How can a courier register as a self-employed?

Are you already working or planning to work as a food delivery courier via online platforms? Then this article is for you! We’ve gathered all the essential information about the requirements that must be met to work legally as a food delivery courier.

1. Register as a self-employed

Food delivery couriers provide services for remuneration, which means they must register as self-employed, conduct economic activity, and pay taxes on their income themselves.

A courier can choose one of two forms of activity: performer of economic activity (saimnieciskās darbības veicējs) or individual merchant (individuālais komersants). The main difference lies in the registration process. Individual merchants register with the Register of Enterprises (Uzņēmumu reģistrs). Performers of economic activity register via the State Revenue Service’s Electronic Declaration System (VID EDS).

Once registered, the courier must choose a tax regime:

- General tax regime

- Microenterprise tax

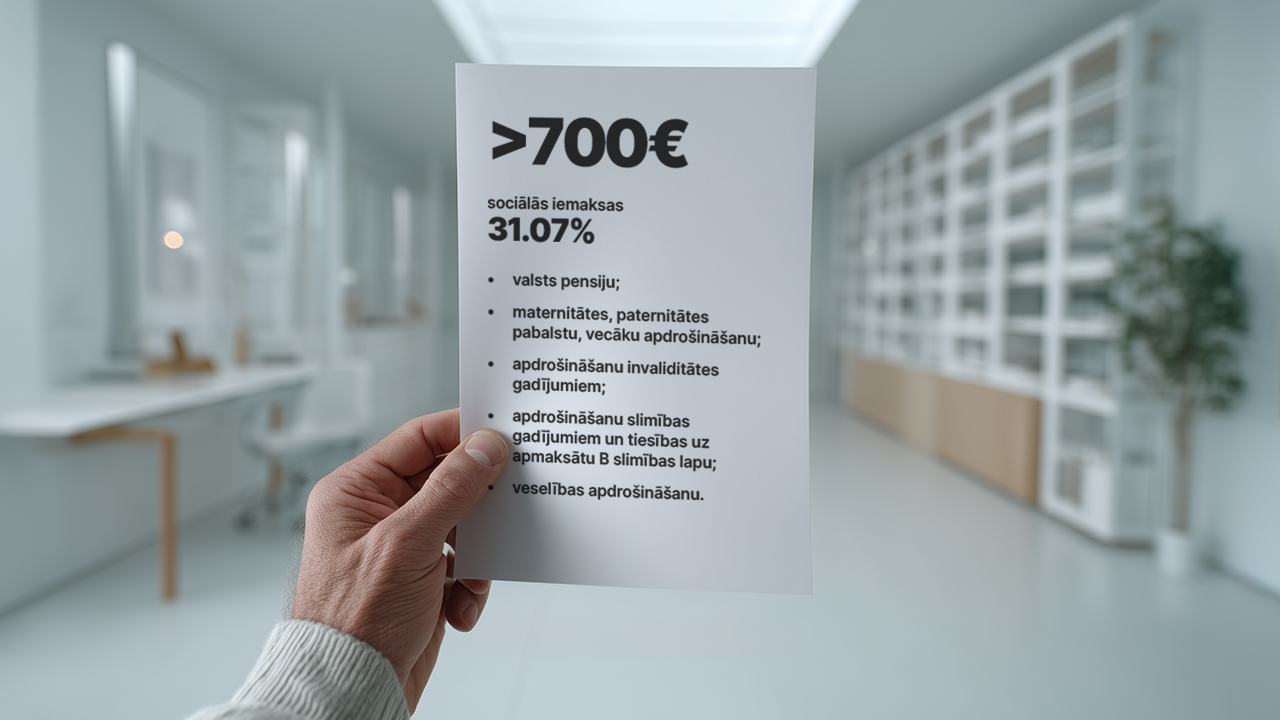

The main difference between the two is in tax rates and calculation methods. Under the general regime, the courier must make quarterly social insurance contributions based on their income and an annual personal income tax payment at rates set by law. Under the micro-enterprise regime, a 25% tax on turnover is paid quarterly. This rate includes both social contributions and personal income tax.

For more details on registration and tax payments, visit:

2. Registration with the Food and Veterinary Service is also required

In addition to registering economic activity, food couriers must also register with the Food and Veterinary Service (PVD). This can be done online via the PVD website under the “Veidlapas” section or in person.

The PVD will check:

- that the person holds a valid residence permit

- the right to work

- registration with the State Revenue Service.

More details about registration requirements and frequently asked questions are available in the information prepared by the PVD.

3. Keep your accounting simple and stress-free

As a self-employed person, the courier is responsible for paying their own taxes. They must declare their income and calculate and pay taxes independently. This can be done conveniently in the following ways:

- Economic activity income account. If you opt for the micro-enterprise regime, you can open a special current account at a bank, deposit all your income there, and automate tax payments.

- Pats.lv accounting system for the self-employed. Suitable for both tax regimes. Particularly useful under the general regime if you wish to include business expenses (e.g. for a car, fuel, mobile phone, etc.). Including expenses helps reduce your taxable income. You can register income and expense documents in the system, which will then automatically calculate taxes and prepare quarterly reports to submit to the State Revenue Service.