Bank integration and payment management

Save time

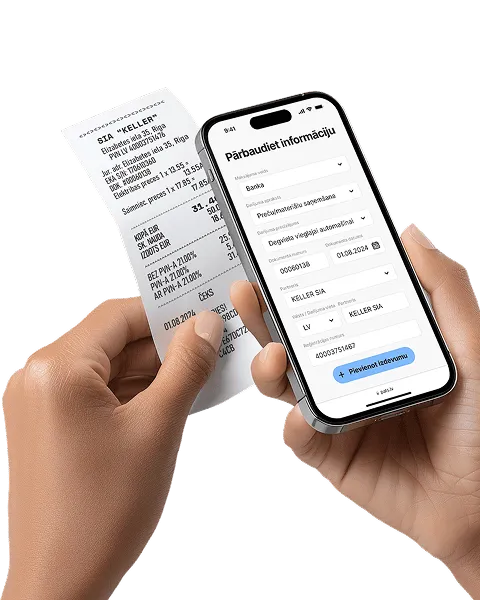

No more rewriting receipts - everything is imported automatically

Maximize your deductions

Get more deductible expenses without the hassle

Automatic sorting

The system suggests a category - you just confirm it

See what's paid

Track invoice status and link it to your income

Everything in one place

ll transactions in one view - simple, secure and easy to manage

How does it work?

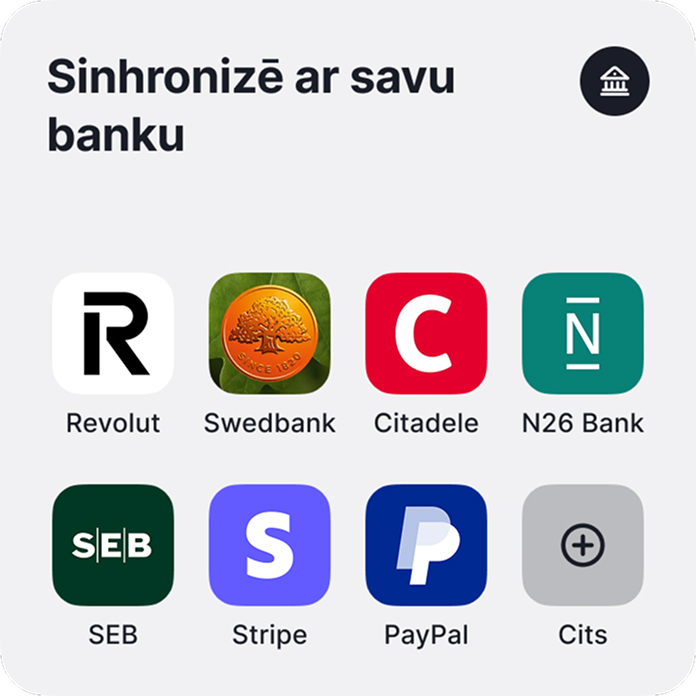

Connect your bank account

Select your bank (Swedbank, SEB, Luminor, Citadele, Revolut etc.) and log in through a secure connection.

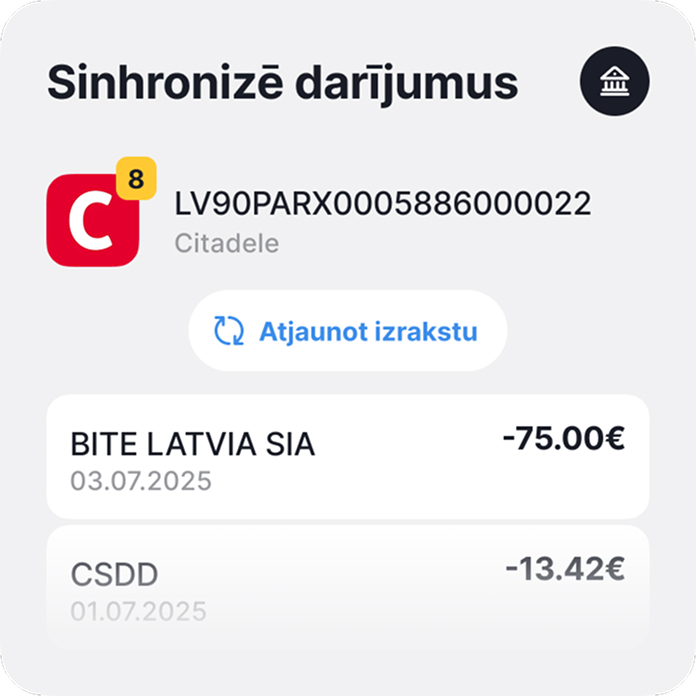

Import transactions

Click “Refresh statement” and all recent transactions will appear in the system.

