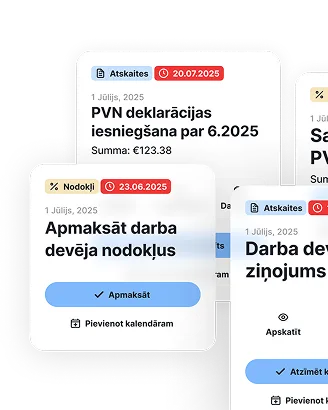

Reporting and tax calendar

Choose your type and period or see all together

Bilance

Report must be submitted by May 31st

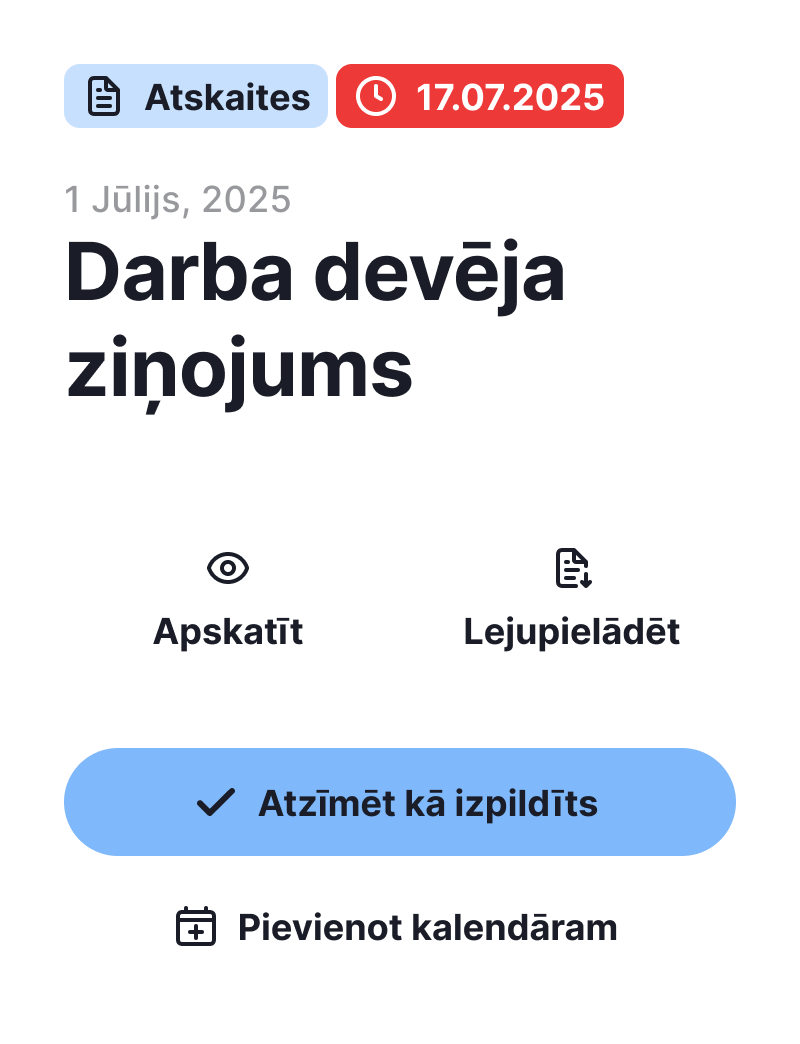

Darba devēja ziņojums

Report must be submitted immediately or by the 17th of the following month

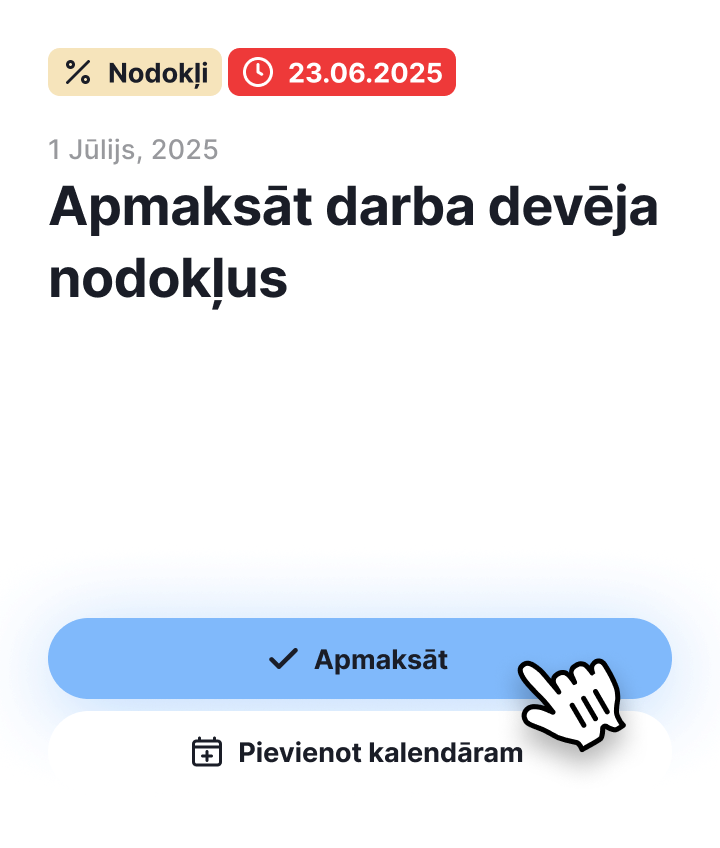

Tax must be paid by the 23rd of the next month

Gada ienākumu deklarācija

Report must be submitted from March 1 to June 1 of the following year, or if the total annual income exceeds €78,100 - from April 1 to July 1

Tax must be paid by June 23, or if the total annual income exceeds €78,100 - by July 23

Gada pārskats

Report jāiesniedz līdz 31.maijam kopā ar Bilanci un PZA

Ieņēmumu un izdevumu uzskaites žurnāls

Report must be available upon request

Tax is not required to be calculated

MUN ziņojums par sociālajām iemaksām

Report must be submitted by the 15th of the quarter (Jan, Apr, Jul, Oct)

Tax must be paid by the 23rd of the quarter (Jan, Apr, Jul, Oct)

