Analytics and tips for expense tracking

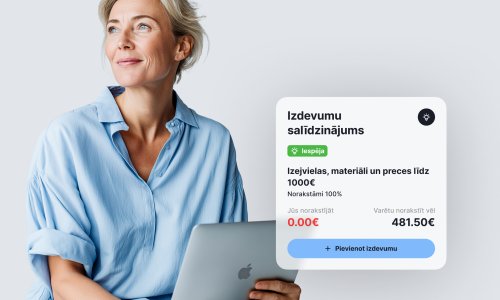

Opportunity

Opportunity

Risk

Analytics and tips for expense tracking

See what expenses others write off

Get advice

Less taxes mean more profit

Accurate accounting helps you save more

Business is not just about revenue. Business is about both revenue and expenses together. Unused allowed expense deductions are your money going straight to taxes. Fewer deductions mean higher overpayment, lower profit, and fewer opportunities to grow.

How does analytics and tips for expense tracking work?

The algorithm analyzes your:

Income-to-expense ratio

Typical expenses in your or similar industry

The ratio between turnover and expenses

Shows what you’ve forgotten or might be overpaying for

The system uses artificial intelligence to show opportunities where you still haven’t used.

Expense comparison

Expense level assessment

Compare your spending structure with industry averages and discover where you can gain additional benefits.

Opportunity cards

Discover cost items you haven’t written off, but other companies fully utilize - for example, bank fees.

Risk warnings

This expense category is too large compared to the industry average.

Fuel tip

Without trip sheets, you can deduct 50% of fuel expenses. With them - 70%

Interneta, programmatūras, pakalpojumu lietojums

Netiek norakstīts vispār

Who is this useful for?

Self-employed

Suitable for self-employed individuals who manage their records independently, without an accountant or accounting experience.

SIA owners

Designed for small businesses that want to manage expenses wisely and use expense optimization tips.

Accountants

For accountants who serve many clients and want to reduce manual workload, automation enables faster work without compromising quality.

Who view industry deductions

Those who want to track expenses correctly and earn more. See what expenses others in your industry deduct and discover opportunities to increase your deductions.

How much does it cost

Functions

- 10 document scans

- Invite accountant

- Catalog of services and products

- Access to documents - 90 days

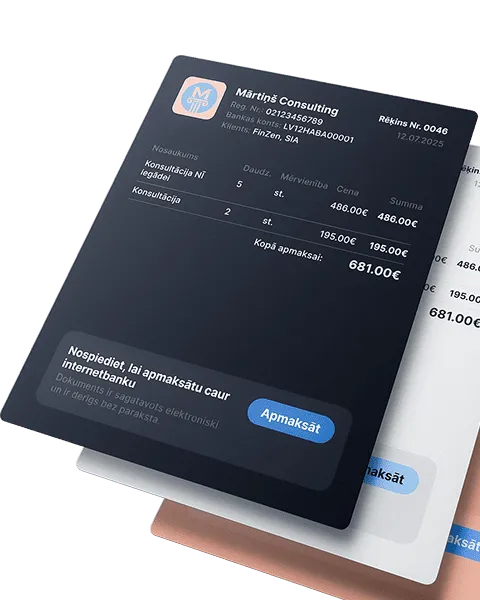

Invoices

- 10 invoices per month

- Language selection

- Invoice design selection

- Adding your own logo

- Electronic invoice

- Payment button directly in the invoice

- Value Added Tax (VAT) declaration for the taxation period

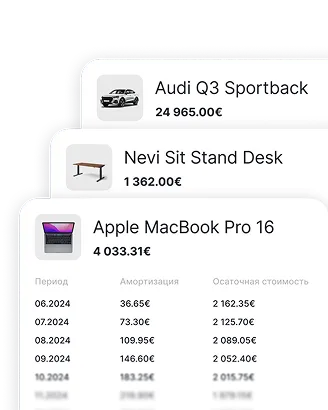

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

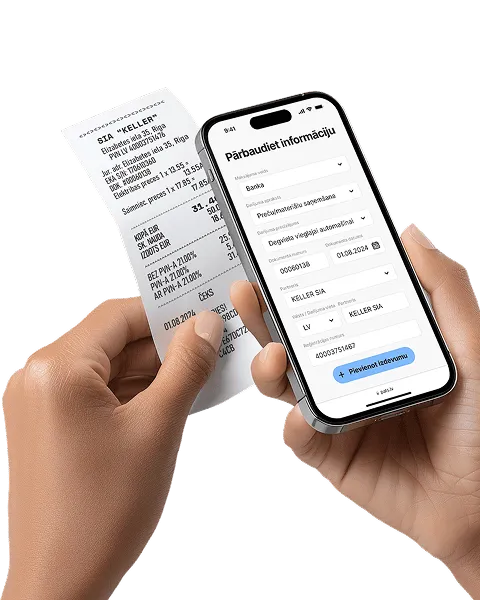

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

Try it - see the difference

Iespēja

Iespēja

Iespēja

Iespēja

- Discover what else you can write off

- Find out how much you can save compared to others

Do your accounting correctly. The difference between stagnation and growth is in your hands - write off expenses with confidence.

Main system features

Issue invoices and get paid faster!

Automate the invoicing process, get paid faster, and focus on what truly drives your business forward

Receipt and invoice scanning

Automation that pays off! Save up to 80% of the time compared to manual data entry

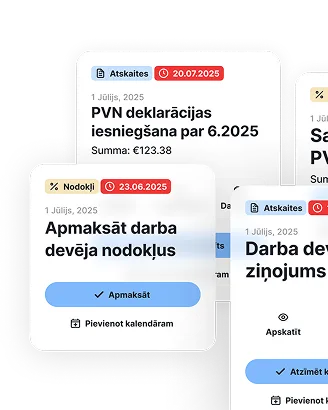

Reporting and tax calendar

All reports and tax declarations are generated automatically - from quarterly to annual. Enter your income and expenses, the system will calculate the taxes - just download and submit

Fixed asset accounting

Enter an asset once - depreciation is calculated automatically, and the data goes straight into the reports

Accept payments without a terminal

Instantly with a QR code or link - perfect for service providers without a cash register. Create an offer, the client scans and pays

Accurate salary calculation every month

Automatically calculates salaries, taxes, and vacation pay, while also preparing all mandatory documents

Bank integration and payment management

The fastest way to manage business transactions - accurately and clearly

Expense analytics and tips

Analyze your expenses and get smart tips on what can be deducted. Compare with others in your field and avoid missing out

What customers say