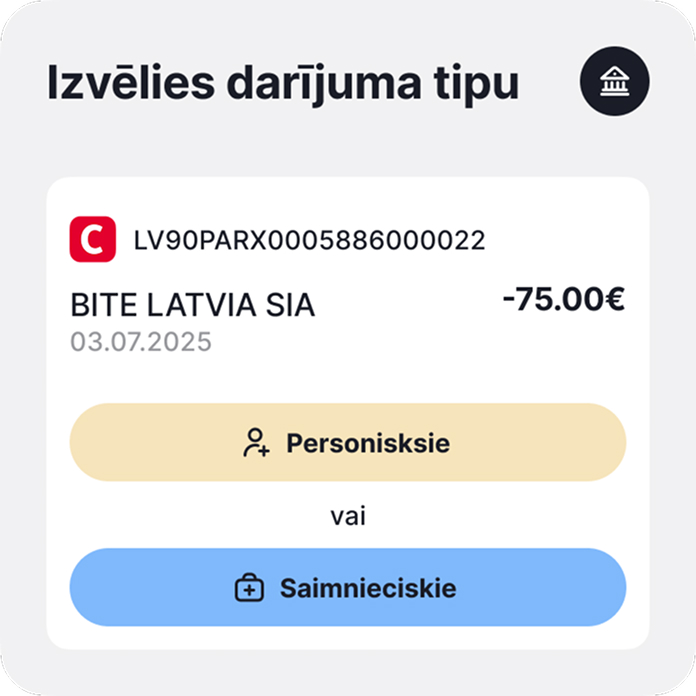

Tag and process

Click “Create” or “Link transaction”

Already more than 20,000 users in Latvia

You just need to enter your data - income, expenses, receipts or invoices, and the system will calculate, sort and remind you of the rest.

Accounting made easier with bank integration

Get more deductible expenses

Reduce your tax burden effortlessly

Save time

No need to retype receipts or search through bank transfers

Automate your accounting

The system suggests a category based on the transaction description, but the final decision is yours

Sort transactions

Everything is visible - mark transactions, add a category and post to accounting

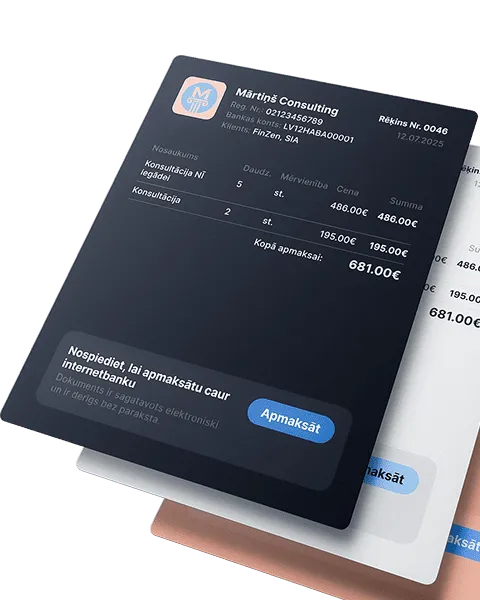

Track payment statuses

See which invoices are paid, which are still pending, and link them to your income

How does it help in daily?

