Accounting for self-employed in Latvija

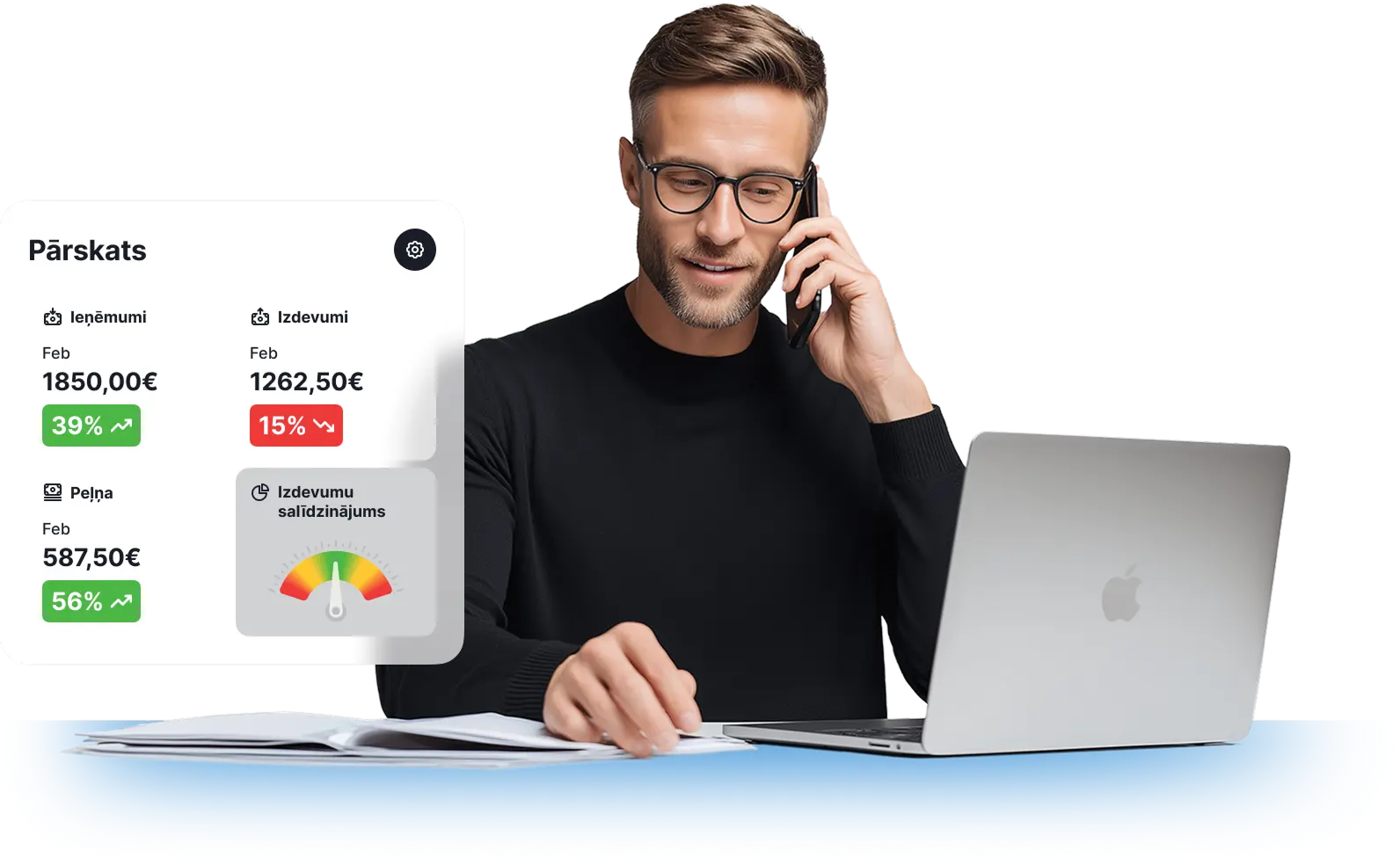

How the system works for self-employed

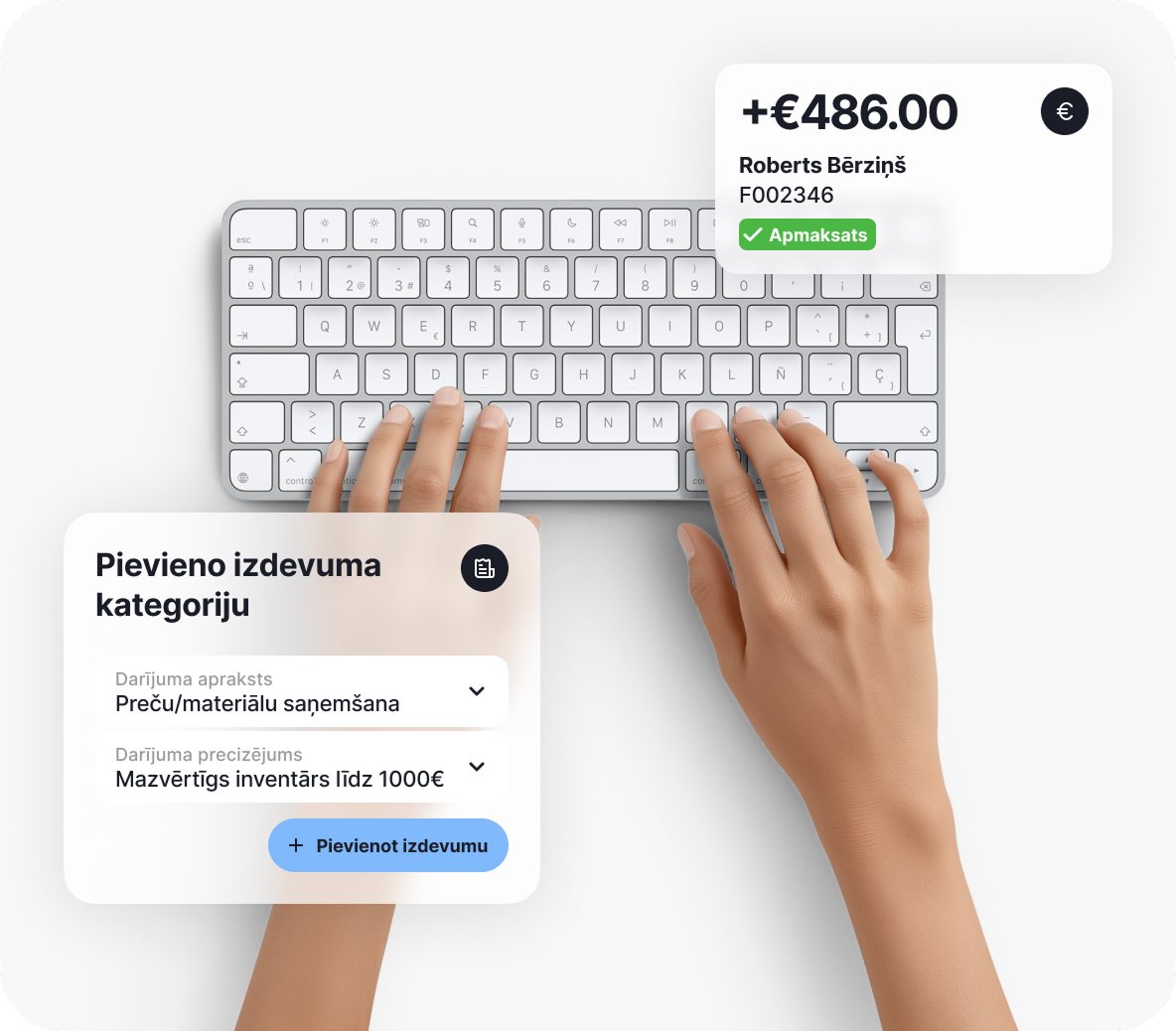

Enter income and expenses

Income

Money you receive for your work or goods. For example, when issuing an invoice to a client

Expenses

Payments for services or goods needed for work. These can be receipts for fuel, an internet bill, phone, or other services

The system prepares journals and reports

Pašnodarbinātā ziņojums par sociālajām iemaksām (VSAOI)

Report must be submitted by the 17th of the quarter (Jan, Apr, Jul, Oct)

Tax must be paid by the 23rd of the quarter (Jan, Apr, Jul, Oct)

Ieņēmumu un izdevumu uzskaites žurnāls

Report must be available upon request

Tax is not required to be calculated

MUN ziņojums par sociālajām iemaksām

Report must be submitted by the 15th of the quarter (Jan, Apr, Jul, Oct)

