Accepted formats

Not just convenience, but a tool to increase profit

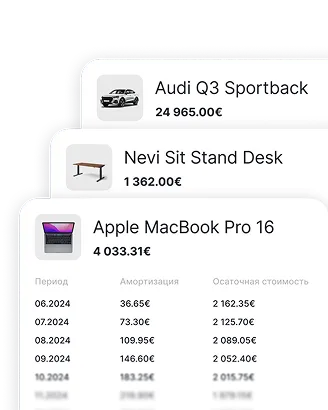

The more expenses - the less taxes

The more expenses you deduct, the less tax you pay. Accounting is not about spreadsheets, numbers, or folders full of receipts. It’s about control. About helping you grow your business, not rush to process receipts at the last moment.

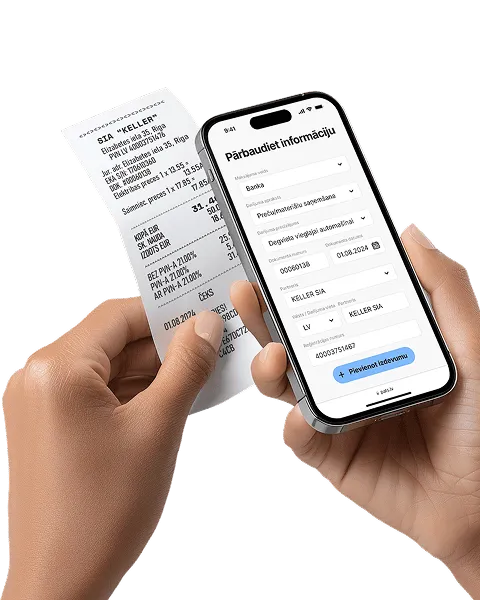

Receipts no longer get lost

No more sending photos to yourself on WhatsApp or keeping receipts in your pocket. They fall out and get lost.

