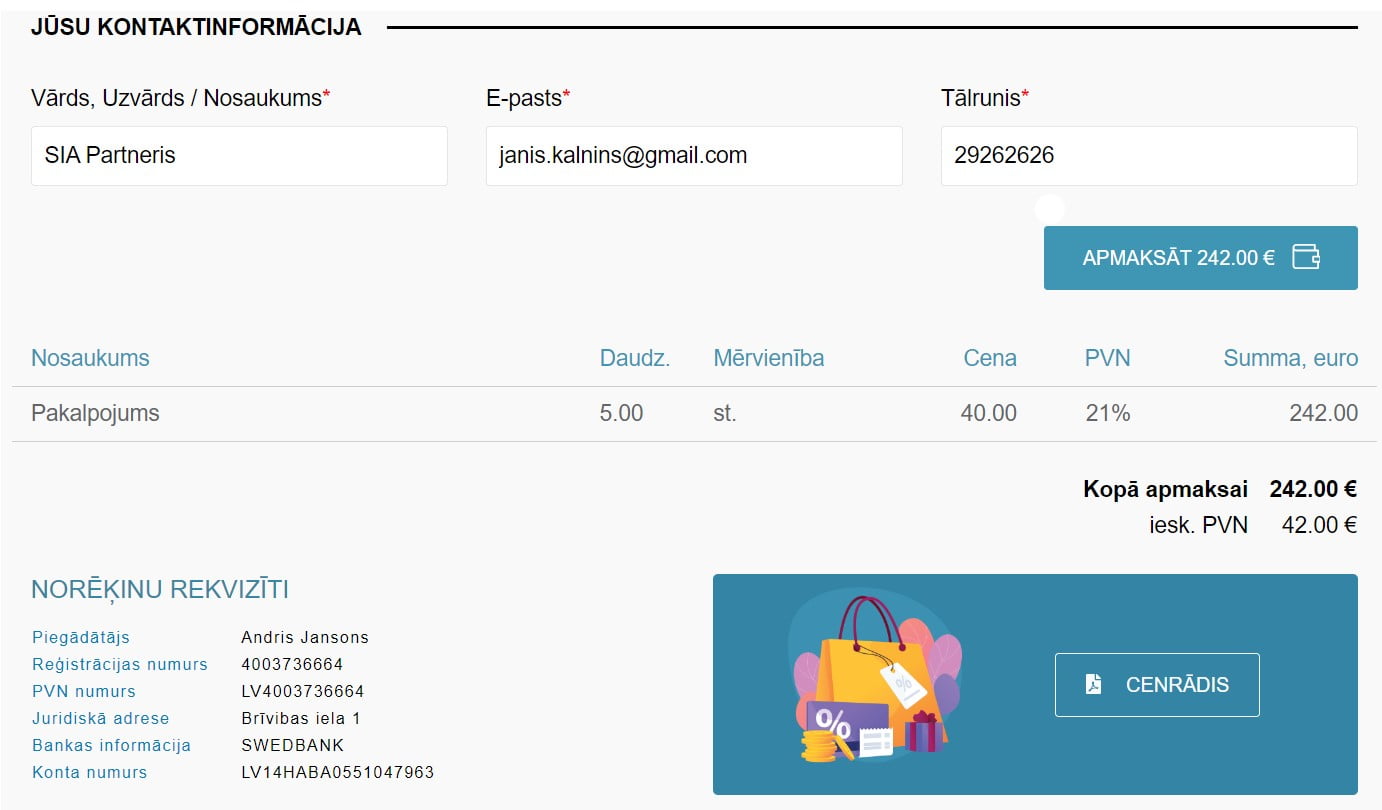

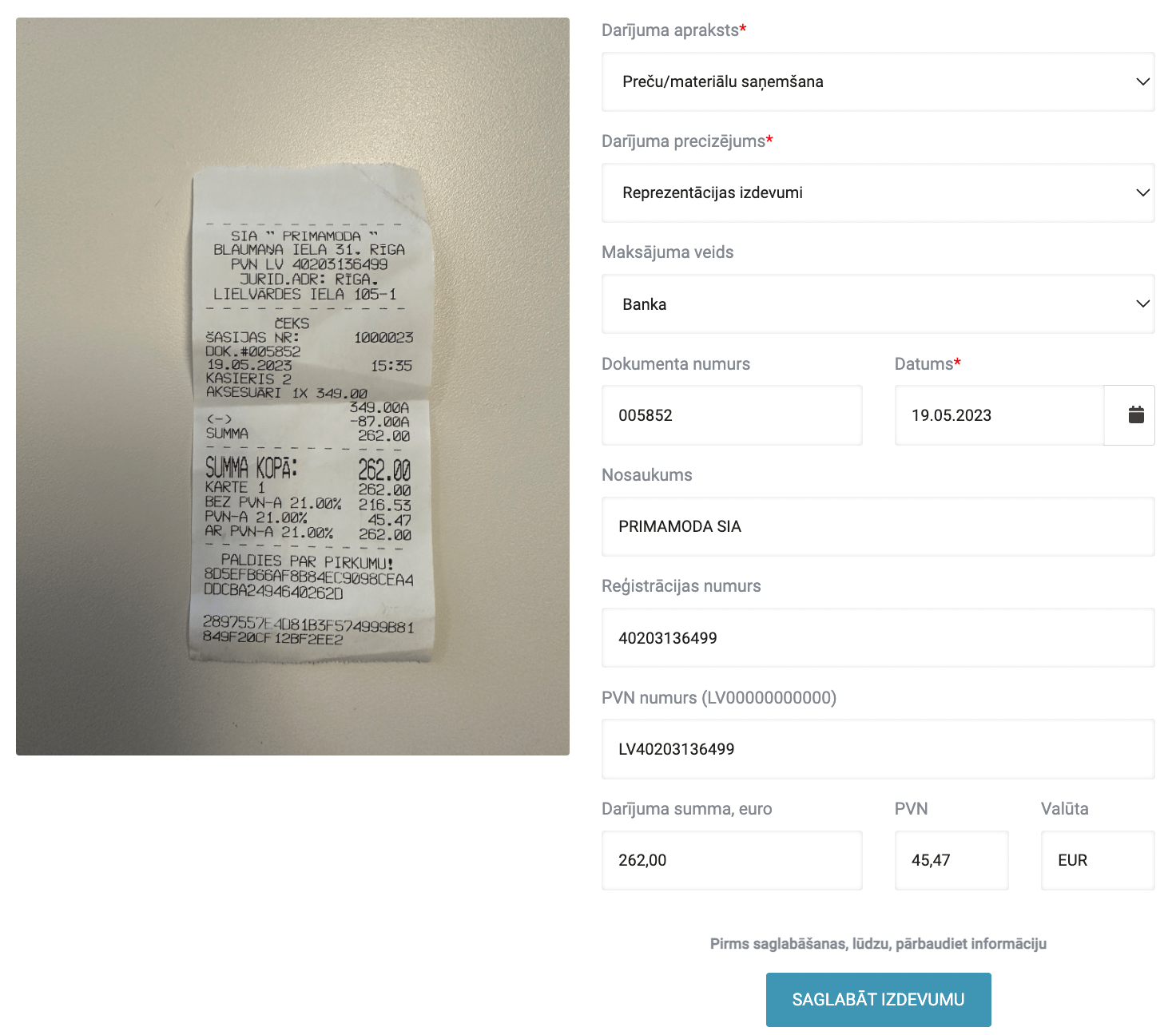

Minimized double or manual data entry, as well as verification of client-added records and automatically generated reports without delays

Up-to-date and complete bank account

statements and supporting documents

are always available

Based on the information entered by the user, the system automatically accounts the amounts of the mandatory state social insurance contributions, VAT, as well as prepares the necessary tax reports – quarterly reports of the self-employed, VAT declarations, microenterprise tax declarations, as well as generates the journal of the income and expenses of the economic activity.

All the important information about the taxes is available on our website – in videos and blog articles. However, Individual training and tax assistance are able to receive at Premium rate.

Should you have any questions or problems using PATS.LV system, do not hesitate to message us on [email protected] or in Facebook live chat. We respond as soon as the question is reviewed, usually it takes no more than one business day.

New users are offered an individually generated PROMO code upon registration, which can be used until the end of the day to purchase a subscription with a 25% discount in the Subscriptions page.

In accordance with the effective version of the Terms of Use of the system, should the user fail to pay for the use of the system, then the user’s access to the system’s functions will be limited, leaving only the possibility to log in, make the payment and access the information already entered before the restrictions came into force (reading, editing, exporting the information).

This set of functions will be available to the user for 90 days after the grace period or the subscription ends. The user should make the payment for the service during this period.

Should the user fail to pay for the service within the said period, their profile will be available for such user for another 90 calendar days, but solely for purchasing the subscription and paying for it. If the user does not renew their subscription within these 90 calendar days, their profile will be blocked after the said deadline and the contractual relationships with this user shall be terminated, and after another 10 calendar days the user’s profile will be deleted.

After the profile is deleted, all data contained within will be deleted as well.

