A modern tool for accountants to manage clients and reports

For those who are always short on time

It’s Friday evening and everything needs to be done fast. Everything is at your fingertips - data, transactions, calculations. No stress, even at the last minute.

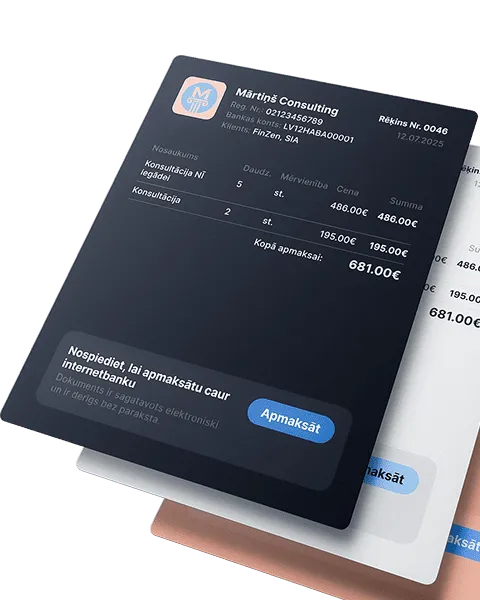

For those whose clients want to see and control everything

Give access - the client will see invoices and reports on their own. Fewer questions, more peace of mind.