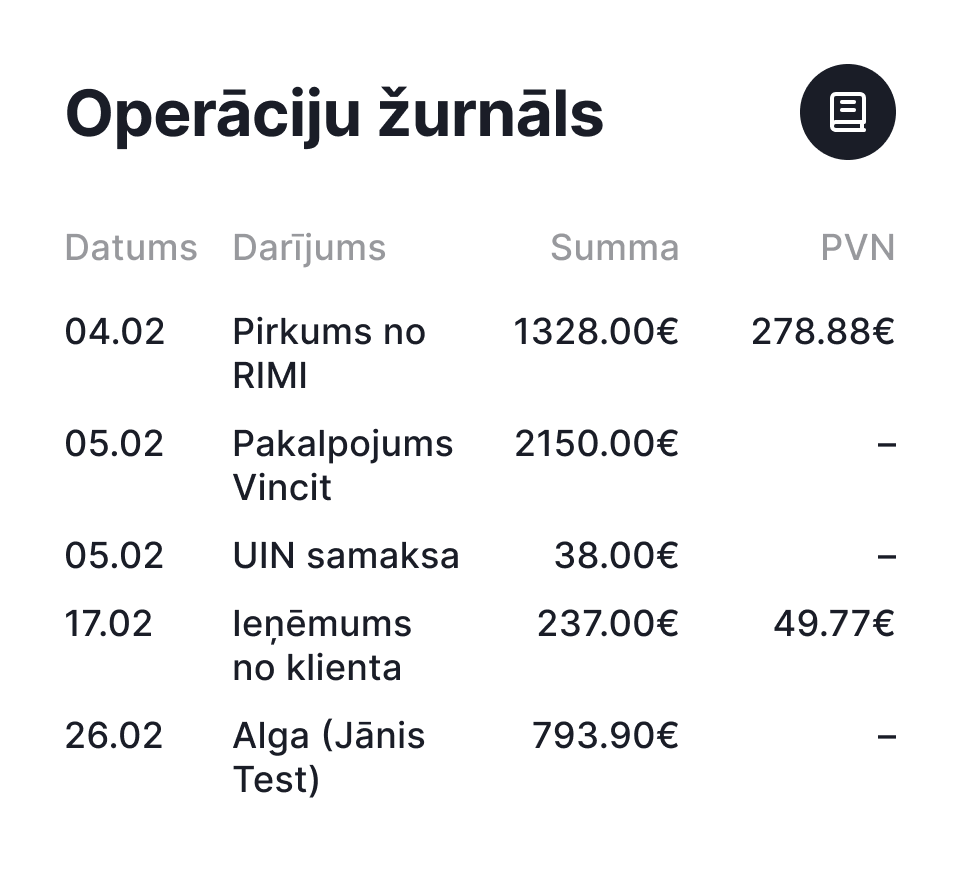

Operāciju žurnāls

Report must be available upon request

Tax is not required to be calculated

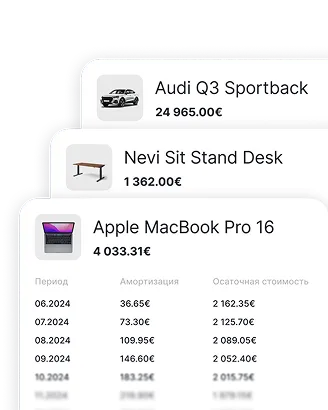

Pamatlīdzekļu un nemateriālo ieguldījumu nolietojuma un vērtības norakstīšanas aprēķins

Report must be available upon request

Tax is not required to be calculated

Paziņojums par fiziskai personai izmaksātajām summām

Report must be submitted by February 1st or the 15th of the following month)

Pašnodarbinātā ziņojums par sociālajām iemaksām

Report must be submitted by the 17th of the quarter (Jan, Apr, Jul, Oct)

Tax must be paid by the 23rd of the quarter (Jan, Apr, Jul, Oct)