One cannot register as a legal entity, but one can register as an accountant who provides services to self-employed. Please click on this link:

PATS.LV system is designed for various forms of registered economic activity:

– pašnodarbinātām personām kas reģistrējās VID

– individuāliem komersantiem, kas reģistrējās UR

– saimnieciskās darbības veicējiem (gan pašnodarbinātiem, gan IK) ar MUN statusu.

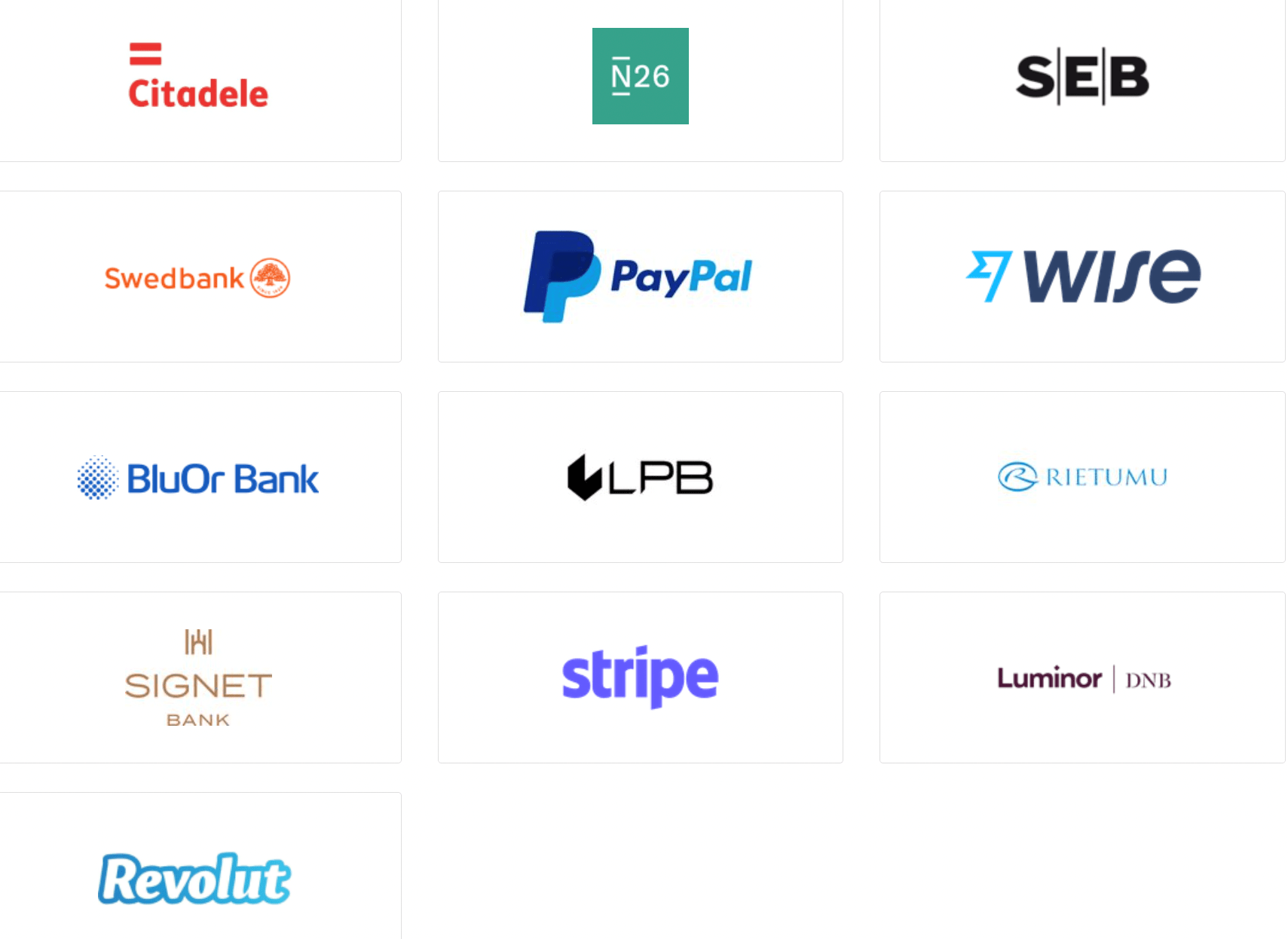

Yes, you can connect the system to your bank account.

Unfortunately, there is currently no such connection, but it is known that the SRS is currently actively working on creating such an opportunity. Currently, you have to manually download the report from the system and upload it into the EDS system.

The data will remain there even after the trial period ends. Please note that after the trial period, you will be able to correct these historical transactions only after a new payment has been made.

Yes, there is.