Tax must be paid by the 23rd of the quarter (Jan, Apr, Jul, Oct)

Pievienotās vērtības nodokļa (PVN) taksācijas perioda deklarācija

Report must be submitted by the 20th of the next month

Tax must be paid by the 23rd of the following month

*By default, the VAT declaration is prepared every month; if a quarter is selected, it is generated for the quarterGada ienākumu deklarācija (pieejama nepieciešamā informācija)

Report must be submitted from March 1 to June 1 of the following year, or if income exceeds €78,100 - from April 1 to July 1

Tax must be paid by June 23, or if income exceeds €78,100 - by July 23

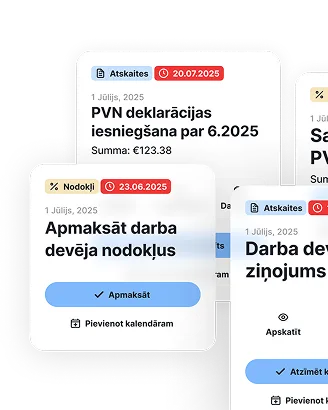

Receive deadline reminders

- About report submission

- About tax payments

- About transaction entry and more

Download the prepared reports and submit them to the VID

Reports are prepared in XML format specifically so they can be directly uploaded to the VID using the EDS system

Pay taxes

The report shows how much and which taxes need to be paid. The payment must be made to the unified tax account

Features useful for self-employed accounting

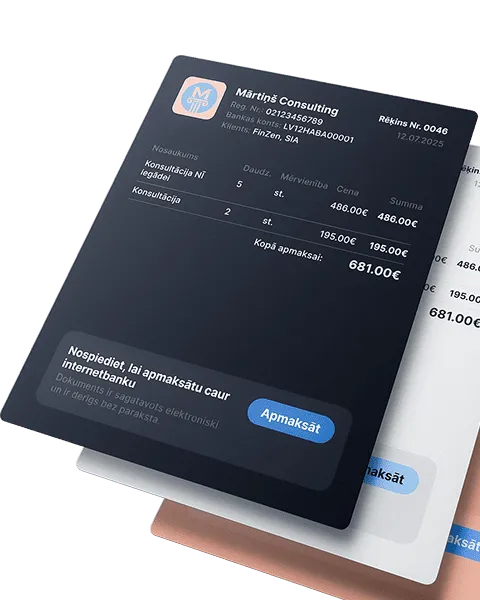

Issue invoices and get paid faster!

Automate the invoicing process, get paid faster, and focus on what truly drives your business forward

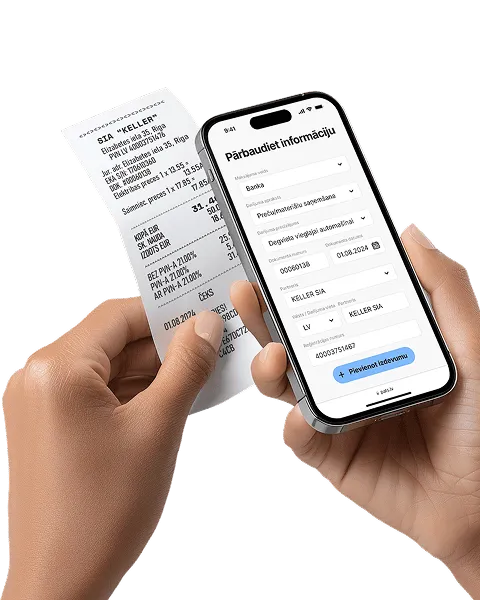

Receipt and invoice scanning

Automation that pays off! Save up to 80% of the time compared to manual data entry

Reporting and tax calendar

All reports and tax declarations are generated automatically - from quarterly to annual. Enter your income and expenses, the system will calculate the taxes - just download and submit

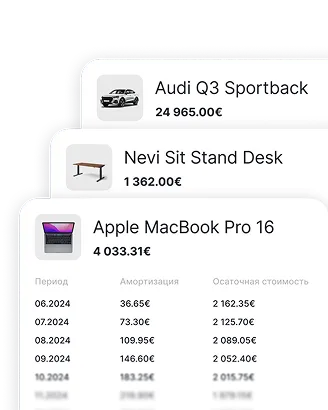

Fixed asset accounting

Enter an asset once - depreciation is calculated automatically, and the data goes straight into the reports