You pay for fuel

The transaction is instantly visible in the system

Paid parking or office supplies

No longer forgotten

Receive commission, repay a loan, or issue an advance

Everything is booked correctly

Split or categorize expenses

Structure your expenses clearly and easily

Security without compromise

Connection via GoCardless

A PSD2-licensed European provider with high security standards

No access or data storage

We do not see or store your bank username or password

Data stored on secure EU servers

All information is encrypted and stored only in secure data centers within the European Union

Most commonly used categories

Providing and receiving services

Invoices, subscriptions, outsourced services

Interest and bank fees

Loans, cards, account maintenance

Purchase of goods and materials

Office, stationery, raw materials

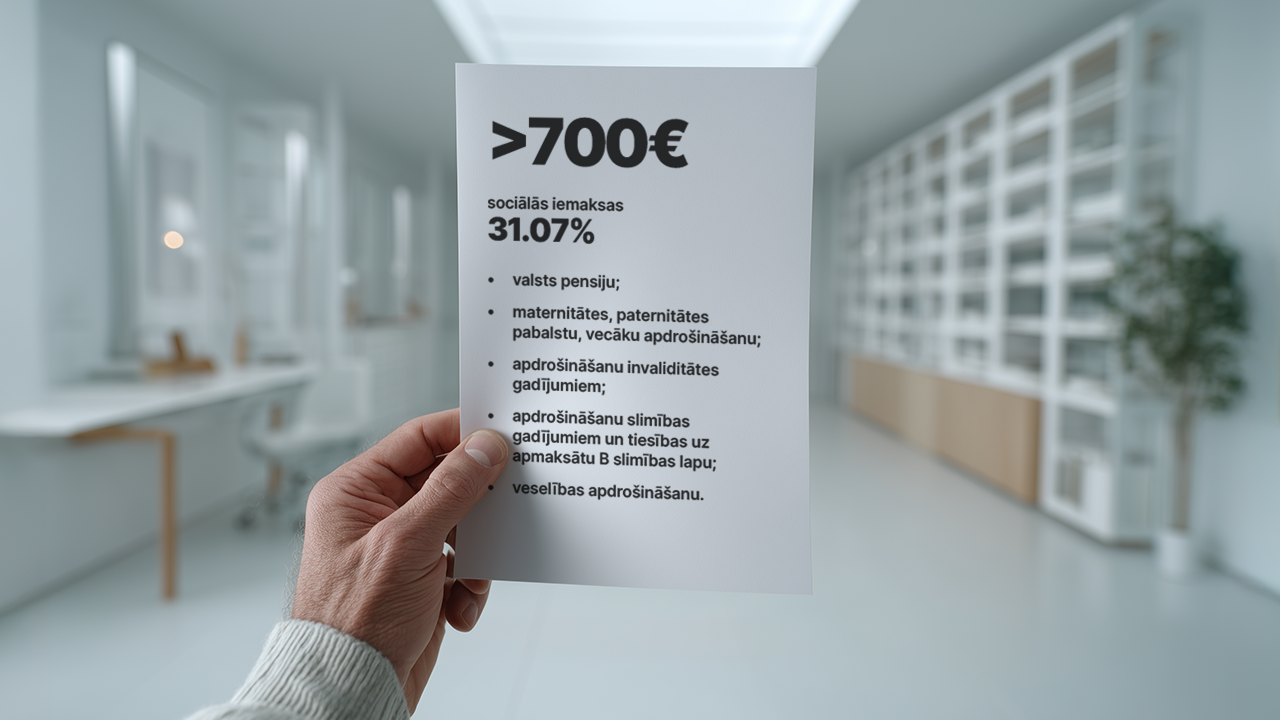

VSAOI contributions

Relevant for self-employed

Personal contributions to the business

When the entrepreneur invests personally

Cash deposit into account

Loan received or repaid

Personal expenses

When the self-employed account is also used for personal expenses

How much does it cost

Functions

- 10 document scans

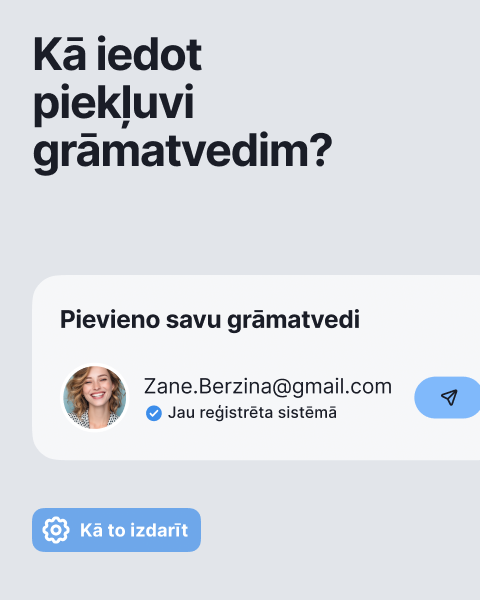

- Invite accountant

- Catalog of services and products

