Smart payroll module for companies

Automatic salary calculation - simple, clear, and accurate

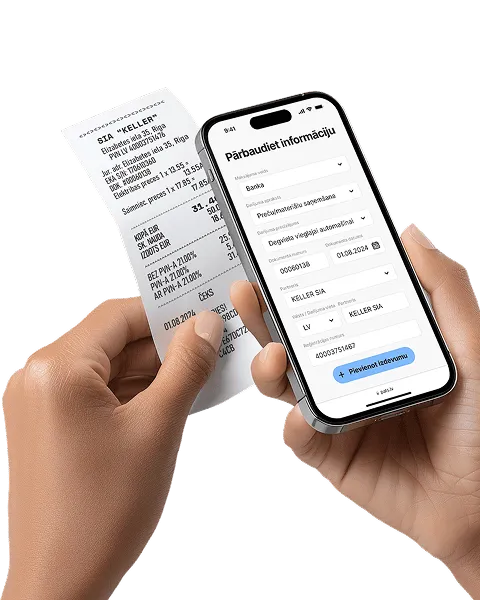

Calculation done for you

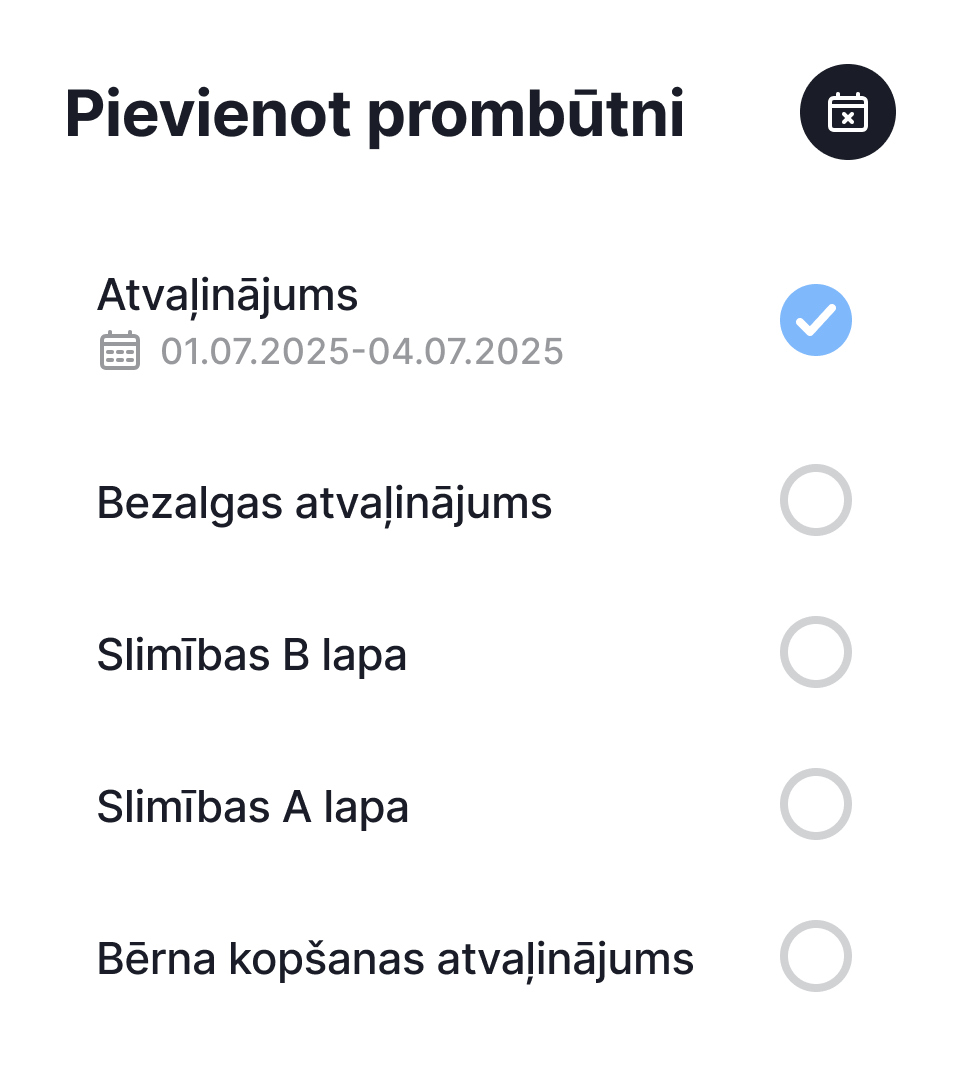

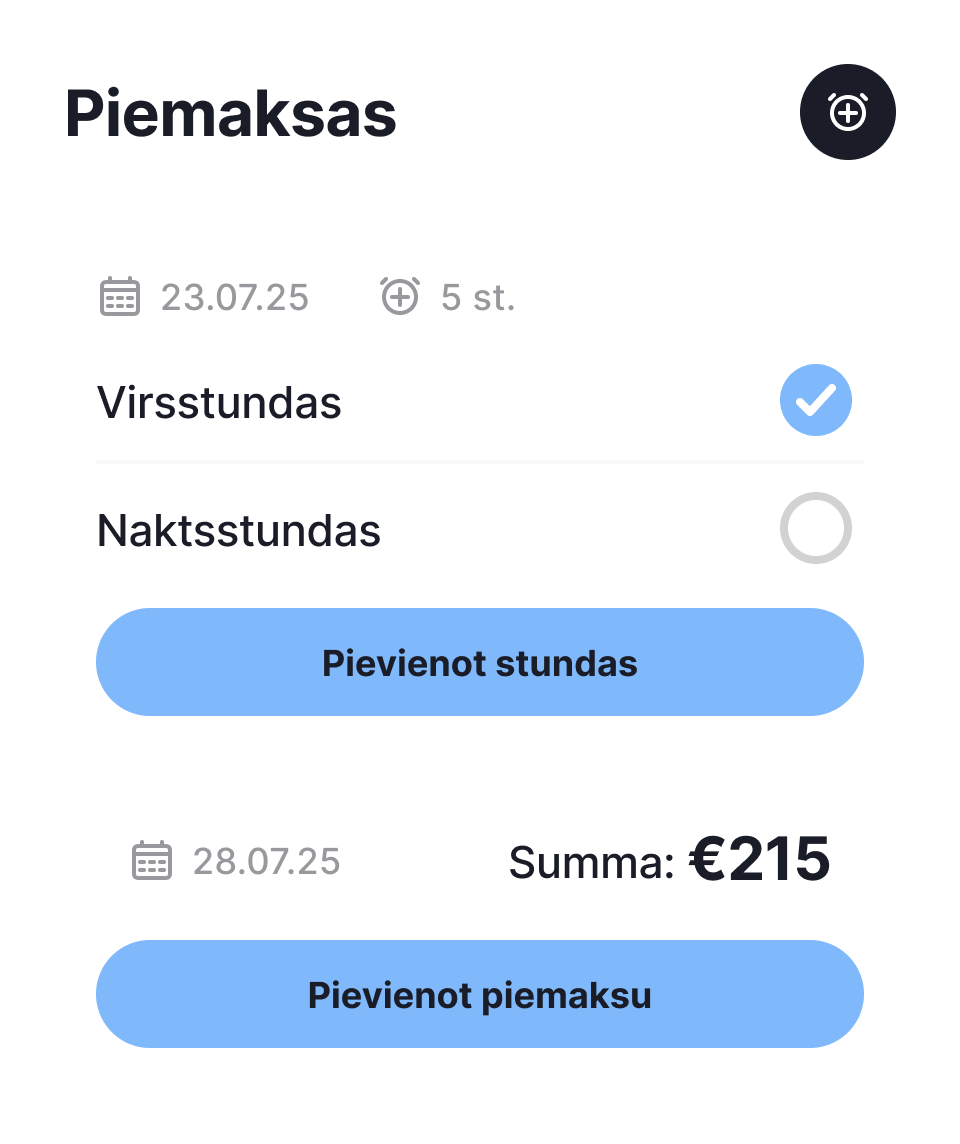

Just enter workdays, vacations, or sick leaves - the system calculates the rest.

