How to avoid cash flow interruptions: a practical guide for entrepreneurs

In the previous article, we took a detailed look at why cash flow interruptions occur and why they affect even experienced entrepreneurs, SIA owners and self-employed professionals in Latvia.

Now let’s move on to the practical part - how to prevent interruptions, which steps truly work, and how to build a cash flow system that keeps your business stable.

How to avoid cash flow interruptions

A cash flow interruption is not inevitable, and it is not the end of the business. It is a signal that your cash flow needs attention. Below are reliable, proven methods that help self-employed individuals and entrepreneurs maintain stability.

1. Cash flow planning

Self-employed individuals and SIA owners often know how much they will earn, but not always - when exactly the money will arrive. This is crucial.

Planning helps you see:

- income dates

- mandatory payment dates

- days with potential deficits

This allows you to prepare in advance, postpone expenses or agree on payment adjustments.

2. Prepayments and advance payments

Even a small advance reduces the risk of cash flow interruption.

Prepayment helps cover:

- materials

- marketing expenses

- subcontractor work

- project start-up costs

This is especially important for self-employed individuals and services with a long delivery cycle.

3. Shorter payment terms

If the standard is 30 days, try 7-14 days.

Make it as easy as possible for your client to pay by offering several payment options:

- card payment

- Apple Pay and Google Pay

- bank link payment

- QR code

The fewer steps required - the faster the money arrives.

4. Splitting large payments

- rent split into parts

- purchases split into batches

- marketing budget split weekly

- taxes planned in advance

This helps self-employed individuals and SIA avoid situations where 4-5 payments “hit” at the same time.

5. Convenient payment methods for clients

If a client can pay the invoice in 10 seconds - they will pay faster.

Modern payment methods speed up cash flow:

- bank card

- internet banking

- built-in online payments

- mobile payments

This directly reduces the risk of a cash flow interruption.

6. Accounting automation

Most interruptions occur because accounting is done manually or irregularly.

A system helps your business when it:

- synchronizes bank transactions

- reads receipts

- shows the actual balance

- analyzes expenses

- reminds you of taxes and deadlines

This gives you real understanding of your situation - not guesses.

7. Financial reserve

A reserve equal to one month of expenses is already a safety cushion. Three months - the ideal scenario for self-employed individuals and small SIA.

This reserve helps you calmly get through:

- late payments

- unexpected expenses

- equipment breakdown

- seasonal downturn

8. What to do if an interruption has already happened

In a critical moment, it may seem that a loan is the fastest solution. But it often creates new and even more complex problems.

A loan fixes the consequences, not the cause

If you don’t change:

- payment terms

- invoice issuance timing

- expense planning

- cooperation model with clients

Then in a month the interruption will repeat.

The debt spiral begins

- monthly obligations

- interest

- fees

- late penalties

Credit rating decreases

- loans become more expensive

- limits decrease

- services may be denied

- landlords become cautious

Stress leads to impulsive decisions

- high-interest loans

- borrowing from private individuals

- covering one payment by delaying another

- postponed obligations

Therefore, the main thing is not to borrow, but to find and fix the cause.

The best approach - fix the process, not the symptom

- negotiations with suppliers

- expense restructuring

- shorter payment terms

- transparency with clients

- using automation

- switching to a modern accounting system

Conclusion

A cash flow interruption is not a mistake and not a sign of business weakness. It is a sign that your cash flow needs attention. It can be predicted and controlled if you understand cash flow and deadlines.

And it is especially important that self-employed individuals and SIA owners in Latvia see their finances in real time.

