Can a Self-Employed Receive Unemployment Benefits?

There are various situations in which a self-employed might need unemployment benefits. For example, in the early stages of entrepreneurial activity, a self-employed may not have a stable income or may have no income at all, leading to thoughts about applying for unemployment benefits. There are also cases where a self-employed individual recently ended an employment relationship, applied for unemployment benefits, and simultaneously wants to start a business. Can a self-employed receive benefits? Let’s clarify!

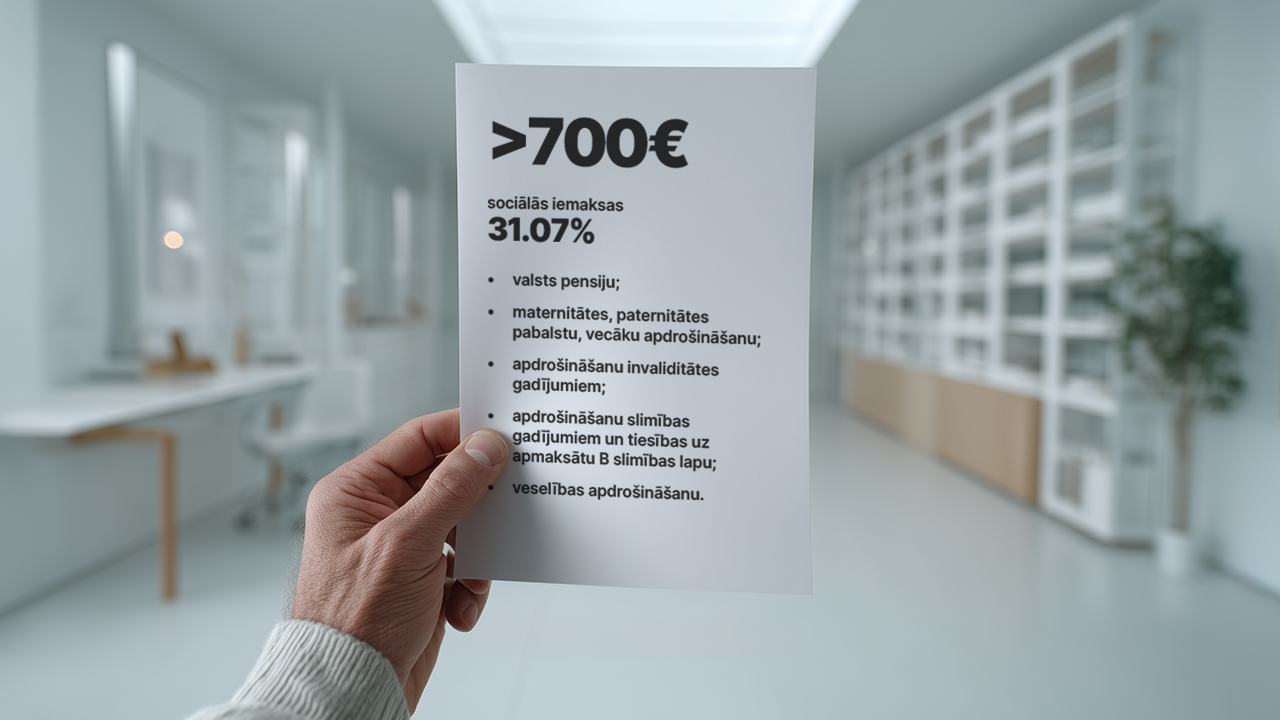

What risks are covered for the self-employed?

For employed workers, social contributions are paid by the employer, but a self-employed is responsible for their own “social protection package.” The type of insurance depends on the amount of social contributions paid by the latter. A self-employed who opts for the personal income tax regime and earns more than €700 per month pays social contributions at a rate of 31.07%. These contributions cover:

- state pensions;

- maternity, paternity, and parental insurance benefits;

- disability insurance;

- sickness insurance, including the right to a paid B-category sick leave;

- health insurance.

Additionally, self-employed must pay an extra 10% contribution for pension insurance. If their income is less than €700 per month, they only need to pay contributions for pension insurance based on actual income.

Regardless of the contribution amount, a self-employed is not insured against workplace accidents, occupational diseases, or, unfortunately, unemployment.

Are there exceptions?

A self-employed is only insured for the risks covered by their social contributions. Therefore, if you are self-employed, want to cease business activity, and were not previously in an employment relationship, you will not be eligible for unemployment benefits.

The situation is different for those who were previously employed. For example, if you decide to cease your business activity and were previously in an employment relationship, you can apply for unemployment benefits. These will be calculated based on the income earned from your previous employment.

If, for instance, you end an employment relationship, receive unemployment benefits, and want to start a business, you are allowed to do so, provided that your income from the business does not exceed €700 per month. Keep in mind that you will still be required to make a 10% pension insurance contribution.

Calculating social contributions for the self-employed can seem complex, especially if it’s your first time doing so. To make this easier, we’ve created pats.lv, an accounting system that calculates taxes and prepares reports on your behalf!