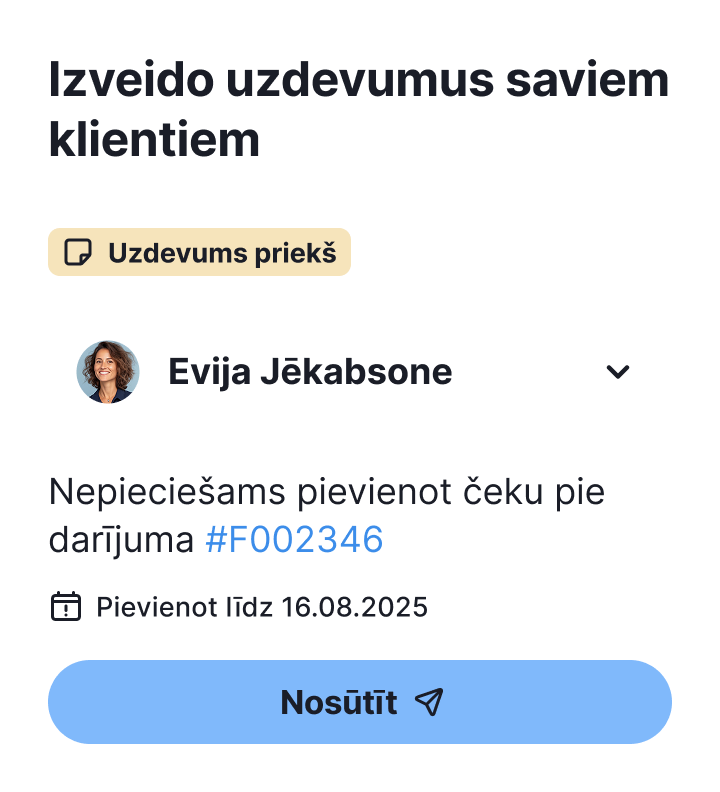

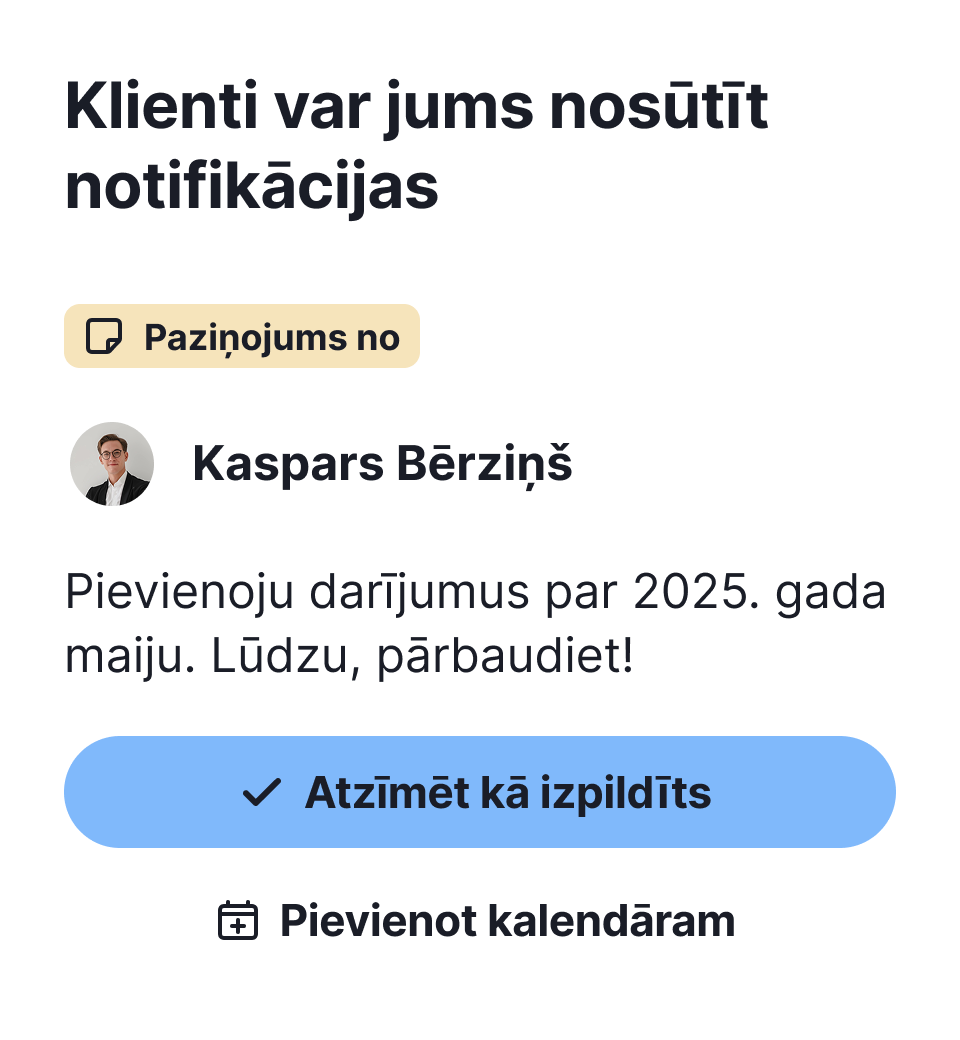

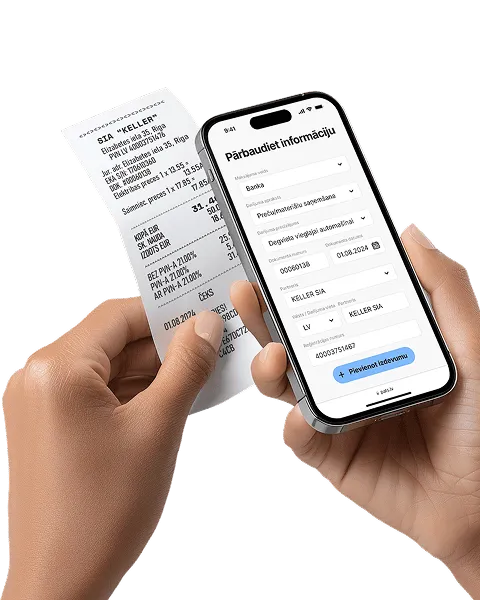

For those whose clients want to do more themselves

The client enters receipts or creates an invoice - you just need to review what they’ve already done.

How does it work?

Register as an accountant on our platform

Manage accounting for all clients in one place: IK, SDV, MUN or SIA

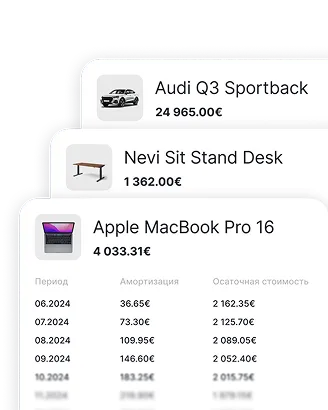

Data is collected automatically

Incoming and outgoing transactions are instantly structured - no Excel or manual sorting

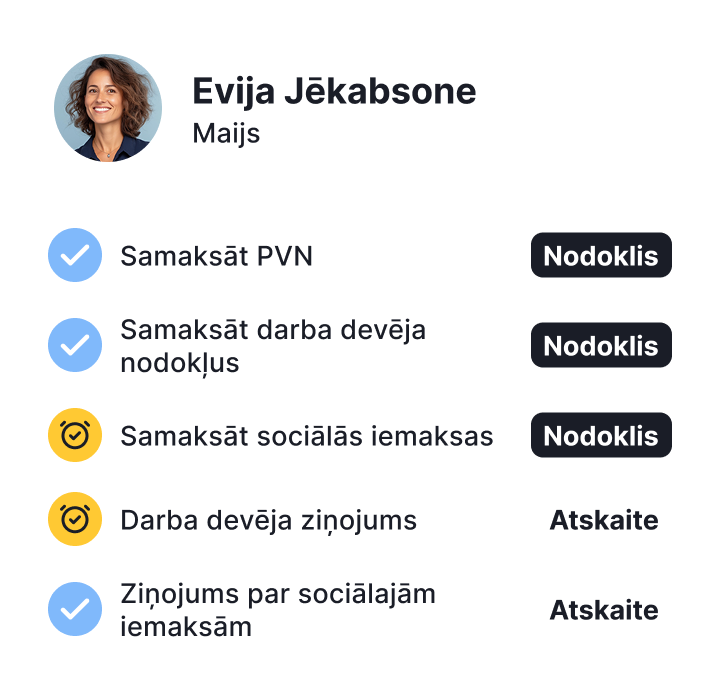

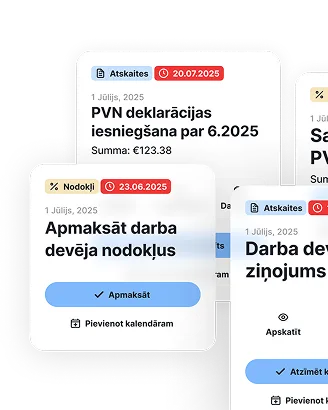

Everything important already organized

Transactions, documents, and calculations are available - the system suggests what to deduct and shows how much others are deducting, so you don't miss anything

Everything you need from the data you've already entered

The system generates reports, declarations, and calculations - one click and everything is ready