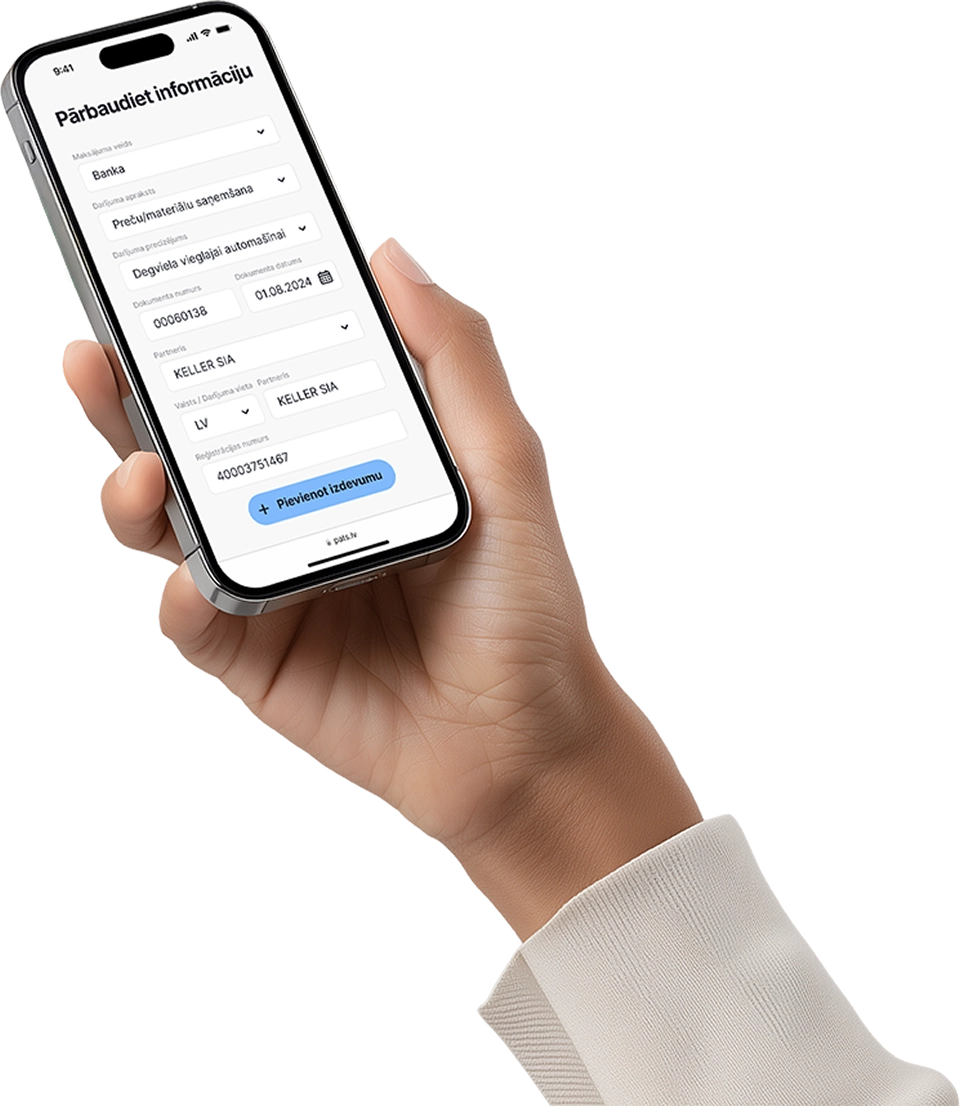

Everything accounted for and on time

Forget long evenings before reporting deadlines - everything will already be in the system. Take a photo, confirm, deduct the expense. And keep working.

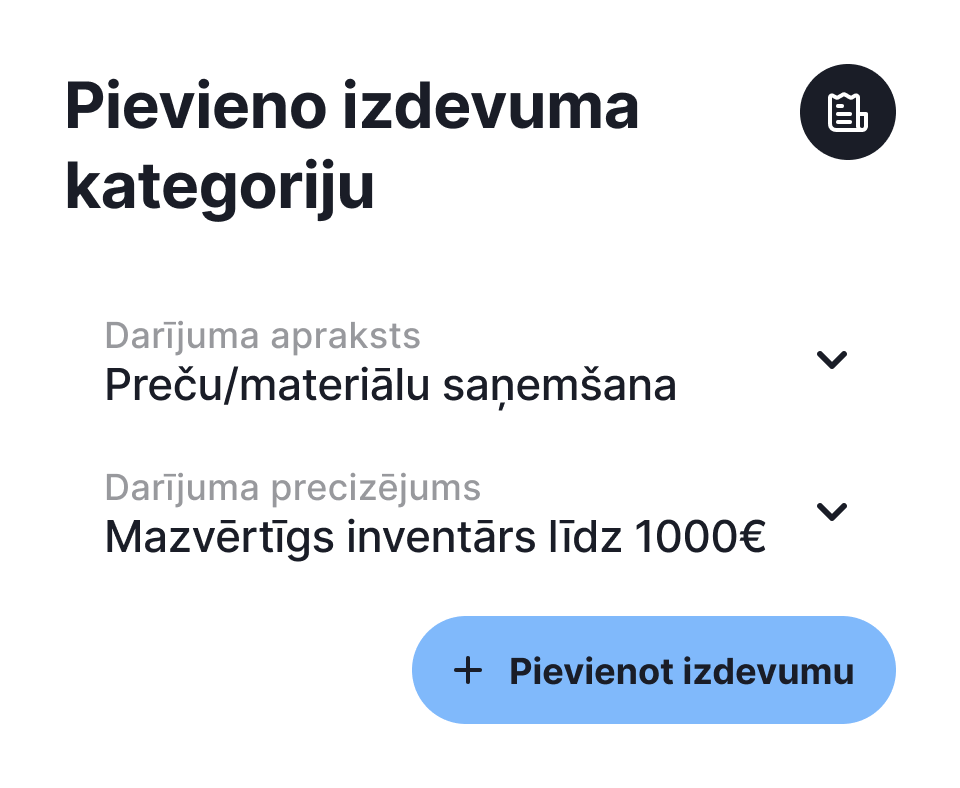

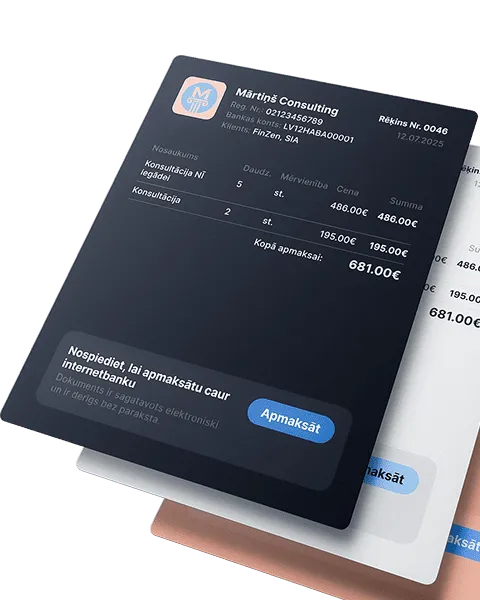

What about invoices? Automatic processing without headaches

The system learns from you

Upload once - the system learns the category. Next time, just review and confirm.