Accurate taxes

Gross, net, personal income tax, and other supplements are calculated according to current tax laws.

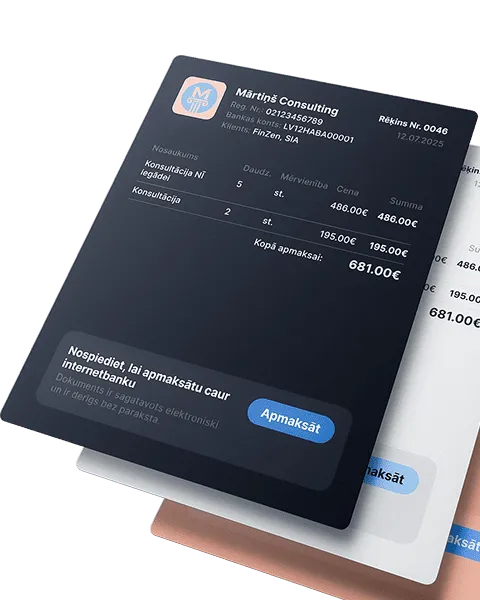

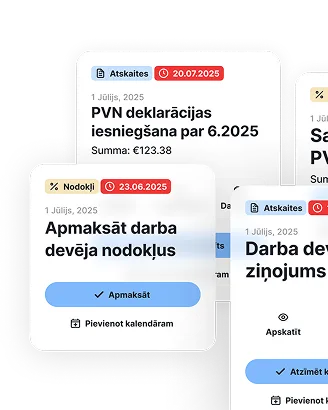

Ready documents

Employment documents, reports, and notifications are generated automatically.