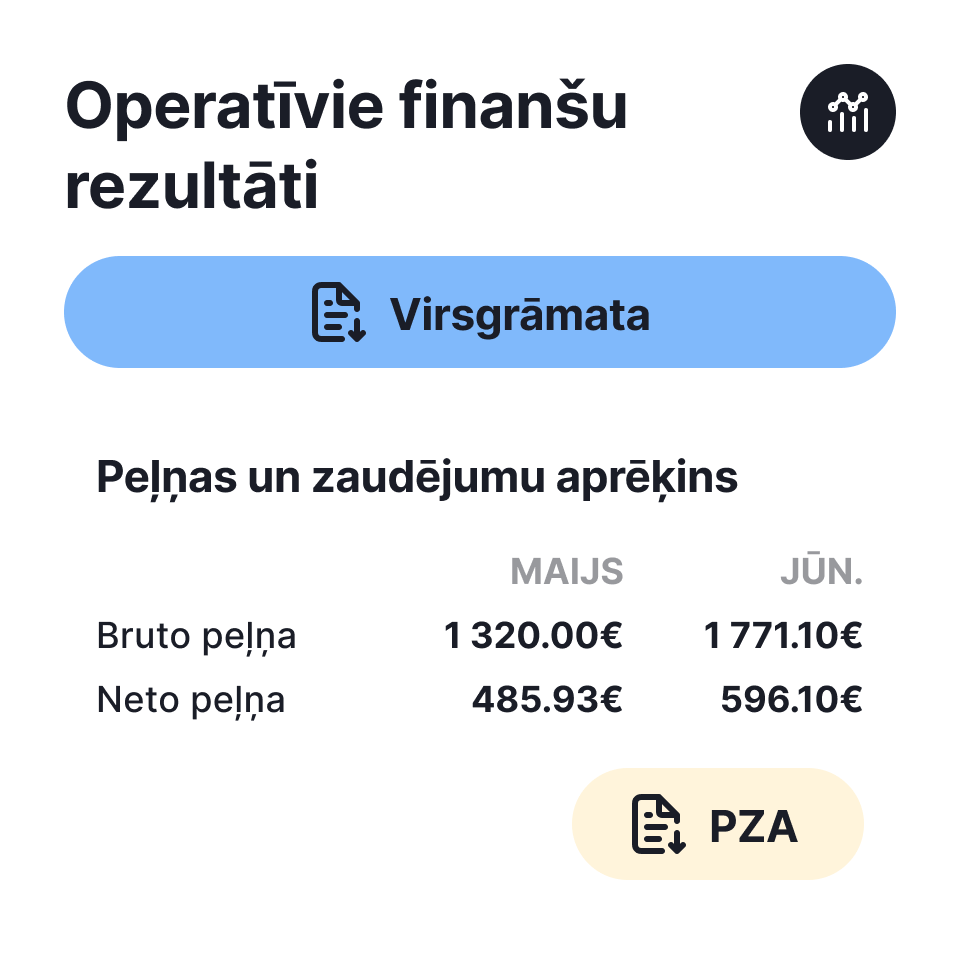

Profit and Loss Calculation

Report must be submitted by May 31st

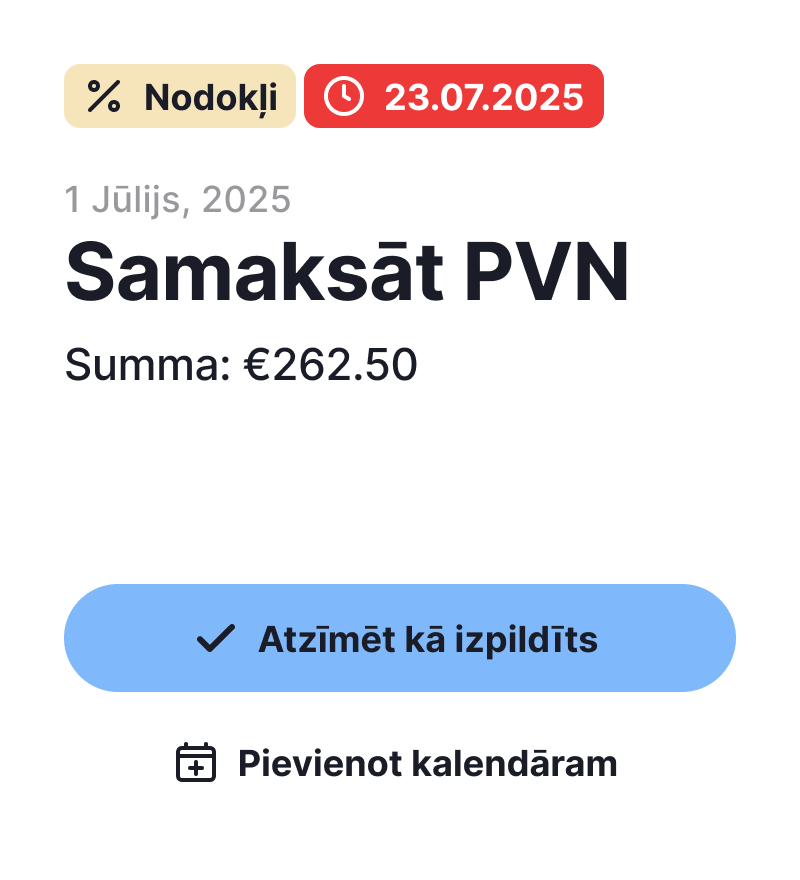

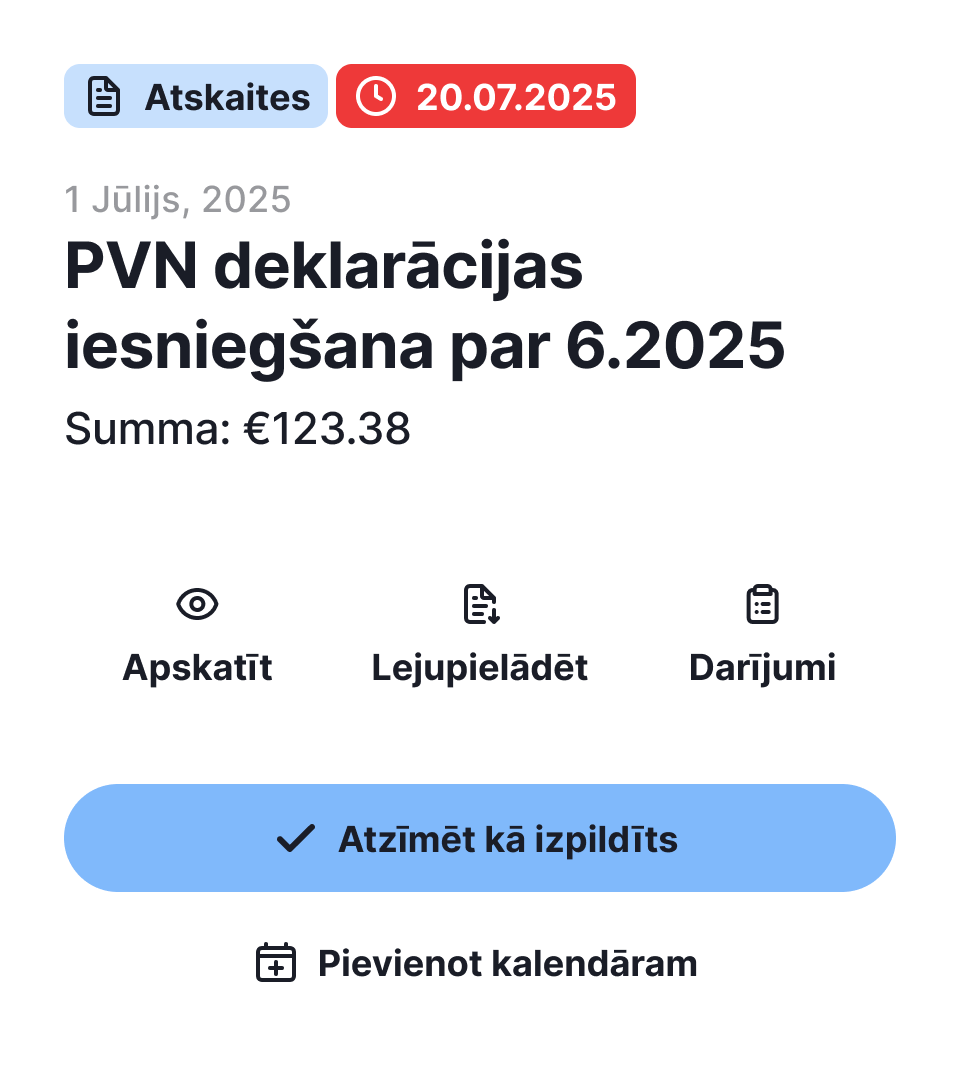

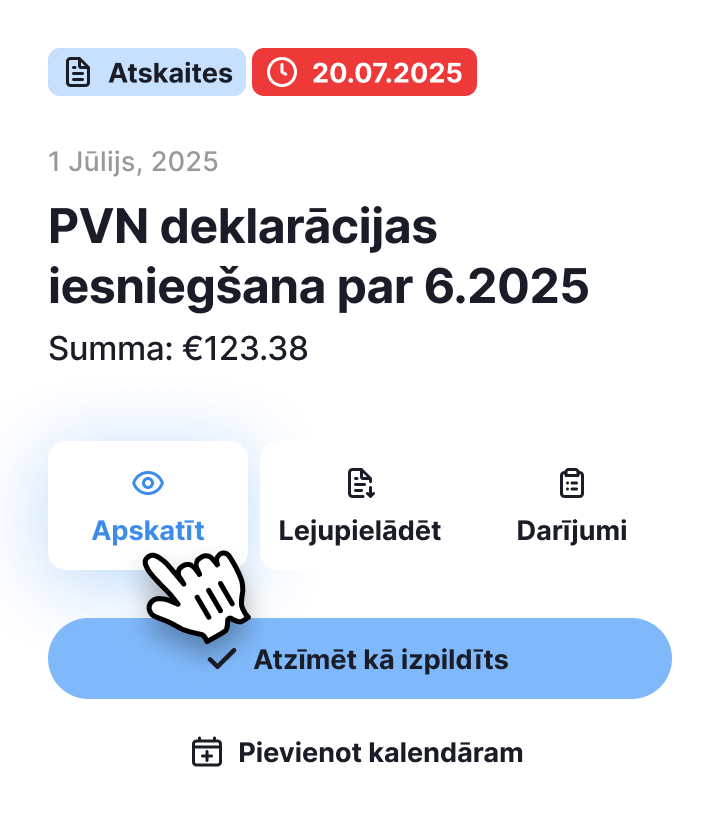

