Gada ienākumu deklarācija

GID iesniegšana saimnieciskās darbības veicējiem un pašnodarbinātajiem ir obligāta. GID par iepriekšējo gadu ir jāiesniedz no 1. marta līdz 1. jūnijam, bet, ja gada ienākumi pārsniedz 78 100 eiro, tad no 1. aprīļa līdz 1. jūlijam. Pašnodarbinātajiem GID iesniegšanai VID EDS jāaizpilda D3 aile

Pāris mājasdarbi, kas jāveic, lai veiksmīgi sagatavotos:

- atceries, ka ir atcelta norma, kura noteica, ka, iesniedzot GID, izdevumi tiek atzīti ne vairāk kā 80% apmērā no kopējiem saimnieciskās darbības ieņēmumiem. Atbilstoši jaunajiem noteikumiem izdevumi vairs nav jādala pilna apmēra un ierobežotos izdevumus, bet saimnieciskās darbības žurnālā jāraksta kopā. Par izmaiņām vairāk lasi šeit.

- sniedzot 2022. gada deklarāciju 2023. gadā, sociālās iemaksas būs attiecināmas uz attaisnojuma izdevumiem. Šo izdevumu uzskaitei būs paredzēta atsevišķa aile, taču šo izmaiņu izstrāde vēl ir procesā un atbilstoši tiks grozīti MK noteikumi nr. 622, par ko drīzumā informēsim.

- Lai aprēķinātu ar IIN apliekamo ienākumu, savlaicīgi jāveic izdevumu precizēšana, lai aprēķinātu, kuri izdevumi neattiecas uz konkrētā gada ieņēmumiem un nav vērā ņemami. Par to vairāk lasi šeit.

Deklarācijā aprēķinātā IIN iemaksas vienotajā nodokļu kontā jāveic līdz 23. jūnijam. Ja nodokļu summa pārsniedz 640 eiro, tad to var dalīt trīs maksājumos: līdz 23. jūnijam, 23. jūlijam un 23. augustam, katrā reizē iemaksājot trešo daļu no summas. Ja gada ienākumu summa pārsniedz 78 100 eiro, tad nodoklis jāmaksā līdz 23. jūlijam. Attiecīgi, ja nodokļa summa pārsniedz 640 eiro, tad arī to var dalīt trīs maksājumos: līdz 23. jūlijam, 23. augustam un 23. septembrim.

Ņem vērā! Iesniedzot GID, saimnieciskās darbības veicējam var nākties piemaksāt nodokli. Šādi var notikt, ja aprēķinātais nodoklis ir lielāks nekā gada laikā avansā samaksātais nodoklis.

IIN avanss – vai man tas jāmaksā?

Jā, iespējams, daudzi jaunie pašnodarbinātie to nezina, taču tā ir – IIN iemaksas jāveic avansā! No 2020. līdz 2022. gadam, kad Covid-19 infekcijas izplatības dēļ ienākumu gūšanas iespējas daudziem pašnodarbinātajiem bija apgrūtinātas, tika uz laiku atcelts IIN avansa maksājums. No 2023. gada šis atvieglojums beidzas, tāpēc atzīmē kalendārā jau tagad – 23. marts ir pirmais šī gada datums, līdz kuram jāmaksā IIN avanss!

Kā tas notiek? IIN avansa maksājumu VID EDS aprēķinu izveido automātiski, balstoties uz iepriekšējā gada ienākumu. Ja GID par iepriekšējo gadu ienākumi ir mazāki par 78 100 eiro, tad tavs pienākums ir veikt IIN avansa iemaksas ne vēlāk kā 23. martā, 23. jūnijā, 23. augustā un 23. novembrī. Savukārt, ja deklarācijā par iepriekšējo gadu ienākumi pārsniedz šo summu, tad IIN avansa iemaksas jāveic ne vēlāk kā 23. martā, 23. jūlijā, 23. septembrī un 23. novembrī.

VID aprēķināto nodokļā avansu ir iespējams samazināt, ja mainās faktiskais ienākuma lielums un pašnodarbinātais iesniedz precizētu avansa maksājumu aprēķinu. Tas var notikt gadījumos, ja būtiski mainījies darbības veids, ieņēmumi, izdevumi, samazinājies peļņas apjoms.