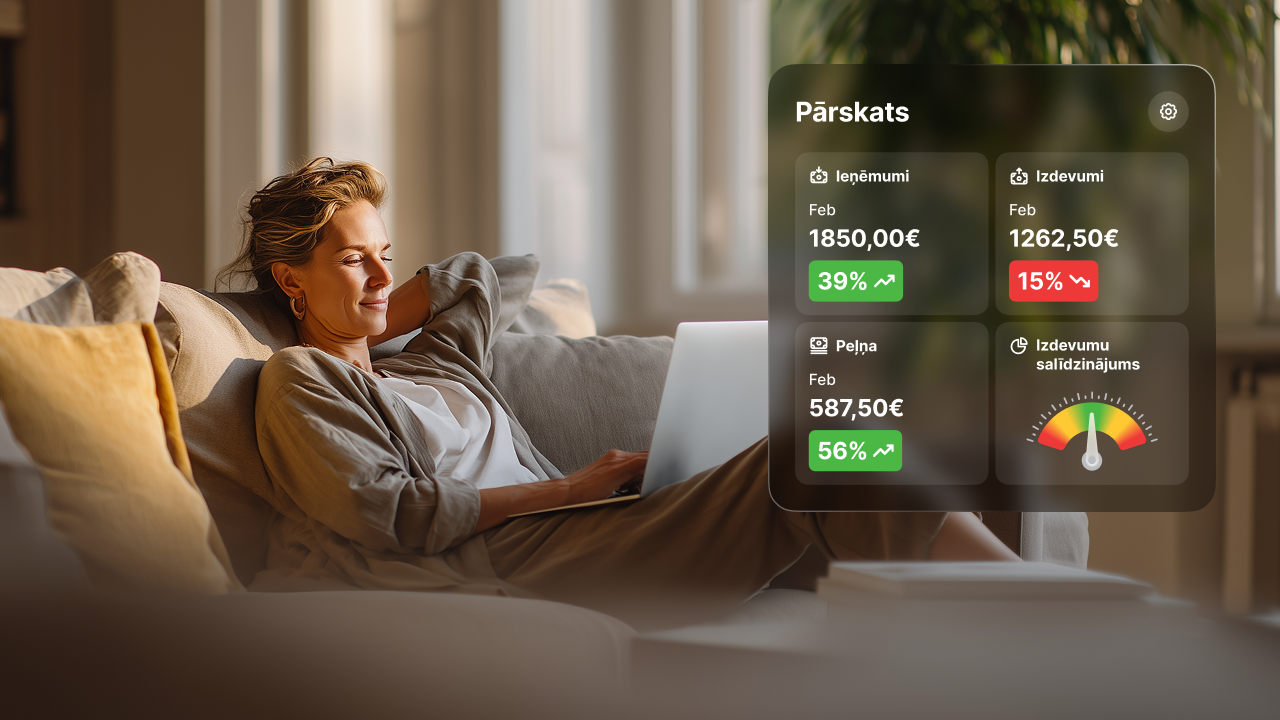

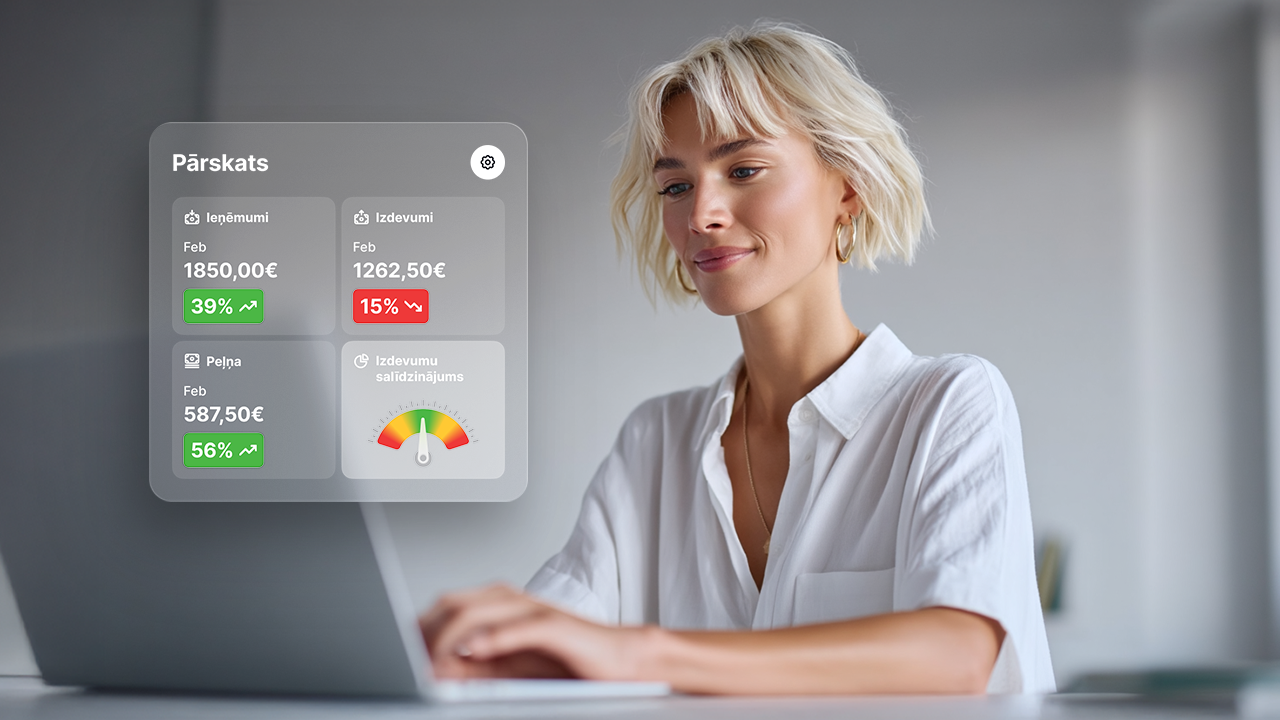

How to avoid cash flow interruptions with pats.lv

Modern accounting by pats.lv helps entrepreneurs and self-employed individuals avoid cash flow interruptions thanks to:

- real-time visibility of income and expenses

- automatic tax calculations

- bank transaction synchronization

- instant receipt and invoice scanning

- expense analytics

- deadline reminders

- modern online invoicing

- payment via link or QR code

- payment status tracking

Pats.lv speeds up cash flow, reduces errors, and helps entrepreneurs make decisions based on facts, not assumptions.

It is not just accounting - it is a tool that significantly reduces cash flow interruption risks. The system is designed so accounting can be done independently or together with an accountant. Register, try all features - feel the difference and choose the plan that suits you best.