Accounting Guide for Latvian Companies (SIA) - 2026

Pats.lv team

Experts in their field

When building and growing a business in Latvia, it is important to stay informed about the most significant changes in taxation and legislation that take effect from 1 January 2026. In this guide, we will look at the key tax updates, as well as how to easily organize accounting with the pats.lv system.

The most important tax changes in 2026

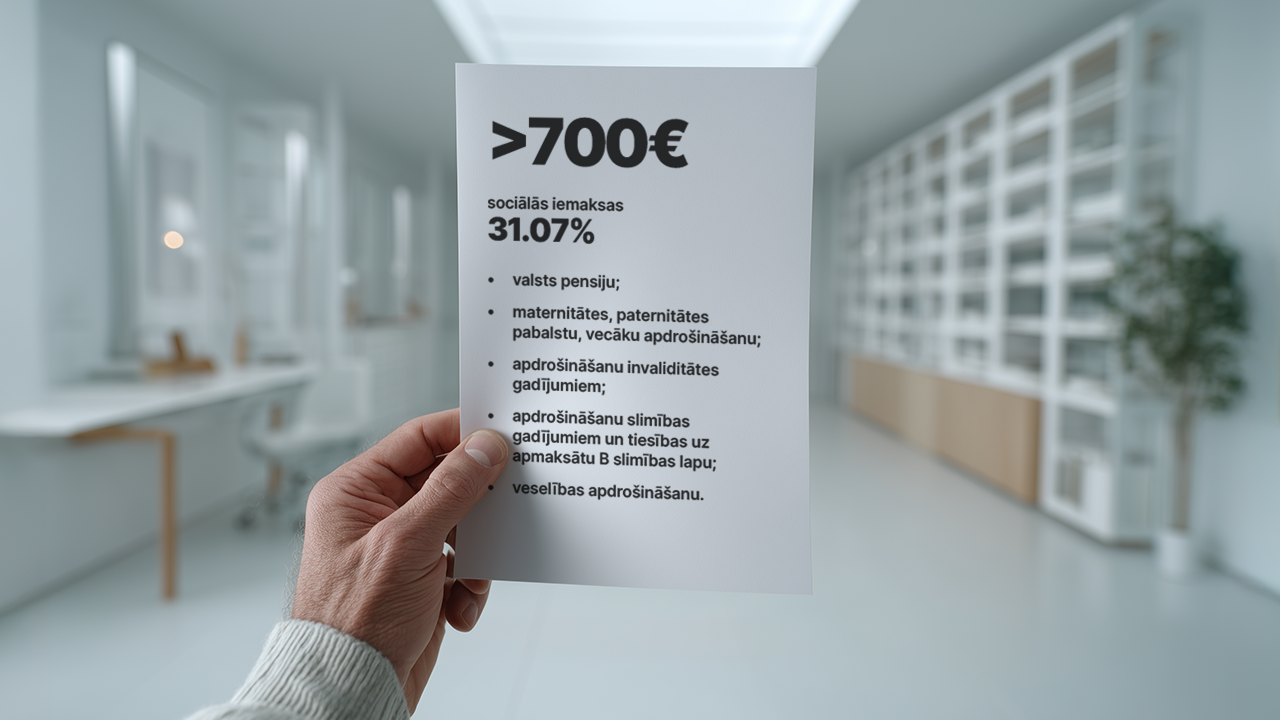

1. Changes in labor taxes

Minimum wage, euros per month

📈 * The national minimum wage increases from €740 to €780 per month.

Fixed non-taxable minimum regardless of income level, euros per month

💶 * The monthly non-taxable minimum increases from €510 to €550.

Check the pats.lv calculator and verify salary calculations.

2. VAT (value added tax)

* From 1 July 2026, within a pilot project until 30 June 2027, a reduced VAT rate of 12% applies to supplies of certain food products such as bread, milk, poultry meat, and eggs, as listed in Annex 2 of the VAT Law.

* The VAT rate for books and press in foreign languages increases from 5% to 21%, ending a significant reduced rate outside specific language groups.

3. Corporate income tax (UIN) and dividends

📈 * Alongside the existing income tax system, corporate income tax payers whose shareholders are only individuals, when distributing profits as dividends, are offered the option to choose an alternative corporate income tax rate of 15%, while applying personal income tax of 6% to the shareholders’ dividend income.

*Information from the Ministry of Finance of the Republic of Latvia: https://www.fm.gov.lv/lv/izmainas-nodoklu-un-finansu-joma-sakot-ar-2026-gadu

What entrepreneurs need to know about accounting in 2026

For an SIA company, regardless of the type of activity, several obligations must be met when closing the 2025 year:

- Prepare and submit the annual report (balance sheet and profit or loss statement). It must be submitted by 31 May together with the Balance Sheet and P&L statement

- Submit the UIN declaration - if the company is a UIN payer or dividends are paid. It must be submitted by 20 January, by the 20th day of the following month, or by 31 May

- Submit VAT returns - if the company is a VAT payer. They must be submitted by the 20th day of the following month

- Prepare employer tax calculations and payroll reports. The employer report must be submitted immediately or by the 17th day of the following month, the notice on amounts paid to a natural person must be submitted by 01 February or by the 15th day of the following month, while information on employees must be submitted immediately, and salary payments must be made in the following month.

Deadlines are strict - delays may result in significant penalties and sanctions, so it is important to plan accounting in advance.

How to switch to the new pats.lv accounting system

When switching to the pats.lv accounting platform from the start of the year (01/01/2026), you need to complete 3 simple steps:

1. Registration and entering company information

Register on pats.lv and provide all required company information - legal address, registration number, VAT payer status, currency, and other details.

2. Enter opening balances and the balance sheet

Enter your company’s opening balances, balance sheet data, and the required P&L (profit or loss statement) figures. This will allow the system to correctly calculate taxes and prepare reports.

3. Start entering transactions from 01/01/2026

Once everything is initially set up, start entering every transaction from 1 January - invoices, expense receipts, bank payments, and payroll.

Pats.lv will automatically calculate and generate reports - VAT returns, annual reports, tax calculations, and will ensure transparency of accounting data.

Why do entrepreneurs choose pats.lv?

✔ Automation: the system automatically prepares the most important tax reports and declarations:

- Balance sheet

- Annual report

- Profit and loss statement

- Corporate income tax (UIN) declaration

- General ledger

- Transaction journal

- VAT (value added tax) return for the tax period

- Depreciation and write-off calculation for fixed assets and intangible investments

✔ Bank integration: bank payments are automatically imported into the system. You can connect all the most popular banks and financial institutions in Latvia

✔ Payroll module: automatically prepared calculations and reports

- Employer report

- Notice on amounts paid to an individual

- Employee information

✔ Simplicity: the system can be used even without extensive accounting knowledge.

✔ Control: reports and tax data tracking are available 24/7 in one place.

Start using pats.lv with the free plan, issuing up to 10 invoices per month. See how convenient the system is, and then switch to full accounting starting from €7 per month!

Register on pats.lv today and start accounting conveniently and without mistakes.