How Latvian self-employed professionals can correctly deduct expenses and avoid overpaying taxes

Many self-employed professionals have already learned how to earn money and sell their products or services, but every month they overpay taxes because they do not fully account for their expenses. Receipts are stored on a phone, in chat conversations, folders on a computer, Google Drive, or Excel files - and in the end, some are lost, some are not counted, and some remain unclear.

The result? Taxes are paid on the full amount instead of the actual profit.

We have prepared a two-part article series with real examples showing:

- how self-employed professionals earn money,

- which expenses can be legally deducted,

- how much tax is paid before and after expense tracking,

- how much time bookkeeping takes,

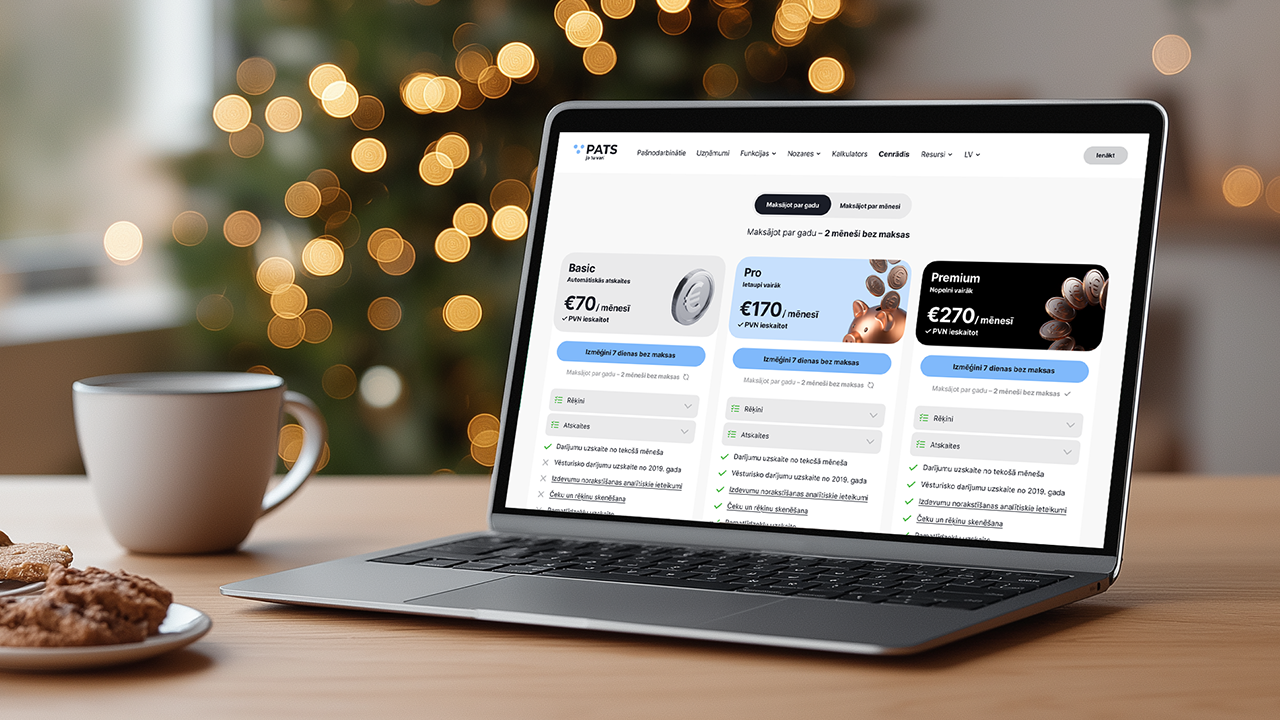

- and why pats.lv is simpler than using traditional accounting services or accounting software.

No “shadow economy” or “schemes” - only legal, transparent, and automated processes.

Why expense tracking is important for the self-employed

Most people start without a clear system: they photograph receipts on their phone, store them in Excel or Google Sheets, create monthly folders on their computer, or send documents to an accountant. This works… until:

- receipts get lost,

- personal and business expenses get mixed up,

- errors appear and it becomes unclear which expense was missed

Accountants start asking many questions - “Where is the receipt? Why is the invoice missing? What is this expense related to?”

And most importantly - some expenses are not recorded at all, which leads to tax overpayment. Receipts are put aside, forgotten, forwarded, and later it becomes difficult to “connect the dots”.

Below is an example of how much this costs in real money.

Example: Self-employed hairdresser (chair rental)

Profile

- Status: self-employed

- Works in a salon

- Rents a chair

- Sometimes works from home

- Income: ~2000 € per month

- No personal vehicle

Work specifics

- Social media

- Advertising to attract clients

- Photo and video content

- Seminars (professional development)

- Own tools

What can be deducted

- Chair rental

- Tools

- Cosmetics and materials

- Camera, lighting, phone (proportionally to business use)

-

Advertising - it is important to note that when paying for services provided by third-country taxpayers, such as Google or Facebook:

- VAT registration is required

- VAT must be paid under the simplified scheme (effective from 2025)

- Courses - both professional hairdressing training and SMM courses (social media marketing - developing a personal beauty brand)

- Work clothing (apron)

- Transportation (bus tickets)

- A portion of utility costs when working from home (for example, if 20 m² of a 100 m² apartment is used for business purposes, only 20% can be deducted).