- Access to documents - 90 days

Invoices

- 10 invoices per month

- Language selection

- Invoice design selection

- Adding your own logo

- Electronic invoice

- Payment button directly in the invoice

- Value Added Tax (VAT) declaration for the taxation period

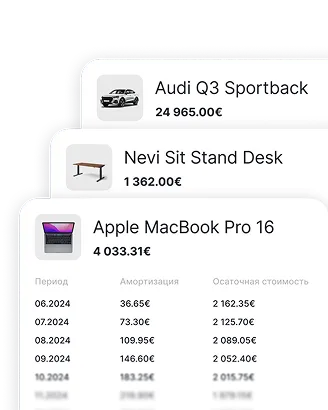

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

Main system features

Issue invoices and get paid faster!

Automate the invoicing process, get paid faster, and focus on what truly drives your business forward

Receipt and invoice scanning

Automation that pays off! Save up to 80% of the time compared to manual data entry

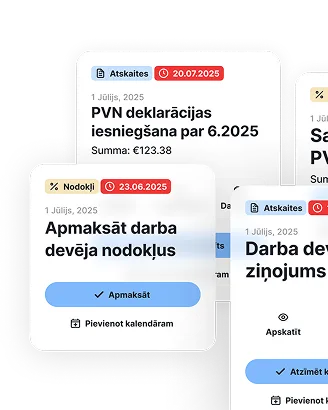

Reporting and tax calendar

All reports and tax declarations are generated automatically - from quarterly to annual. Enter your income and expenses, the system will calculate the taxes - just download and submit

Fixed asset accounting

Enter an asset once - depreciation is calculated automatically, and the data goes straight into the reports

Accept payments without a terminal

Instantly with a QR code or link - perfect for service providers without a cash register. Create an offer, the client scans and pays

Accurate salary calculation every month

Automatically calculates salaries, taxes, and vacation pay, while also preparing all mandatory documents

