Convenient accounting done by yourself

Pay annually

Get 2 months free!

Spend less time on accounting

No prior knowledge required

Automatic reports, convenient accounting of income and expenses

Spend less time on accounting

Saves your time

Issue invoices, take pictures of receipts, synchronize bank account

Accounting system designed for small businesses

For the self-employed and individual entrepreneurs

Keep track of taxes, record income and expenses, submit reports, and receive timely reminders.

For companies - Ltd.

Automatic preparation of tax returns (VAT, CIT) and financial reports (Annual report, Balance sheet, P&L). Enter transactions, get automatically prepared reports.

Already more than 20,000 users in Latvia

You just need to enter your data - income, expenses, receipts or invoices, and the system will calculate, sort and remind you of the rest.

Main system features

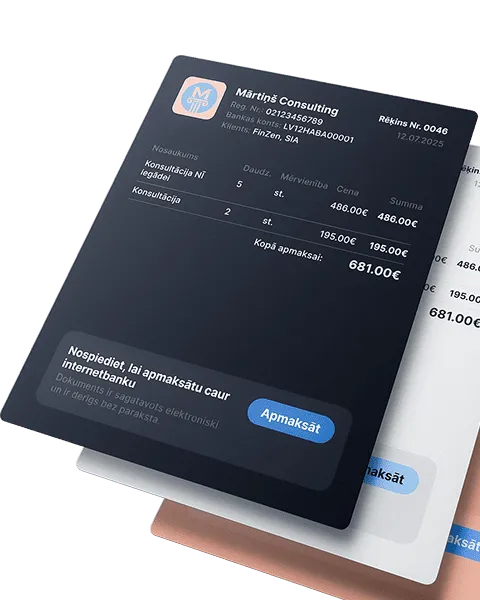

Issue invoices and get paid faster!

Automate the invoicing process, get paid faster, and focus on what truly drives your business forward

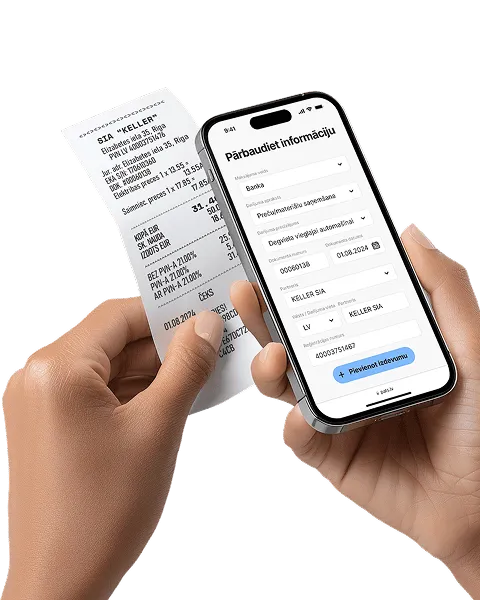

Receipt and invoice scanning

Automation that pays off! Save up to 80% of the time compared to manual data entry

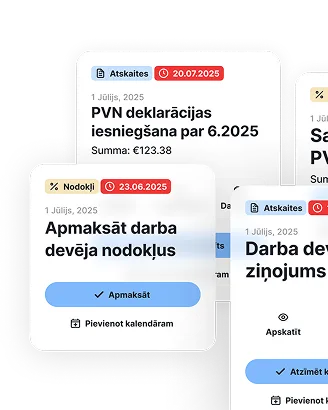

Reporting and tax calendar

All reports and tax declarations are generated automatically - from quarterly to annual. Enter your income and expenses, the system will calculate the taxes - just download and submit

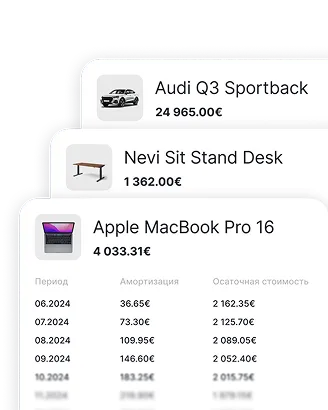

Fixed asset accounting

Enter an asset once - depreciation is calculated automatically, and the data goes straight into the reports

Accept payments without a terminal

Instantly with a QR code or link - perfect for service providers without a cash register. Create an offer, the client scans and pays

Accurate salary calculation every month

Automatically calculates salaries, taxes, and vacation pay, while also preparing all mandatory documents

