Pašnodarbinātais un darba ņēmējs vienlaicīgi – kas jāzina?

Esi iecerējis līdzās algotam darbam uzsākt savu saimniecisko darbību? Esam apkopojuši svarīgāko informāciju, kas jāzina pirms kļūsti par pašnodarbināto!

Vai darba ņēmējs var būt pašnodarbinātais?

Jā, protams! Šādu iespēju bieži vien izmanto darba ņēmēji, kas, piemēram, vēlas īstenot uzņēmējdarbību, attīstot kādu no saviem hobijiem, vai līdzās algotam darbam gūt papildu ienākumus. Ja vien darba devējs līgumā nav noteicis ierobežojumus saimnieciskajai darbībai, tad droši var līdzās algotam darbam īstenot savu saimniecisko darbību un kļūt par pašnodarbināto.

Vai ir jāmaksā nodokļi arī no saimnieciskās darbības?

Jā, protams! Šādu iespēju bieži vien izmanto darba ņēmēji, kas, piemēram, vēlas īstenot uzņēmējdarbību, attīstot kādu no saviem hobijiem, vai līdzās algotam darbam gūt papildu ienākumus. Ja vien darba devējs līgumā nav noteicis ierobežojumus saimnieciskajai darbībai, tad droši var līdzās algotam darbam īstenot savu saimniecisko darbību un kļūt par pašnodarbināto.

Nodokļu iemaksas darbā par tevi veic darba devējs, taču saimnieciskajā darbībā nodokļu aprēķins un iemaksas jāveic pašam atbilstoši noteiktajām likmēm un maksāšanas kārtībai. Ja reģistrēsies kā pašnodarbinātais un izvēlēsies nodokļus maksāt vispārējā kārtībā (lai uzzinātu, kurš no nodokļu maksāšanas režīmiem tavā gadījumā būs izdevīgākais, izpildi šo testu), tad jārēķinās ar divām likmēm. Mēnesī gūtais ienākumu apmērs nosaka to, vai iemaksu aprēķinā jāizmanto lielā likme – 31,07%, kas ietver dažādas apdrošināšanas, vai tikai pensiju apdrošināšanas likme – 10%. Ja ienākumi mēnesī ir vismaz 700 eiro vai lielāki, tad iemaksas jāveic 31,07% apmērā no vismaz 700 eiro vai citas, paša izvēlētas, lielākas summas. Papildu tam jāveic iemaksas 10% apmērā pensiju apdrošināšanai. To aprēķina kā starpību starp faktiskajiem ienākumiem un šiem 700 eiro vai citas lielākas summas, no kuras tika veiktas iemaksas ar likmi 31,07% (piemēram, ja ienākumi mēnesī ir 900 EUR, 31,07% jānomaksā no vismaz 700 EUR, savukārt no pārējiem 200 EUR – 10%, kopējai nodokļu summai sastādot 237,49 EUR). Ja ienākumi mēnesī nesasniedz 700 eiro apmēru, tad jāveic tikai 10% pensiju apdrošināšana no faktiskajiem ienākumiem.

Pašnodarbinātajiem, kas izvēlas nodokļus maksāt vispārējā kārtībā, jāiesniedz arī ceturkšņa atskaite līdz 17. janvārim, 17. aprīlim, 17. jūlijam un 17. oktobrim, un līdz tā paša mēneša 23. datumam jāveic aprēķinātā nodokļa iemaksas vienotajā nodokļu kontā. IIN aprēķins vispārējā kārtībā notiek, piemērojot gada ienākumam atbilstošu likmi. Aprēķins notiek, iesniedzot gada ienākumu deklarāciju no 1. marta līdz 1. jūnijam. Nodokļa iemaksa jāveic līdz 23. jūnijam.

Kurš veic minimālās sociālās iemaksas – pašnodarbinātais vai darba devējs?

Gan uz darba ņēmējiem, gan uz pašnodarbinātajiem attiecas arī minimālās sociālās iemaksas no minimālā objekta 2100 eiro ceturksnī. Ja neesi darba attiecībās, pašam ir jāizvērtē, vai sociālās iemaksas tiek veiktas no vismaz 2100 eiro ceturksnī . Ja paralēli saimnieciskajai darbībai esi darba attiecībās, visi tavi ienākumi tiek skaitīti kopā un ņemti vērā, aprēķinot minimālās obligātās iemaksas. Gadījumā, ja tiek secināts, ka nesasniedz minimālo sociālo iemaksu objektu – 2100 eiro ceturksnī – un ir nepieciešams veikt papildu iemaksu, darba devējam ir pienākums segt šo starpību.