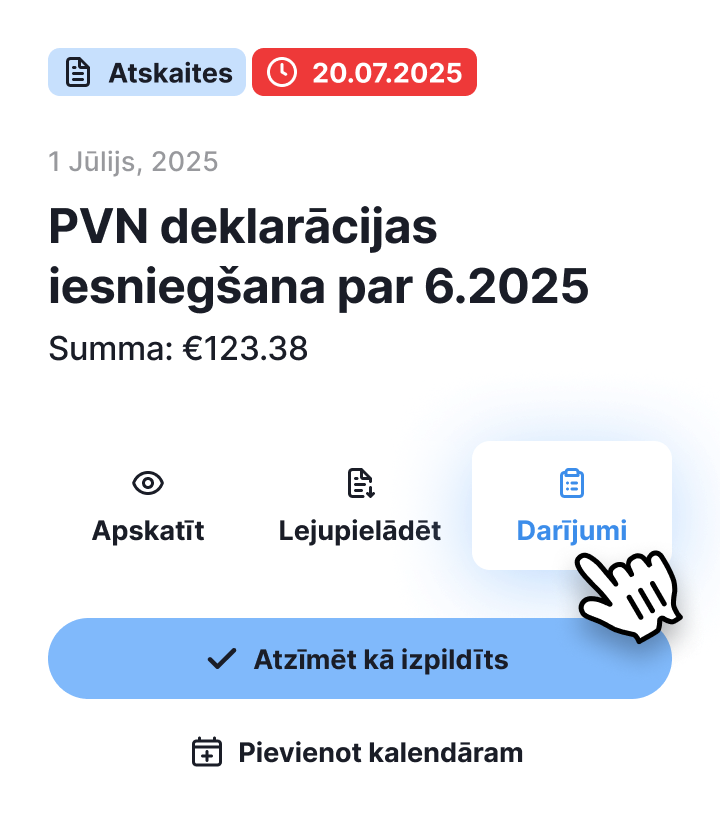

Pievienotās vērtības nodokļa (PVN) taksācijas perioda deklarācija

Report must be submitted by the 20th of the next month

Tax must be paid by the 23rd of the next month

*By default, the VAT return is prepared every month, but if the user has chosen to prepare the VAT return quarterly, then it will be prepared for each quarter.

Uzņēmuma ienākuma nodokļa (UIN) deklarācija

Report must be submitted by January 20th, the 20th of the following month, or May 31st