What cannot be deducted

- Personal purchases

- Everyday clothing

- Expenses without a receipt or required details (if the amount exceeds 30 EUR)

- Private trips

(simply put: if it is not for work, it is not a business expense)

Financial example

Below is a detailed example with real but variable expenses. Expenses are shown as an average per month on an annual basis, because in practice they are not the same every month. One month they may be materials, another month advertising, training, or travel costs. Over the year, they form a stable amount that significantly reduces taxable profit.

Monthly income: 2000 €

Expenses:

- chair rental 500 € (including utilities - electricity, water, heating);

- materials 300 € - hair dyes, oxidants, care products, disposable gloves, foil, towels, disinfectants;

- advertising 200 € - social media, promotion on Facebook / Instagram, ads on service portals (for example, ss.lv), paid tools and apps for content creation;

- tools 100 € - scissors, clippers, hair dryer;

- courses 150 € - professional training, seminars, masterclasses, and events abroad.

Total: 1250 €

Without expense tracking

Taxes on 2000 € = 780 € (approximate)

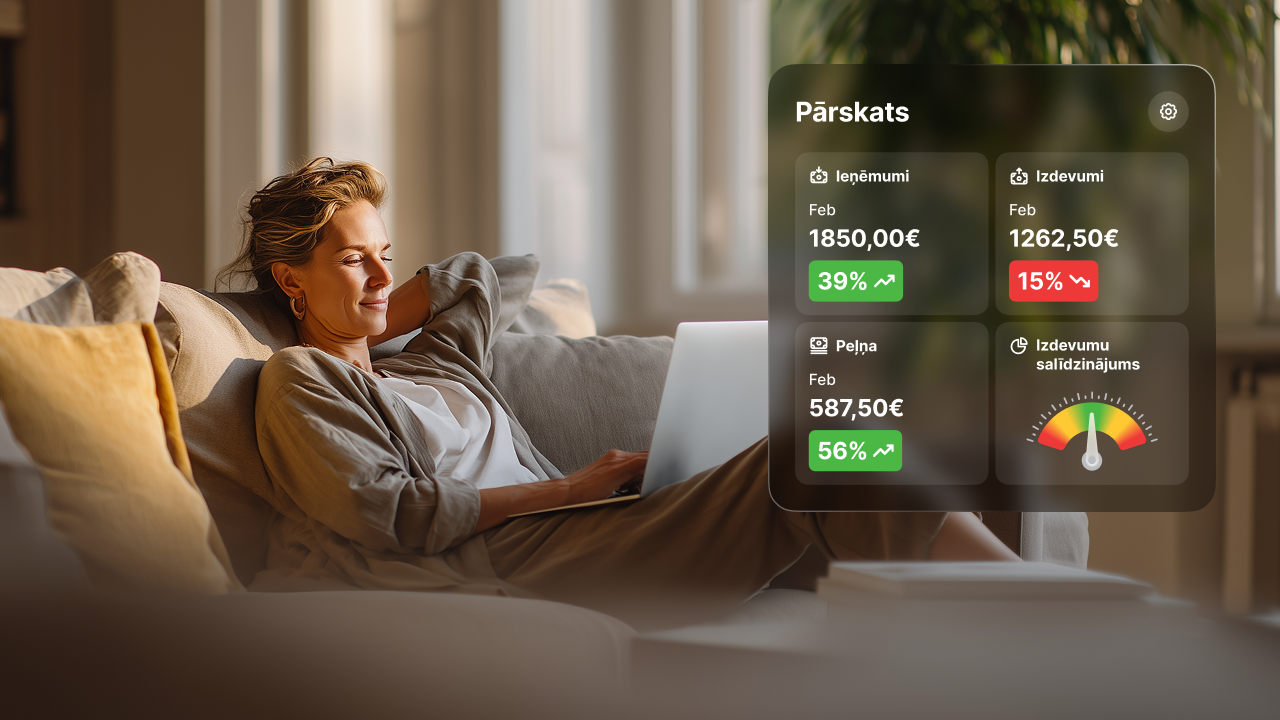

With expense tracking

Taxable amount: 2000–1250 = 750 €

Taxes: 247 €

Savings:

~533 € per month

~6396 € per year

Why does accounting feel complicated for hairdressers? Many small receipts, mixing personal and business expenses, fear of mistakes, lack of time for bookkeeping, and poorly chosen tools such as Excel or complex accounting software.

How pats.lv helps

- Everything in one place - data, transactions, reports

- Receipts can simply be photographed with a phone, without manual data entry

- Automatic transaction categorization

- Clear taxes without an accountant

- Ability to receive payments without a cash register

- Option to ask a tax expert a question

Summary

- Less stress - tax calculations and reports are prepared automatically

- Lower tax burden

- Clear understanding of your earnings

- No chaos in documents - everything is always available in the system

Start tracking without chaos with pats.lv you track expenses, see your taxes, avoid overpaying, and save time.

Soon we will also publish a second blog about an individual trader (IK) in the field of digital marketing. Subscribe to our weekly newsletter to regularly receive more useful information. 👇 It is free, and you can unsubscribe at any time. 👇