How to correctly calculate and pay vacation pay?

Every year, employees look forward to their well-earned vacation - a time to rest and spend with loved ones. For the employer, however, this period brings additional responsibilities: calculating vacation pay, preparing reports, meeting deadlines and ensuring everything is done according to the law.

And this is exactly where a number of questions arise:

How to correctly calculate vacation pay?

What should you do if the employee has not worked a full 6 months?

How to handle unused vacation days?

How does vacation pay affect tax calculations?

Below we explain the key principles every employer should know.

Basic principles of calculating vacation pay

According to the Labour Law, every employee is entitled to an annual paid vacation of no less than four calendar weeks. This means a total of 28 calendar days, of which the employer pays for 20 working days. If public holidays fall during the vacation, the vacation is extended by the number of such holidays. The employee and employer may agree to split the annual paid vacation into parts, but one part must not be shorter than two uninterrupted calendar weeks.

The calculation is based on the average earnings, which include:

- the employee’s salary for the last 6 months,

- supplements and bonuses if they are defined in the contract or internal rules,

- the number of days actually worked (excluding sick leave and previous vacations).

Formula:

Average daily earnings = total salary / number of days worked

Vacation pay = average daily earnings × number of vacation days

According to general rules, vacation pay together with salary for the period up to the vacation start date must be paid no later than one day before the employee begins their vacation. At the same time, the law gives the employee the right to request in writing that vacation pay be postponed to the next payday.

How to handle “tricky” situations?

The employee wants to take vacation “in advance”

If the employee has not yet worked 6 months, vacation may be granted if both parties agree. It is important to document this. In such cases, since there are not enough months for a standard 6-month average, the calculation uses only the remuneration actually earned up to the first day of vacation.

Unused vacation days

Compensation for unused vacation days may only be paid when the employee leaves the company. In this case, the employer must pay for all accumulated unused vacation days.

How does vacation pay affect tax calculations?

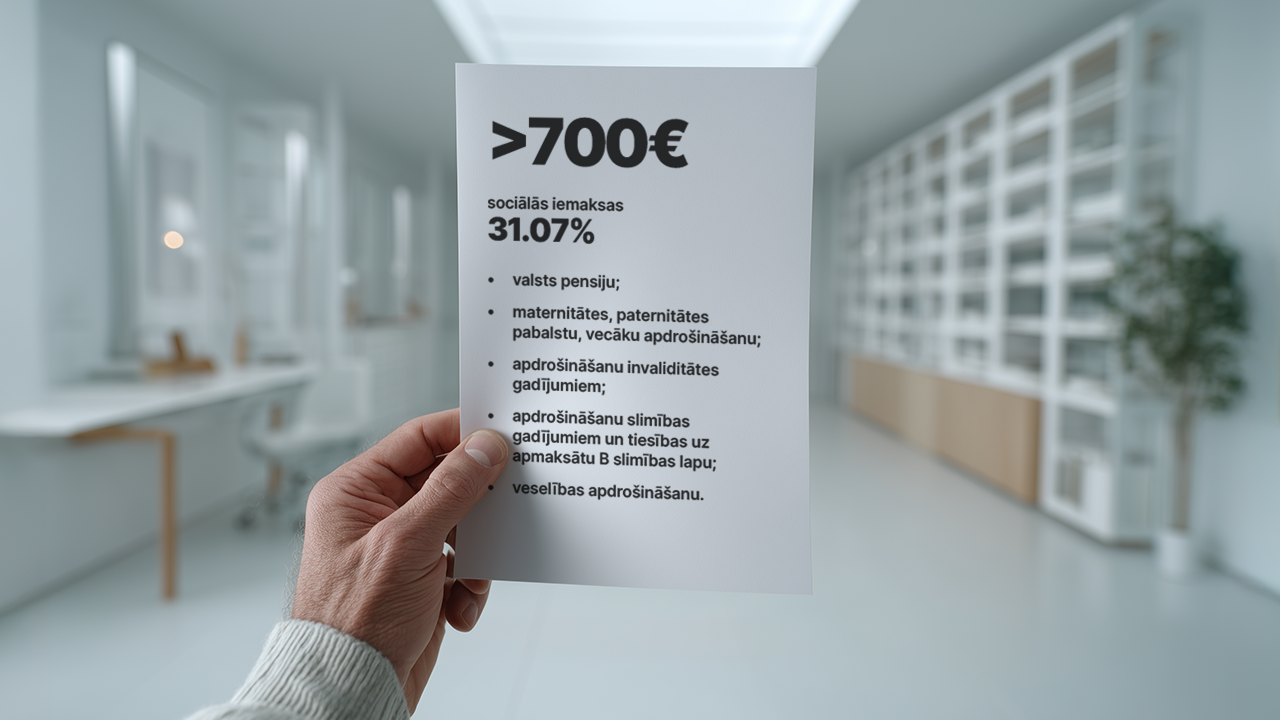

In Latvia, vacation pay is taxed just like regular salary, affecting both personal income tax (IIN) and social security contributions (VSAOI).

How to manage all this efficiently?

Many business owners still calculate everything manually or in Excel, always afraid of making a mistake. But errors in payroll can lead to problems with the VID, employee dissatisfaction and administrative risks.

That is why we created the pats.lv salary module, designed specifically for Latvian payroll calculations, where:

- vacation pay can be calculated automatically;

- all legally required parameters and calculation rules are included;

- the system automatically shows how many vacation days have been accrued;

- taxes, daily rates and vacation amounts are calculated automatically;

- reports ready for submission to VID can be generated directly from the system.

In addition, the module also includes:

- working time tracking,

- overtime,

- sick leave,

- parental leave,

- and everything else a Latvian employer needs to manage payroll smoothly.

Register - save time and avoid mistakes, try the salary module free for 7 days.