Tax must be paid by January 23rd or the 23rd of the following month

Virsgrāmata

Report must be available upon request

Tax is not required to be calculated

Ziņas par darba ņēmējiem

Report must be submitted immediately, but payment is due next month

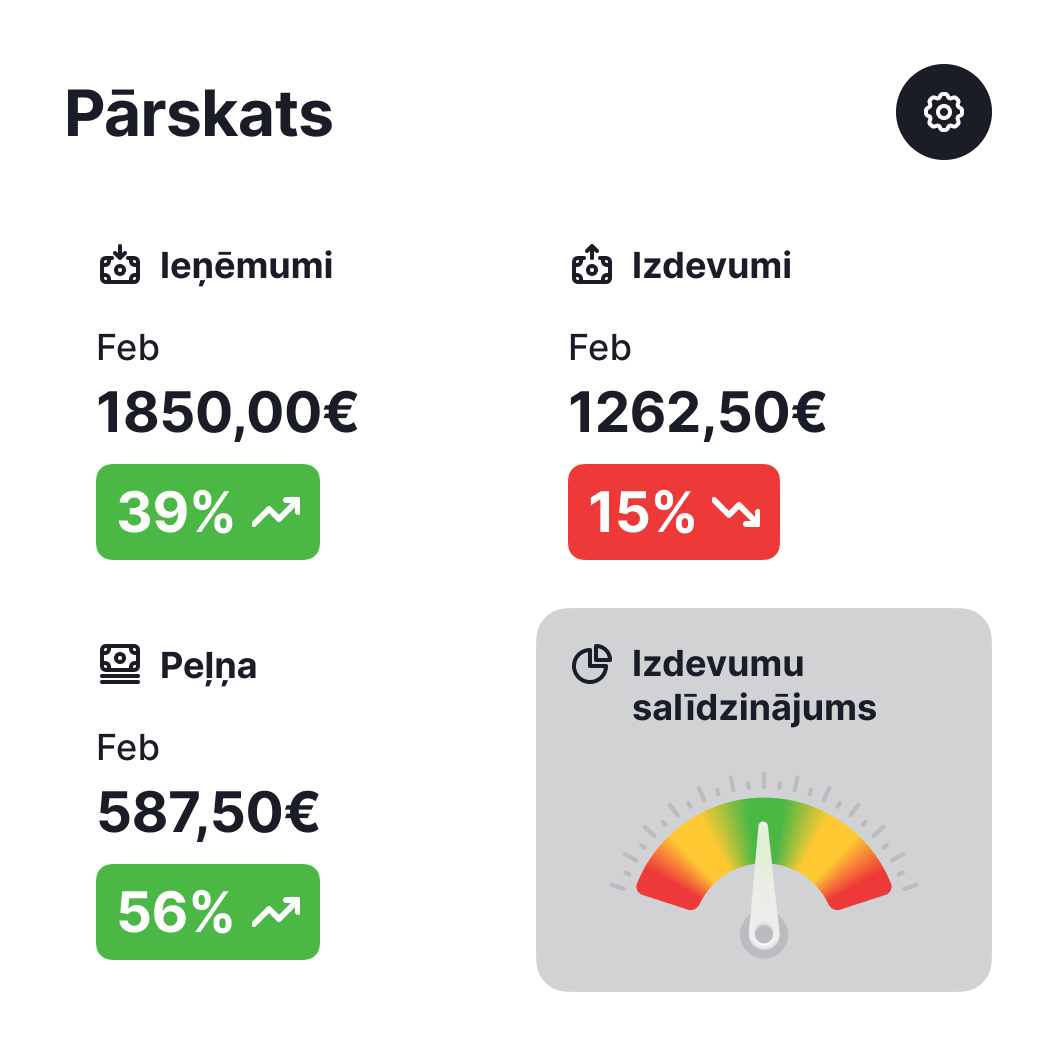

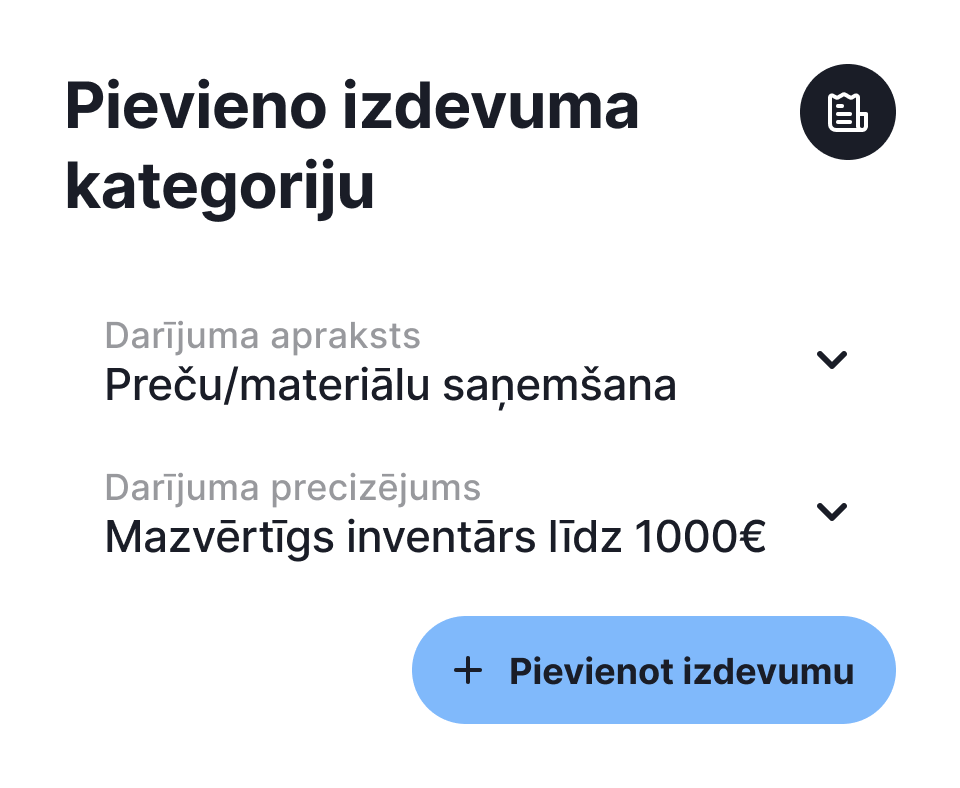

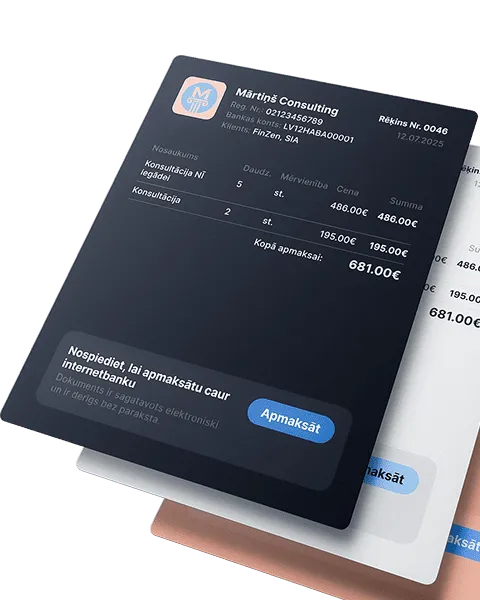

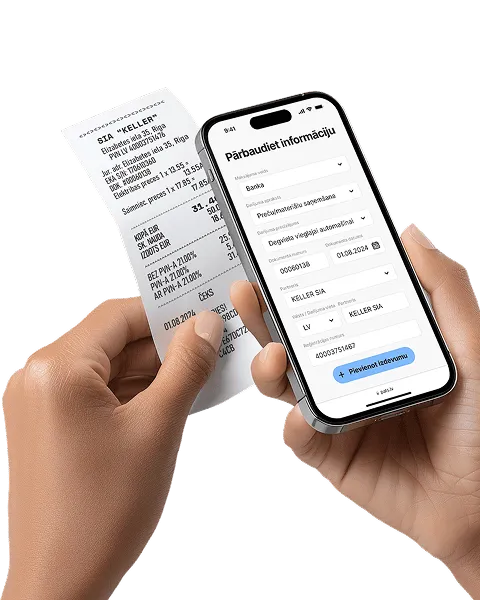

The accounting system makes reports as simple as possible - just enter the data.

Automatically prepared file formats for EDS submission

No more Excel and formulas, no more tables - everything is already prepared. Download and submit.

All reports in line with SRS requirements.

Everything is clear and understandable. Accounting that you control - not the other way around.

Main system features

What customers say

Frequently asked questions