Problems faced in the education sector

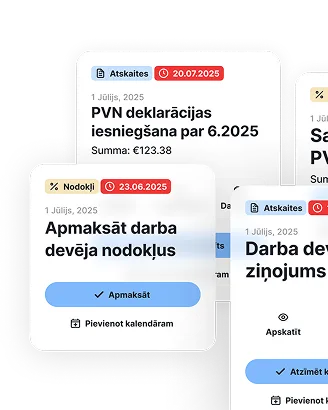

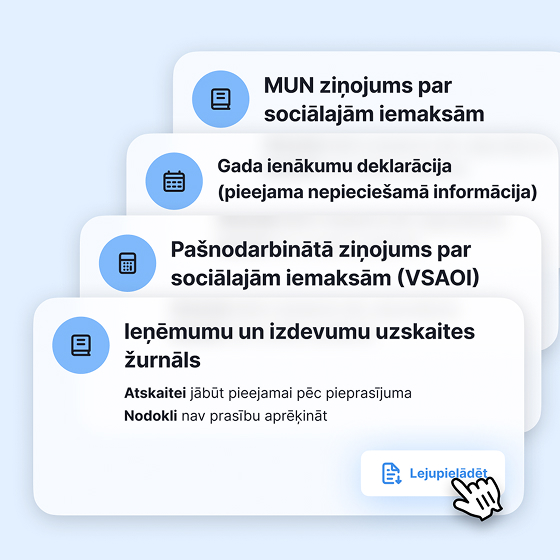

- Tax issues - uncertainty about which tax regime to choose and complications with income tax, social contributions, VAT calculation and payment

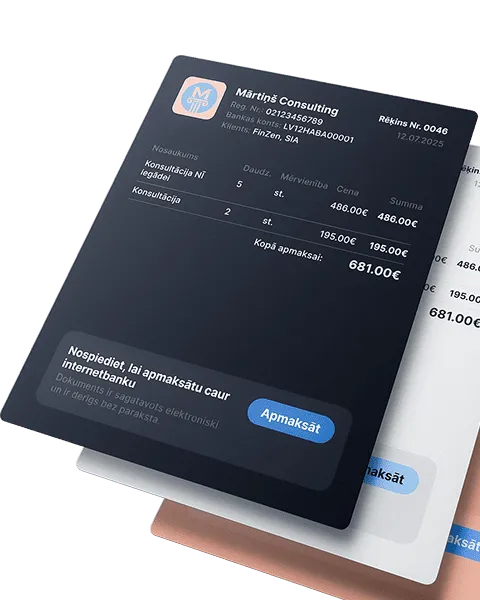

- Invoicing and client payments - need a tool that easily generates invoices for private lessons and tracks payments

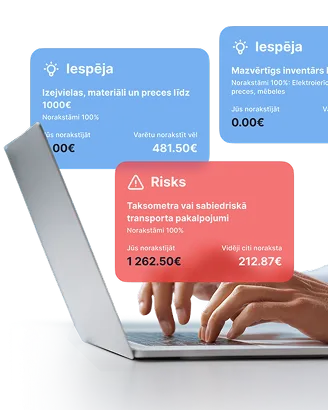

- Expense planning - unclear whether investments (training, equipment, software, room rental) can be accounted as expenses

- International services - working with foreign clients (online coaching, lessons, etc.), questions arise about VAT, currency conversion and invoice formats

