Līdzīgi raksti

Purchase of Goods and Expense Registration for a Self-Employed VAT Payer

Pats.lv users and self-employed individuals often approach us with valuable questions. We’re sharing an answer to one of them – it might be useful for you too, to ensure proper expense reporting in your business activity journal!

Question from a self-employed person:

I want to purchase a phone for business purposes for EUR 800.

On the seller’s website, there is an option to display the price without VAT.

As a self-employed person with VAT payer status, can I purchase this phone at the price wit

12. November, 2024

Read

Can jointly e-signed documents be used separately?

Reader asks: It is possible to include several documents in an eDoc package that need to be signed with a single e-signature. Can the documents signed together in such a package be used individually?

21. May, 2024

Read

Can a Self-Employed Receive Unemployment Benefits?

There are various situations in which a self-employed might need unemployment benefits. For example, in the early stages of entrepreneurial activity, a self-employed may not have a stable income or may have no income at all, leading to thoughts about applying for unemployment benefits. There are also cases where a self-employed individual recently ended an employment relationship, applied for unemployment benefits, and simultaneously wants to start a business. Can a self-employed receive benefit

11. September, 2024

Read

What should a self-employed individual know about hiring employees?

When a small self-employed business starts gaining momentum, with an increasing number of clients and work, the need for additional help - employees - often arises. Can a self-employed person hire employees? What needs to be considered? Here are some tips, based on frequently asked questions.

3. July, 2024

Read

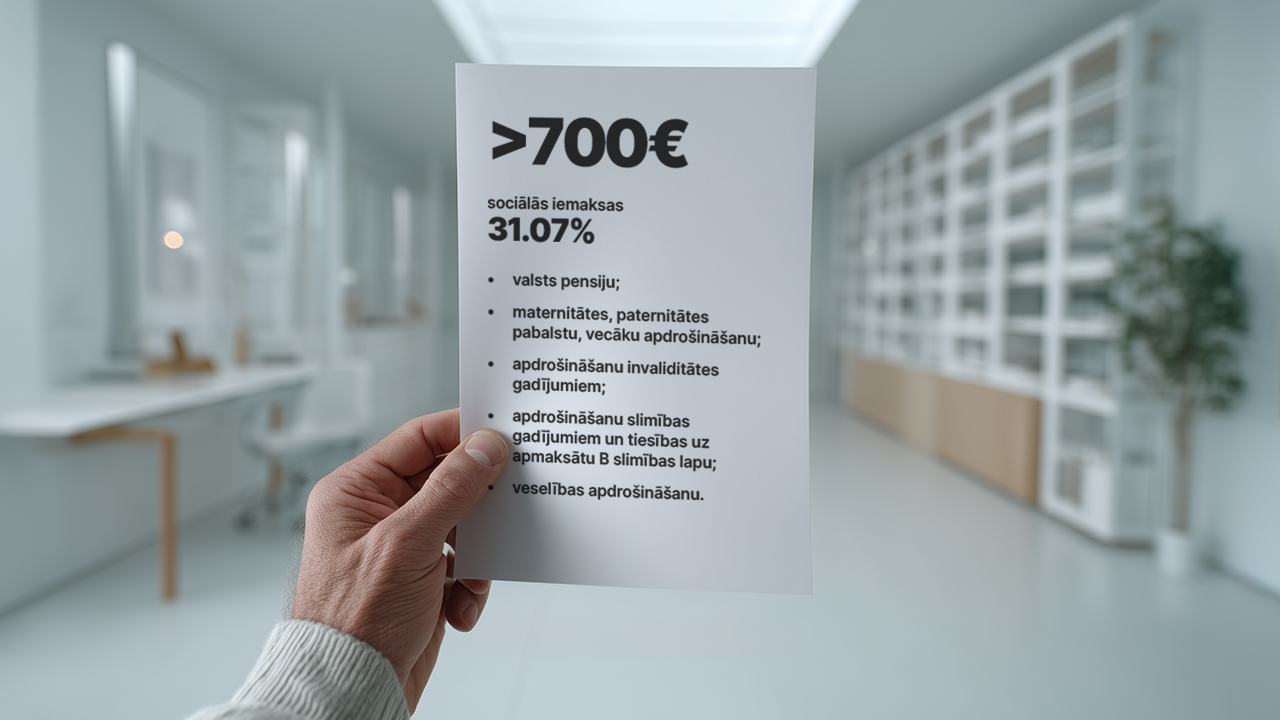

Amendments in Taxation Policies for 2025: What Self-Employed and Micro-Enterprise Tax Payers Need to

The new year will bring a series of significant tax changes that will also affect entrepreneurs – self-employed individuals and micro-enterprise tax (MUN) payers. We have compiled the most important information – take a look and be ready for 2025!

10. December, 2024

Read