Ja esi iecerējis līdzās algotam darbam uzsākt savu saimniecisko darbību un kļūt par pašnodarbināto, iesakām iepazīties ar svarīgāko informāciju par reģistrāciju, nodokļu režīmiem, maksāšanas kārtību un citiem nosacījumiem mūsu blogā “Kā kļūt un būt par pašnodarbināto?”

Uzsākot saimniecisko darbību, jārēķinās ar patstāvīgu grāmatvedības kārtošanu, ieņēmumu un izdevumu uzskaiti, lai veiktu precīzu nodokļu aprēķinu. Paveikt to paša spēkiem var šķist sarežģīti, it īpaši, ja tas tiek darīts pirmo reizi. To ir svarīgi izdarīt ar lielu precizitāti, lai samazinātu ar nodokļiem apliekamo ienākumu apmēru un ietaupītu saimnieciskās darbības attīstībai tik ļoti svarīgos līdzekļus. Mazināt šaubas par datu pareizību un nodokļu aprēķinu var ar atbilstoši piemeklētas grāmatvedības programmas palīdzību.

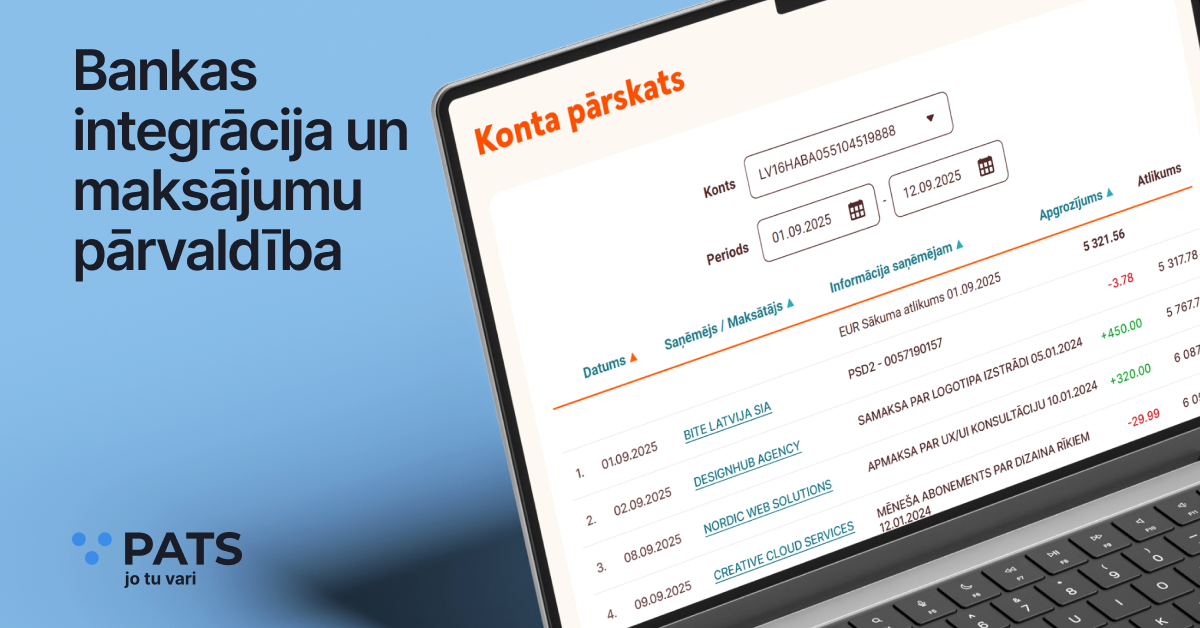

Ja esi šādas programmas meklējumos, izmēģini Pats.lv! Pats.lv sistēma grāmatvedības kārtošanu padara vienkāršāku, jo viss sarežģītais – nodokļu aprēķins, saimnieciskās darbības žurnāla aizpildīšana un atskaišu sagatavošana – notiek automātiski. Viss, ko lietotājam atliek darīt – cītīgi veikt ieņēmumu un izdevumu uzskaiti (izmantojot Pats Pro iespējams pievienot savu bankas kontu, lai arī šis notiktu automātiski) un datus augšupielādēt sistēmā.

Lai lietotu pats.lv, nav nepieciešamas priekšzināšanas grāmatvedībā – izmēģini un pārliecinies par to pats! Reģistrējies un lieto pirmās 7 dienas bez maksas!

Raksts atjaunināts 25.11.2024.