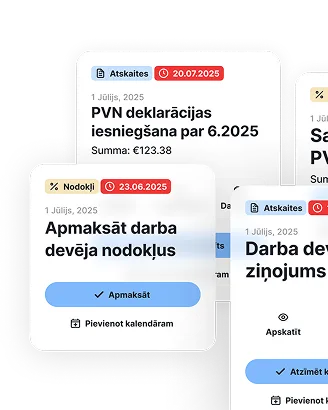

Detects changes and gives tips

The system detects if the amount increases, decreases, or looks unusual. It suggests what, how, and how much you can deduct as expenses.

Fewer clicks - more clarity

Invoices for phone, internet, hosting, Google and META ads repeat - but now you don’t need to enter them manually every month.

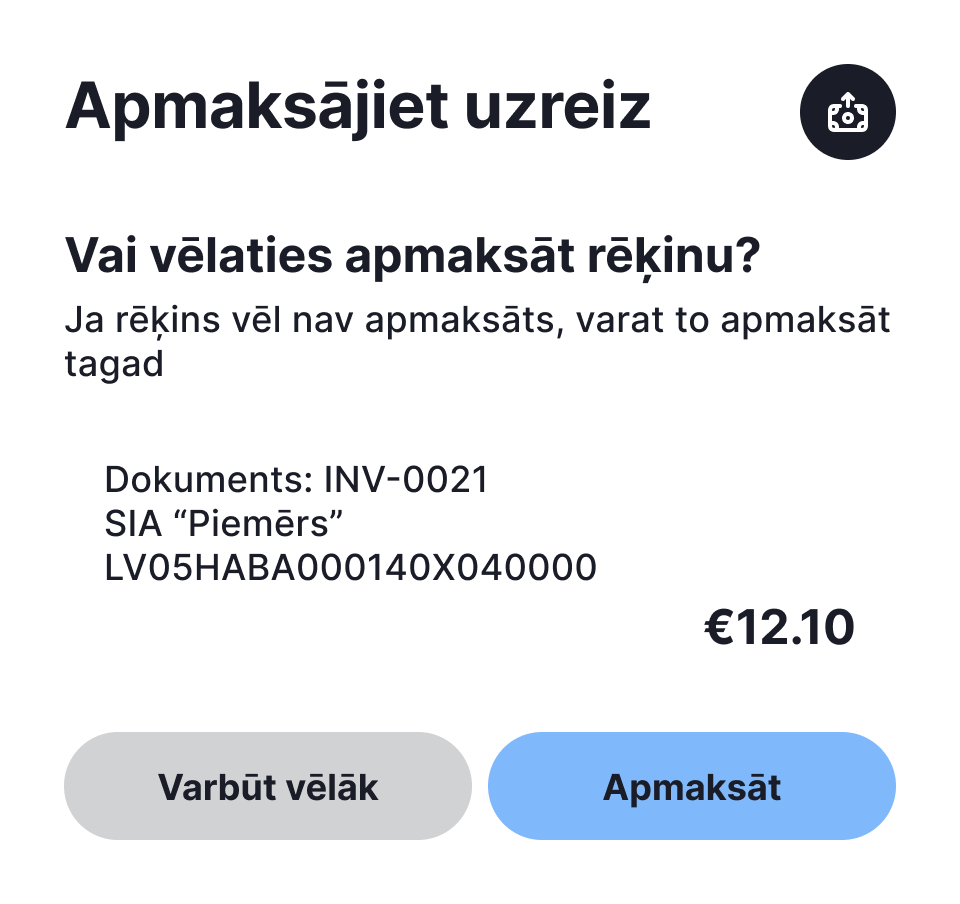

Invoice paid instantly

Just scan and you can pay the invoice right in the system. No extra steps, no copying, no data entry.

What do clients register most often?

Parking, fuel, office supplies, licenses

Representation expenses - client meetings, gifts

Partially deductible expenses (e.g., 50% of internet or electricity)

Business trip expenses

Main system features

What customers say

Frequently asked questions