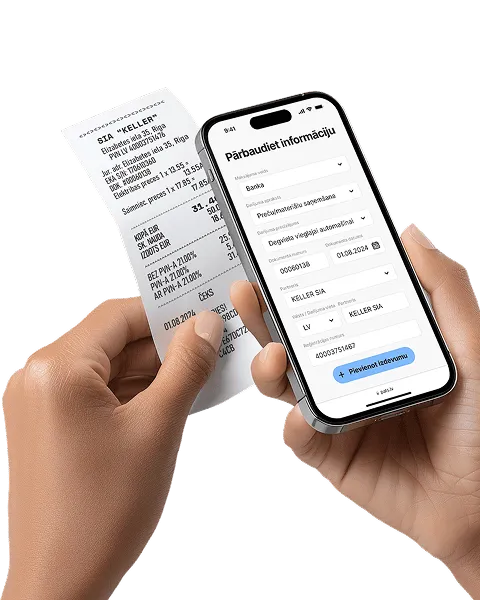

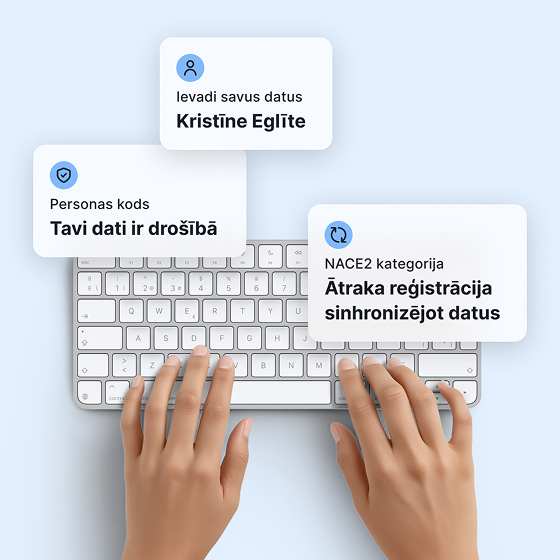

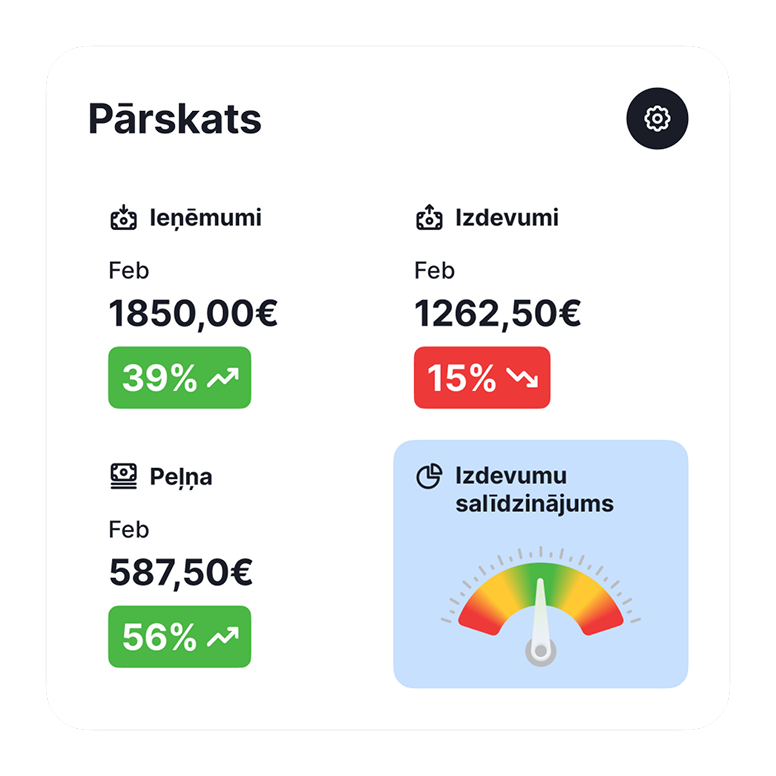

Solution - just enter the data, while the system prepares the calculations and reports

With our features, your accounting becomes simple and easy to understand.

Expenses most often written off by teachers, mentors, coaches

Service acquisition

Accounting services and professional licenses, invoicing service)

Purchasing of goods and materials

Learning materials (books, workbooks, teaching aids, subscriptions to e-books or courses)

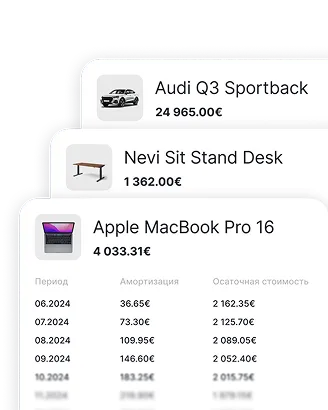

Purchase of fixed assets

Computers, tablets, phones, printers, cameras, microphones, sports equipment

Office rent and utilities

Classrooms, studios, gyms, coworking spaces

Marketing and sales

Advertising costs (social media, Google Ads), website maintenance and hosting

For more than 1200, the core business is:

Online lessons

Private tutoring

Giving lectures

Selling self-development courses

Personal training at the gym

Pricing

- Choose the plan that fits your work

- 7-day free trial

- All expenses are recorded automatically - no piles of papers

Premium - the perfect choice, as it lets you issue unlimited invoices and receive instant payments via QR code.

Free invoices

Invoices and documents

Functions

- 10 document scans

- Invite accountant

- Catalog of services and products

- Access to documents - 90 days

Invoices

- 10 invoices per month

- Language selection

- Invoice design selection

- Adding your own logo

- Electronic invoice

- Payment button directly in the invoice

Pay for a year - 2 months free

What customers say

If you are only planning to start your business activity

Registering as self-employed or starting a new company is now easier than ever.

Choose the form of activity and tax regime

Register with the State Revenue Service (VID) or the Company Register

Entrust accounting to pats.lv and focus only on your business

Register as a VAT payer if you need to