Goods purchased abroad for business activity of the self-employed

Goods purchased abroad for business activity of the self-employed

Have you bought a product in a foreign shop that could be useful for your business activity? We’ve summarised the key points that self-employed individuals should keep in mind when attributing goods purchased abroad to business expenses.

Can I write it off as an expense?

Yes, of course! Just like expenses for goods bought in Latvia, expenses for goods purchased abroad can also be attributed to your business. Take into account:

- you must be self-employed and paying taxes under the general tax regime – only under this regime can you write off expenses;

- the link between the expense and your business activity must be confirmed by appropriate documents – a receipt, invoice or other document;

- the documents must contain your details if the transaction amount exceeds EUR 30.

What else should be considered?

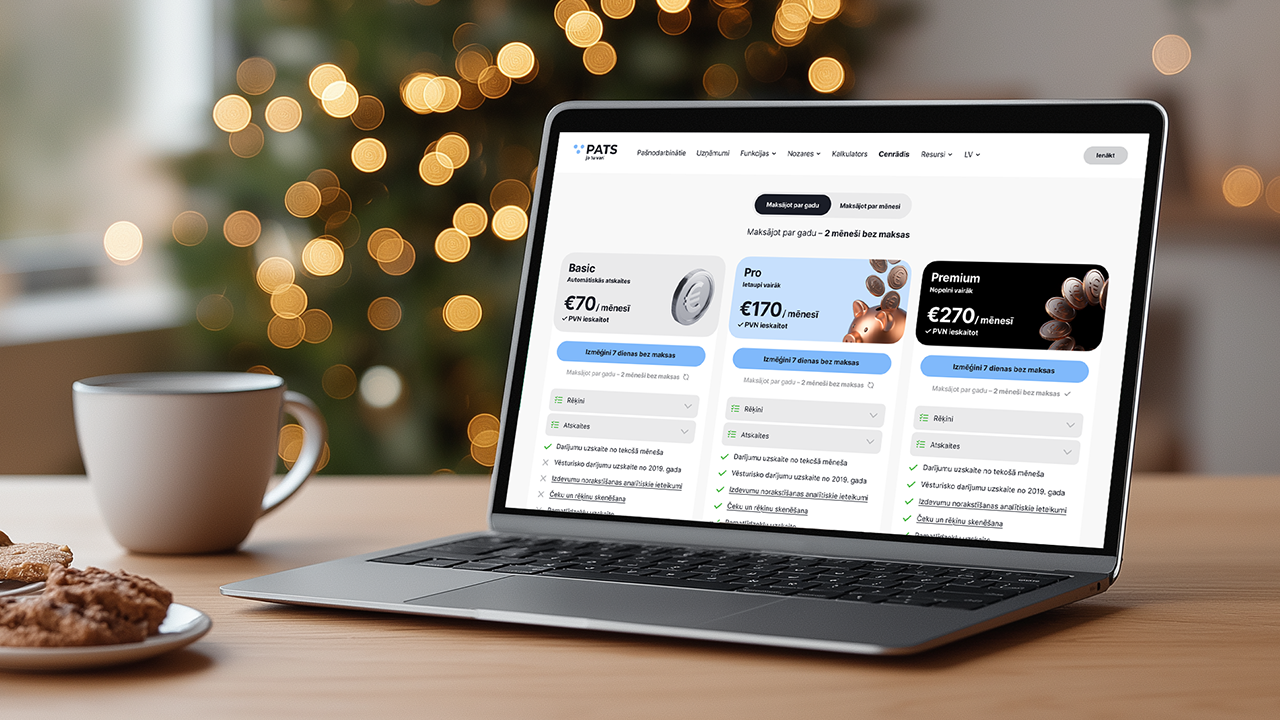

Product value. A product is considered low-value inventory if its value does not exceed EUR 1000. Expenses for such a product can be attributed to business costs immediately in full, or proportionally when writing them off. This can be done in the “Izdevumi” section of Pats.lv.

A product valued at more than EUR 1000 is a fixed asset. Fixed assets must be registered, depreciation calculated, and gradually attributed to business expenses. This can also be done in the “Pamatlīdzekļi” section of Pats.lv:

- create a fixed asset card;

- choose the depreciation calculation period;

- pats.lv will automatically calculate depreciation and add the expenses to the business activity journal.

Read more about fixed asset depreciation in our blog.

VAT registration

Assess how much you purchase abroad during the year and whether you need to become a VAT payer! You are required to register as a VAT payer once the value of goods purchased within the European Union without VAT in a calendar year reaches or exceeds EUR 10,000.

Have a question about another type of expense?

- help.pats.lv – we collect frequently asked questions

- Pats.lv is an accounting software that includes expense analytics in your profile – recommendations for writing off expenses, based on what you and other self-employed individuals in your sector write off.