Guide 2025 - Company Accounting (SIA) in Latvia

What is an SIA and why register it? SIA (sabiedrība ar ierobežotu atbildību) – the most popular form of business in Latvia. It is suitable both for beginner entrepreneurs and for those planning to expand their activities. Very often, self-employed individuals reach the need to transition to an SIA.

At the time of writing, we have more than 15,000 users, most of them self-employed. As their needs grew, we adapted the system for SIA accounting as well. Advantages of an SIA: limited liability, tax flexibility, greater opportunities for growth and attracting investment.

What main reports and statements must an SIA prepare:

- Annual report (consisting of the balance sheet and profit and loss statement);

- UIN declaration – if the company pays dividends or incurs expenses subject to this tax

- PVN (VAT) declaration – if the SIA is a VAT payer

- Employer’s reports / notifications on payroll tax calculations.

Deadlines are strict, and delays may result in significant penalties. Therefore, SIA accounting requires more attention.

How much does an accountant for an SIA cost

Accountant services for an SIA usually start at €100–150 per month for a minimal volume of documents (10–15 transactions). If the number of documents is higher or there are employees, the amount easily reaches €250–400 per month. The annual report is often charged separately (from €200 and up). For small businesses, these are significant costs. Using our system, these costs can be substantially reduced, as tariffs are available from €7 to €27 per month.

Complexities of SIA accounting

The main difficulty – the number of reports and deadline control. It is necessary to consider:

- mandatory submission of PVN and UIN declarations;

- preparation and submission of the annual report, consisting of the balance sheet and P&L;

- preparation of the general ledger;

- accounting of fixed assets and calculation of depreciation;

- correct calculation of salaries, vacations, and sick leaves.

Why entrepreneurs choose our system

Pats.lv was created to remove most of the routine related to report preparation, help avoid mistakes, and provide a convenient place for storing documents and managing accounting. In fact, the accounting system replaces the everyday work of an accountant: you only need to enter income and expenses – and the system itself will prepare the necessary reports.

Examples of automation

- Automatic preparation of PVN declarations, annual reports, and employer’s reports/notifications.

- Bank integration – all payments automatically enter the system, nothing needs to be rewritten manually.

- Recognition of receipts and invoices – take a photo of a receipt, and the data is immediately recorded.

- Fixed asset accounting – the system calculates depreciation itself, you only need to create an asset card.

- Payroll module – calculates gross/net salaries, taxes, vacation pay, and prepares all documents and reports.

- Tax calendar – reminds you of deadlines and helps not to forget anything.

- Analytics and advice – AI-based recommendations on expenses: what can be written off, where the risks are, and how to reduce the tax burden.

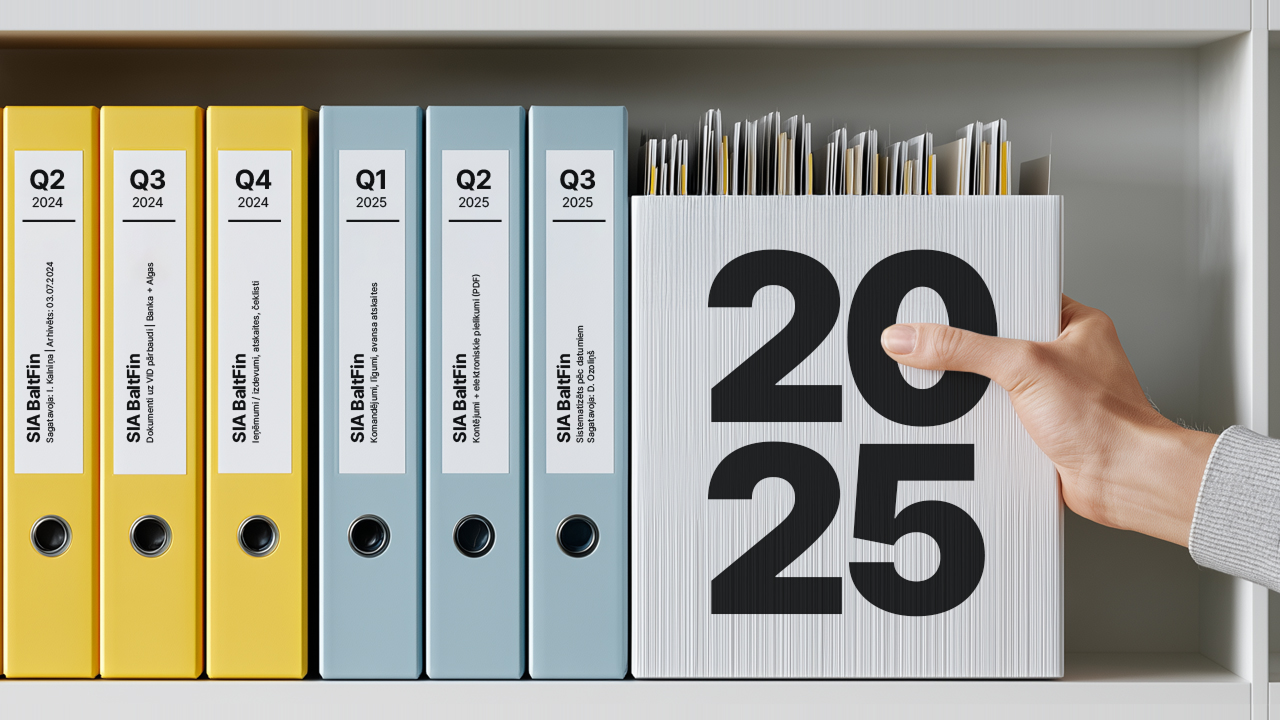

- Document storage – all receipts, invoices, and reports in one place, available for editing and downloading.

- Invoice issuance – you can create invoices with your company logo and send them directly from the system.

- Invoices with online payment – you can add a payment button by card, Apple Pay, or Google Pay.

The difference between working with an accountant and accounting in Pats.lv

- Classic accountant: all documents are sent to the accountant, who processes them and prepares reports. Cons – high cost, manual work, and constant dependence on the accountant. Pro – responsibility can be shifted to a specialist.

- Pats.lv: the entrepreneur enters the data themselves (or it is automatically loaded from the bank/receipts), and the system prepares reports. Con – responsibility for the accuracy of the data entered lies with the entrepreneur. Pro – speed, transparency, and low cost (from €7 to €27/month). Accounting jointly with an accountant – the entrepreneur does the daily accounting themselves, while the accountant connects to the system to check and submit reports to VID.

Advantages of Pats.lv

- Price: tariffs from €7 to €27/month.

- Simplicity: the system can be used even without accounting knowledge.

- Automation: reports are generated automatically.

- Control: always see the real picture of income, expenses, and taxes.

- Document storage: everything in one place.

- Invoices with online payment.

- Flexibility: accounting can be done independently or together with an accountant.

- Development: the system is constantly being improved.

Note

The Pats.lv system is intended for micro-companies that, on the balance sheet date, do not exceed 2 of 3 criteria: a) balance sheet total – €63,000 b) net turnover – €125,000 c) average number of employees during the reporting period – 5

The company director may do the accounting themselves if they are the only board member and shareholder of the SIA. The Pats.lv system is not intended for associations and foundations.

Try it yourself

Register today and try accounting for your SIA. See for yourself how simple and convenient it is to issue invoices, add receipts, synchronize the bank, and prepare reports without errors. Start risk-free – 7 days free!