The most important about the Micro-enterprise Tax (MUN) regime

Self-employed individuals can operate under four different tax regimes:

- general tax payment procedure;

- micro-enterprise tax (MUN);

- reduced patent fee for pensioners and persons with disability of group 1 or 2;

- Notification of economic activity without registering as a self-employed person (e.g. property rental).

This time we’ll focus on the micro-enterprise tax (MUN) regime.

When can a self-employed person choose the MUN regime?

MUN taxpayers can be individuals performing economic activity, sole traders, individual undertakings, and farms or fisheries. Conditions: expected annual turnover does not exceed EUR 40,000 and you are not registered as a VAT payer (until the VAT registration threshold is reached).

Economic activity performers can register for this status at the State Revenue Service (VID) when starting their activity. If the activity has already been registered and, for example, you decide to become a MUN payer this year, you must register by December 15. Re-registration of MUN status is not needed afterward.

What taxes must be paid?

The advantage of the MUN regime is its simplicity – a single tax rate covers both social contributions and personal income tax.

Under the MUN regime, tax is paid on turnover (i.e. income). As of January 1, 2024, the tax rate is 25%, regardless of the annual turnover.

MUN declarations must be submitted quarterly by January 15, April 15, July 15, and October 15. Tax payments must be made to the unified tax account by the 23rd of the same month. Of the paid tax, 80% goes to your social insurance and 20% to personal income tax. Note: social contributions in this regime are significantly lower compared to the general tax regime or employee contributions. This may impact the size of your pension and benefits!

Important! MUN taxpayers have an even simpler way to handle taxes! Only MUN taxpayers can use a simplified solution – the income account (SDI account), which automates tax calculation and payments. You must deposit all your business income into this account – the bank and VID handle the rest. Learn more on the VID website.

Minimum social contributions

Minimum social contributions also apply to MUN taxpayers. If the MUN payer is also an employer, they must make contributions both for themselves (if not working elsewhere) and for their employees. The State Social Insurance Agency calculates these contributions within three months after the quarter ends and notifies VID by the 20th day of the third month. The MUN payer must:

- pay contributions for employees by the 23rd of the month;

- pay contributions for themselves by the 23rd of the third month following the notification, covering the previous calendar year.

If a MUN payer who is not employed elsewhere expects income below EUR 1860 per quarter (i.e. EUR 620 per month), they must submit a statement to VID about projected income for the next quarter. In this case, no minimum mandatory contributions will be calculated. Submission deadlines: January 17, April 17, July 17, and October 17.

Check if you belong to a group exempt from these contributions: list of exempt population groups.

What restrictions exist?

Although the MUN regime has several advantages, there are restrictions, which means not everyone can qualify as a MUN payer:

- MUN cannot be used by VAT payers. If a MUN payer becomes (or must become) a registered VAT payer, they lose MUN status starting the next year.

- A MUN payer cannot simultaneously be a self-employed person under the general tax regime or a reduced patent fee payer.

- MUN taxpayers cannot deduct business-related expenses, unlike self-employed individuals under the general tax regime. Therefore, this regime is more suitable for those with few or no business-related expenses.

Employees

If you hire employees as a MUN payer, taxes for them must be paid under the general tax regime – full personal income tax and social contributions. Learn more in the VID methodology guide.

Accounting

MUN taxpayers keep records using the single-entry accounting system and must complete the MUN business income and expense journal. Income and expenses are grouped to simplify tax calculation and declaration.

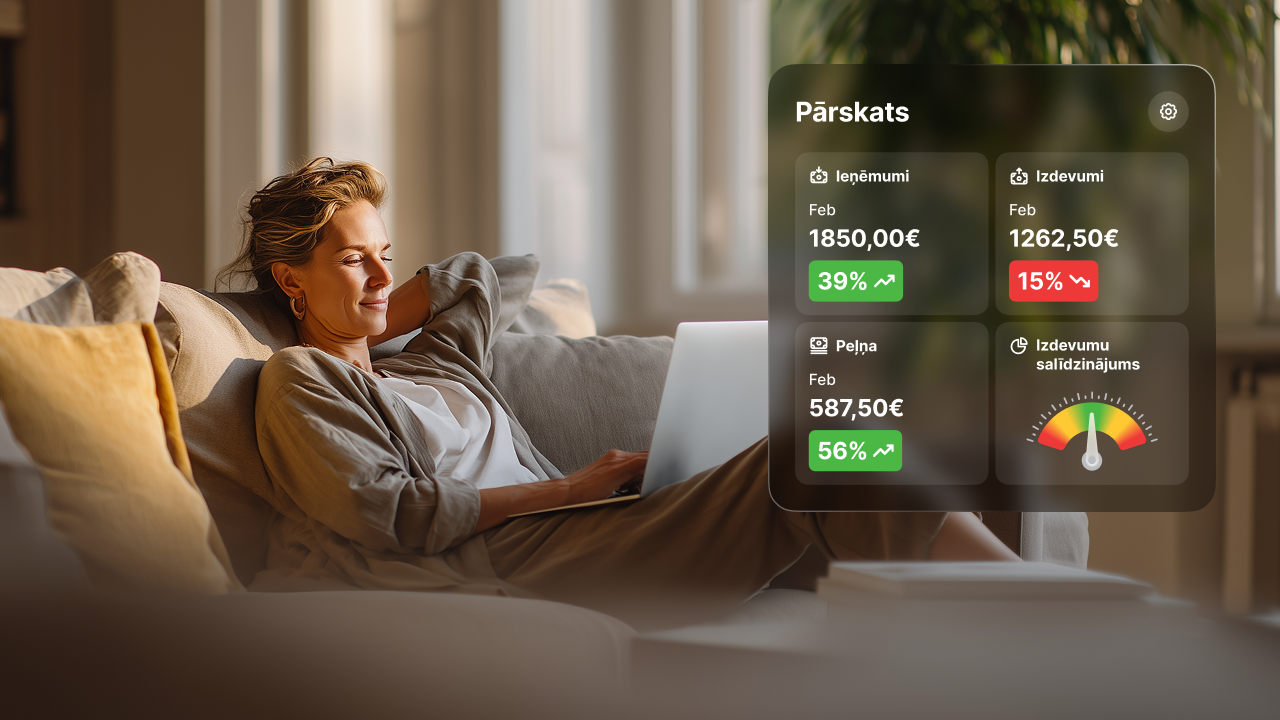

This journal is also available on Pats.lv. If you want to manage accounting and taxes easily, choose Pats.lv – tax calculation and report preparation are done automatically. First 7 days are free and only EUR 5 per month for basic functions – try it now!