Atceries! Ja esi pašnodarbinātais, kurš savu saimniecisko darbību reģistrējis 2023. gadā, IIN avansa maksājumus var neveikt. Taču, ja vēlies, IIN avansa maksājumus vari veikt brīvprātīgi 30 dienu laikā pēc saimnieciskās darbības uzsākšanas, iesniedzot avansa maksājumu aprēķinu par prognozēto ienākumu. Ja izvēlies veikt IIN avansa maksājumus saimnieciskās darbības uzsākšanas gadā, tad pirmais maksāšanas termiņš ir tas termiņš, kas seko mēnesim, kurā uzsākta saimnieciskā darbība. Tātad, ja reģistrēji saimniecisko darbību janvārī vai februārī, tad pirmais avansa maksāšanas termiņš būs marts.

Pāris noderīgi resursi, kuros iesakām ieskatīties, lai savu gada ienākumu deklarāciju iesniegtu atbilstoši likuma prasībām, kā arī savlaicīgi veiktu maksājumus un uzzinātu par izmaiņām:

- VID informatīvais apkopojums par saimnieciskās darbības veicējiem

- VID informatīvais apkopojums par gada ienākumu deklarāciju

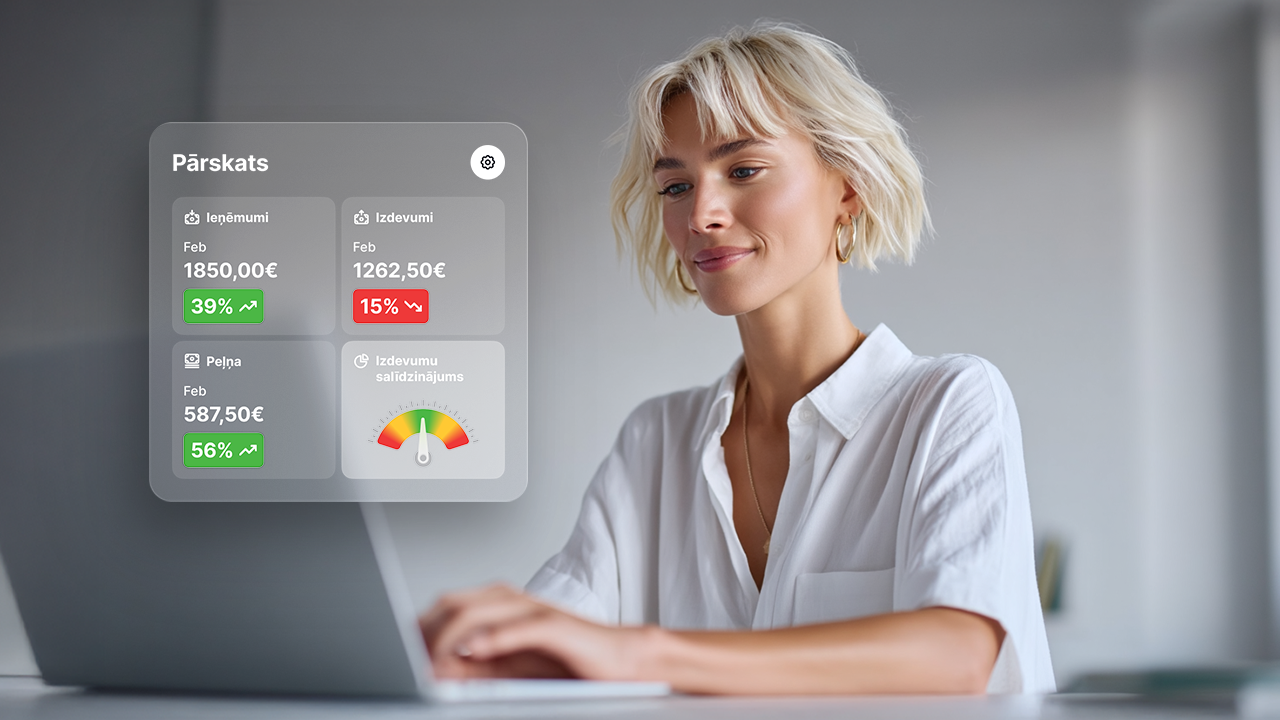

Pats.lv, balstoties uz pašnodarbinātā ievadīto informāciju par darījumiem, automātiski sagatavo gada deklarācijas iesniegšanai nepieciešamos datus, kurus pašnodarbinātajam jāiesniedz VID EDS. Viss sarežģītais – nodokļu aprēķins, saimnieciskās darbības žurnāla aizpildīšana un atskaišu sagatavošana – pats.lv notiek automātiski. Viss, ko lietotājam atliek darīt – cītīgi veikt ieņēmumu un izdevumu uzskaiti un datus augšupielādēt sistēmā.

Lai lietotu pats.lv, nav nepieciešamas priekšzināšanas grāmatvedībā – izmēģini, pirmās 7 dienas bez maksas!