When does a self-employed person in Latvia need to register as a VAT payer?

Have you, as a self-employed person, ever asked yourself – do I need to register as a Value Added Tax (VAT) payer, and when? Read this article to get answers to the most frequently asked VAT-related questions from self-employed individuals!

When must a self-employed person become a VAT payer?

According to the law, anyone can voluntarily register as a VAT payer from the moment VAT-taxable transactions are made. However, the law also defines cases where VAT registration is mandatory for both individuals and legal entities.

One of the most common mistakes made by self-employed individuals is missing the moment when VAT registration becomes mandatory. Failure to register can significantly affect your business operations and accounting. So remember to track and act promptly:

- if the total amount of VAT-taxable transactions exceeds EUR 50,000 over the previous 12 months – you must register once this threshold is reached;

- if the value of goods purchased from within the EU (excluding VAT) reaches or exceeds EUR 10,000 in a calendar year;

- if services are received from or provided to an EU country or third-country VAT payer – VAT must be paid from the start, regardless of the amount. Note: this applies only to services.

Important! For example, if you provide services to a VAT payer in another EU country, the place of supply is considered the location of the recipient's business. Even if the service was delivered in Latvia, the law treats the place of supply as the other EU country. So don't assume you only need to register as a VAT payer when you reach EUR 40,000 in transactions. If you're providing cross-border services, registration is required from the very first such transaction.

A real-life example is provided by professor Inguna Leibus from Latvia University of Life Sciences and Technologies:

“I had an interesting case. A piano tuner registered as self-employed was invited to another EU country to tune pianos. Unfortunately, I had to inform him that he needed to become a VAT payer at that point, as he would issue an invoice to a business in another EU member state.”

Our recommendation: keep these mandatory rules in mind and ask yourself before each transaction – do I need to register as a VAT payer? Watch this video for more.

You must register as a VAT payer by the 15th of the following month. Submit an application to the State Revenue Service (VID).

Note!

- You can become a VAT payer temporarily if one of the above criteria applies.

- Micro-enterprise tax payers (MUN) cannot be VAT payers.

Do I have to file a VAT declaration?

How can you avoid missing the right moment to register for VAT? The best way is to separately track taxable and non-taxable transactions in your accounting records. VAT tracking is mandatory for VAT payers but can also be done voluntarily by others – which we recommend, as it helps you monitor your turnover and register on time. It can also help you decide whether early registration would be beneficial.

A registered VAT payer using a single-entry bookkeeping system (and not using the cash accounting method) must also maintain a VAT ledger in addition to the regular income and expense journal. The rules for completing this ledger are set in target="_blank" Cabinet Regulation No. 254172, and examples can be found in the VID guidelines.

The information in this ledger is used to complete the VAT declaration. In most cases, the declaration must be submitted by the 20th of the following month and the tax paid by the 23rd. VAT declaration functionality is also available in the pats.lv system.

Recommended resources for learning more about VAT registration and taxable transactions:

- “Accounting and Taxes for the Self-Employed” by Professor Inguna Leibus

- VAT declaration guidelines from VID

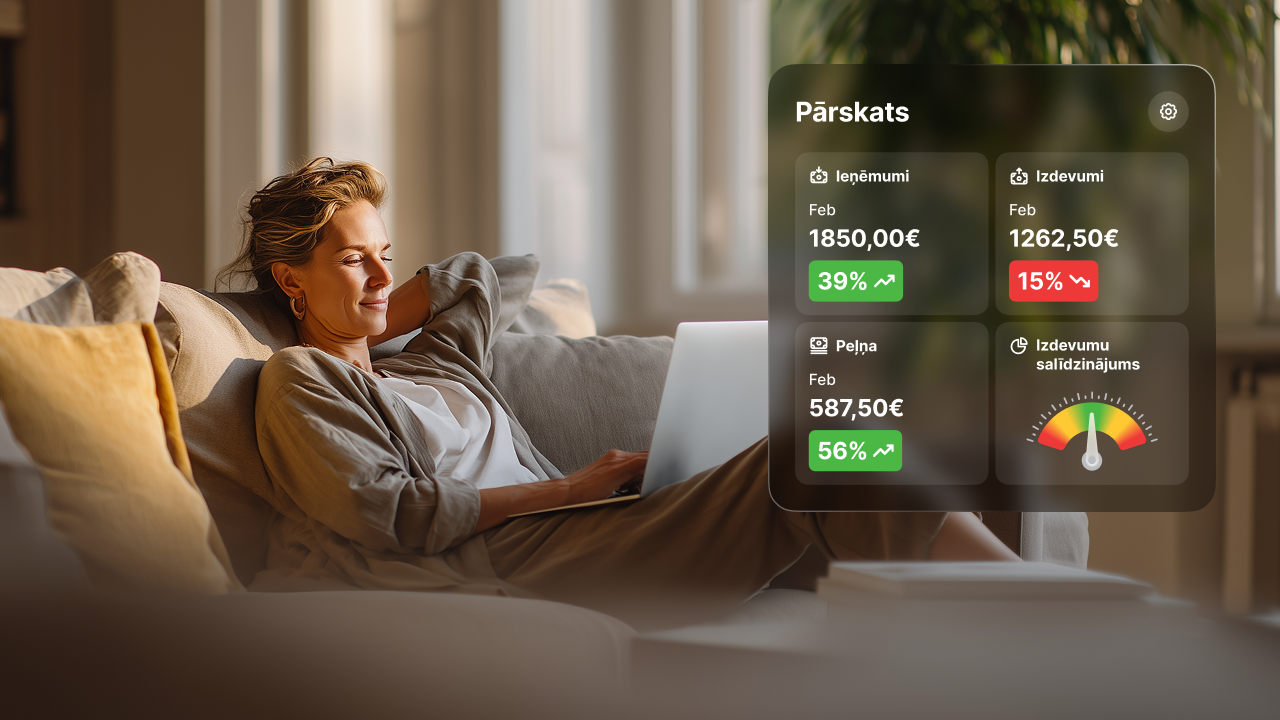

Doing your own accounting may seem complicated, especially the first time. Choosing the right accounting software will help you feel confident about your tax calculations.

Looking for such a solution? Try Pats.lv! It automates tax calculations, record keeping, and report preparation. All you need to do is track your income and expenses and upload the data into the system.

No prior accounting knowledge is needed to use pats.lv – try it free for the first 7 days!