Accept payments without a terminal

Instantly with a QR code or link - perfect for service providers without a cash register. Create an offer, the client scans and pays

Accurate salary calculation every month

Automatically calculates salaries, taxes, and vacation pay, while also preparing all mandatory documents

Bank integration and payment management

The fastest way to manage business transactions - accurately and clearly

Expense analytics and tips

Analyze your expenses and get smart tips on what can be deducted. Compare with others in your field and avoid missing out

Problems and fears that self-employed people face

The system automatically shows what, when, and how much tax you need to pay based on your information - just enter your details and your income/expenses to ensure an accurate calculation

“Afraid of a VID audit”

Everything is stored in the system, not across devices, WhatsApp, or emails. All transactions are recorded correctly, data is securely saved, and documents are always available in one place

“My income and expenses don’t match what’s shown in the reports - I spend too much time looking for mistakes”

The system, with bank statement integration, automatically matches income and expenses so nothing goes unnoticed - taxes are always reflected accurately

“I don’t know which expenses I’m allowed to deduct in my activity”

Using artificial intelligence, the system compares your data with millions of similar users’ transactions and suggests which expenses you can deduct based on your turnover

“I want to do my own accounting but I’m afraid of making mistakes”

Instructions, videos, and reminders guide you step by step. Premium plan users can ask questions to our expert

“Not sure where to start”

Free webinars and recordings, blogs, step-by-step videos, and a calculator help you choose the most suitable tax regime or business form

How to start using pats.lv

Register create a profile in our accounting system

Enter your data - the system will automatically load information from the public register and adjust to your tax regime.

If you’re not yet registered as self-employed and just planning to start, you can still see how the system works.

Add income and expenses

Send an invoice to the client, add a receipt, or enter the transaction manually.

If the payment comes later - select “No” and add the payment after it’s received.

Get ready-made reports and submit them to the VID

The system prepares quarterly reports, VAT, and VSAOI declarations - you only need to upload them to the VID EDS.

Pats.lv - an easy-to-use accountant for the self-employed

Ask an expert

If you don’t have an accountant but have questions - the Premium plan for €27 per month lets you ask our tax expert or accountant. Answers are saved in your profile - much more efficient than phone consultations!

No accountant, but I want one

From your profile, create a request if you need an accountant - for one-time help or full-time accounting services, and we’ll find the right professional for you.

Give access to the accountant

If you work with your own or an external accountant, you can give them access in the system so they can help manage your accounting

Questions about using pats.lv?

Our support team is always ready to help - ask your question and get clear step-by-step instructions

How much does it cost

Functions

- 10 document scans

- Invite accountant

- Catalog of services and products

- Access to documents - 90 days

Invoices

- 10 invoices per month

- Language selection

- Invoice design selection

- Adding your own logo

- Electronic invoice

- Payment button directly in the invoice

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

If you didn’t find what you’re looking for

If you’re not yet engaged in economic activity - as a self-employed person, sole trader, or MUN taxpayer

If you’re unsure which business form and tax regime to choose - try our easy-to-use calculator and experiment with estimated figures. It will help you make a clear decision and understand whether it’s more beneficial for you to register a SIA or work as self-employed

If you plan to hire or already have employees, see how the salary calculator works

The salary calculator shows the net and gross salary, as well as the employer’s total expenses for the employee

Registration with the VID

Find out how to register your business activity and become self-employed

Own company

If you’re thinking about accounting for your company or about starting a new SIA

Even if you’re not a user but have a question - feel free to write to us at [email protected]

Your digital accountant - suitable for all industries and professions

Start and feel the difference

From employee to owning your own salon

Invoices, tax calculations, reminders - everything happens automatically. No more Excel or manual work.

From hobby to first orders

See how much you earn and where you spend. Use recommendations based on data of similar users to write off expenses correctly and safely.

Student combines studies and work

VAT, quarterly and other reports are prepared automatically and are available for submission at the required time.

How sewing turned into an international business

Invoices with payment status - see what has been paid, what is overdue and where to take action. No mistakes. No uncertainty.