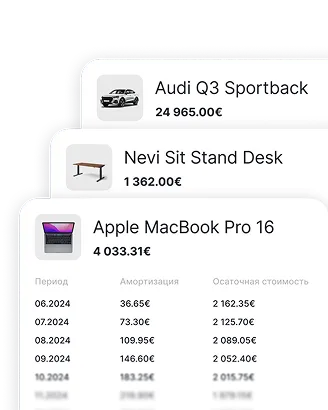

Everything in one place

All employee and salary info in the system - no payroll calculator needed.

Who is this perfect for?

SIA with employees

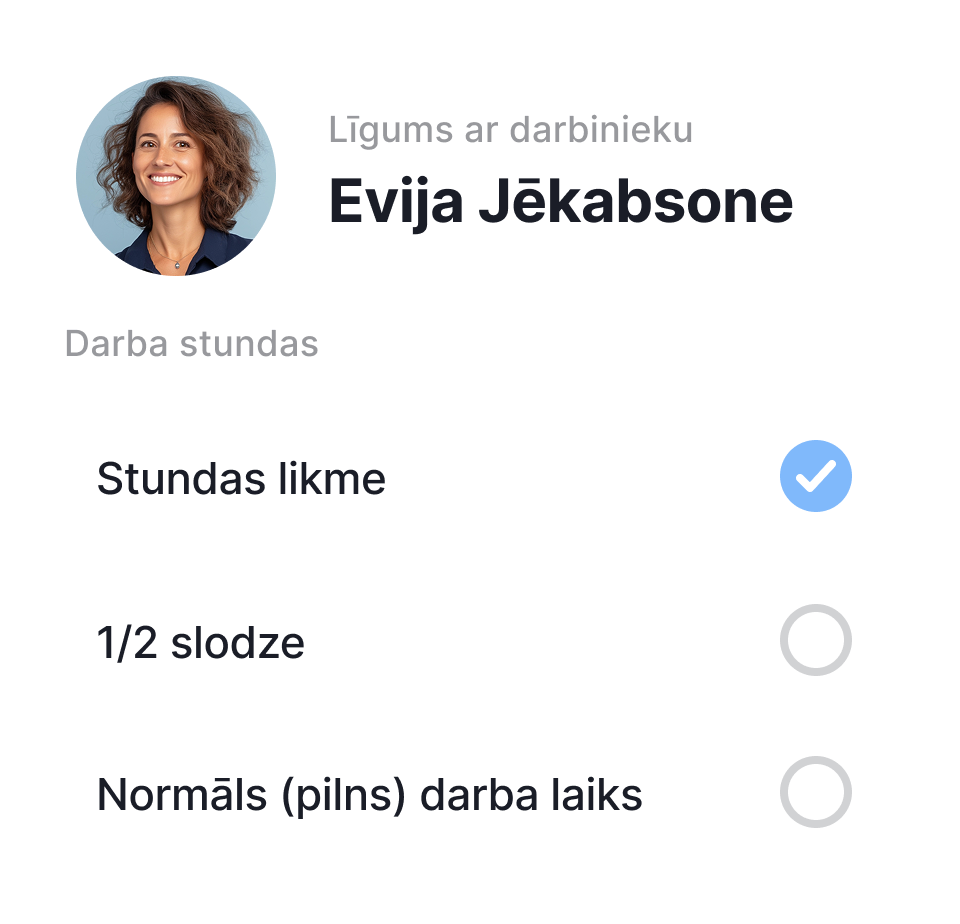

Salary calculation for full-time, part-time, or hourly rate

Self-employed employers

Easily pay employees without accounting knowledge

For accountants

It is possible to serve both companies and Self-employed persons

For drivers with control

Manage the process yourself - from contract to payment

Smart payroll module for companies

Business for you, numbers for the system

Vacations, sick leaves, and other cases are processed automatically, without unnecessary communication.

Automatic tax calculation

The accounting system always applies current rates and calculates taxes accurately.

Everything is already programmed

No need to look for tables or legal appendices - everything you need is already in the accounting system.

Not just the amount, but also clarity

The payroll module helps you understand why exactly this amount must be paid and also prepares the appropriate documents.

Main system features

What customers say

Frequently asked questions