Bank integration and payment management

The fastest way to manage business transactions - accurately and clearly

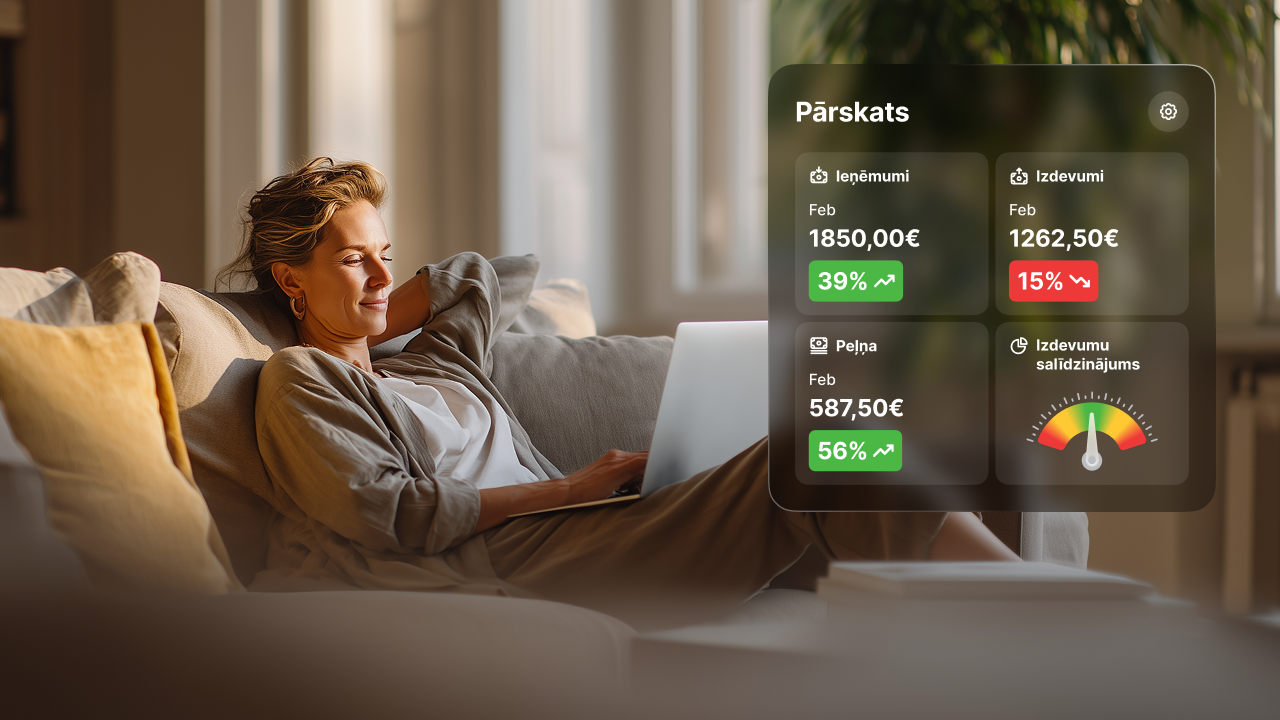

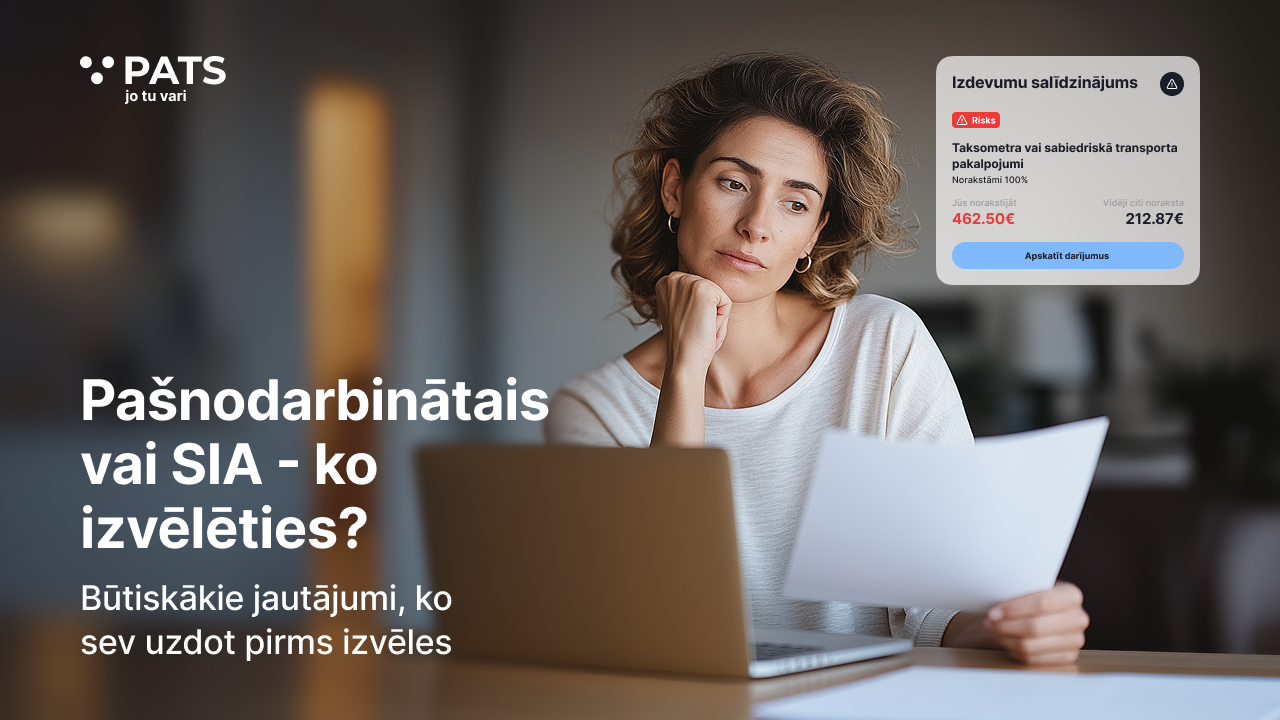

Expense analytics and tips

Analyze your expenses and get smart tips on what can be deducted. Compare with others in your field and avoid missing out

What customers say

Get only what matters. Only what you need.

Accounting is under control. You’re in the right place.

Frequently asked questions