Bank integration and payment management

The fastest way to manage business transactions - accurately and clearly

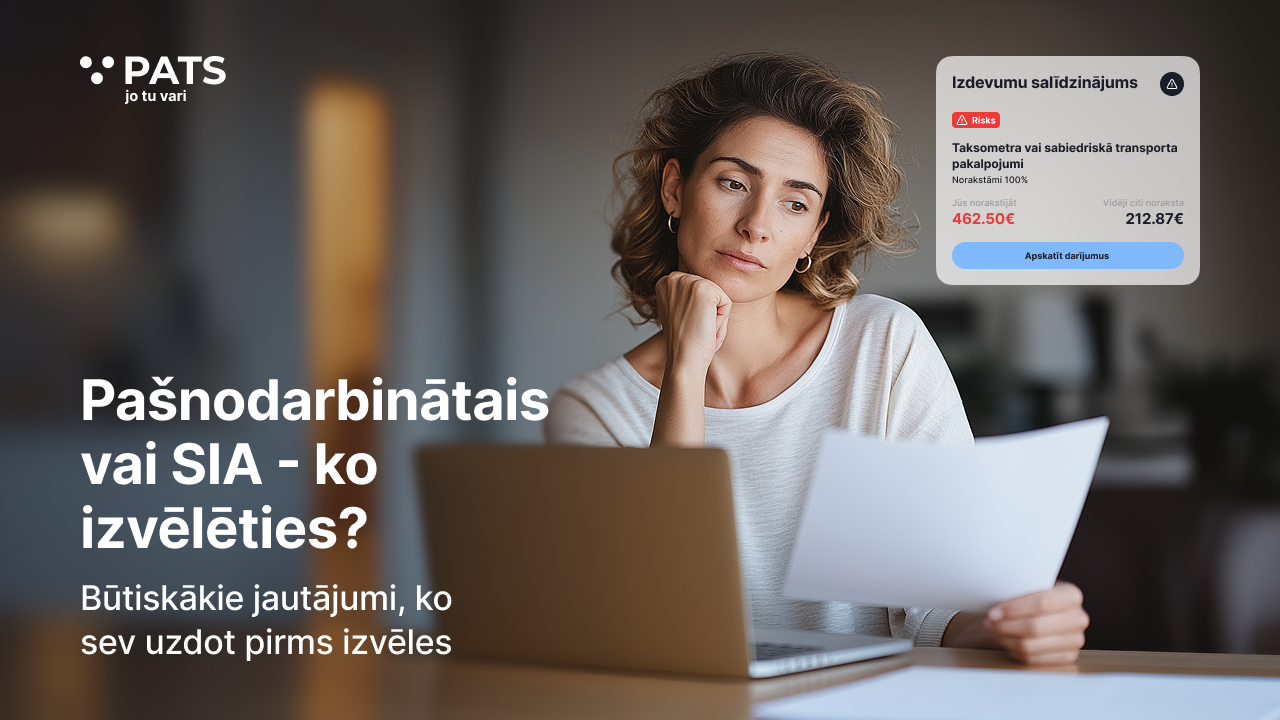

Expense analytics and tips

Analyze your expenses and get smart tips on what can be deducted. Compare with others in your field and avoid missing out

Registration in one minute

Start doing your own accounting! Simple and understandable!

Fewer clicks, faster start. With pats.lv everything starts automatically.

Registration is complete. You have 7 days to try everything.

Company information

Registration completed. You have 7 days to try everything.

- Link account statement

- Add a payment method

- Set up your invoice design

- Enter employee data

Everything’s ready. Where will you start?

An accounting system with all the features you really need

Invoice with your logo in one minute

Choose an invoice design, add your logo, and send it. It looks professional and convincing.

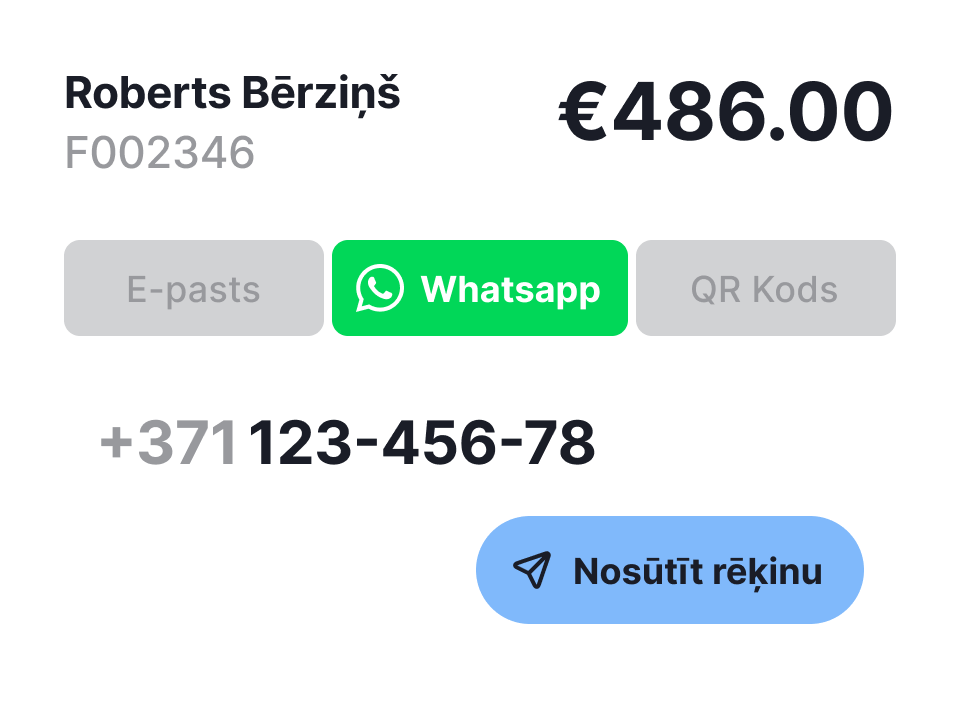

Send invoices to customers in the way that is most convenient for them

Choose how to send the invoice: via email, WhatsApp or as a QR code. Fast, convenient and without unnecessary effort on your part.

See how much you have to pay each month

VAT, PIT and social contributions in one place. Compare periods and follow changes in taxes in a single view.

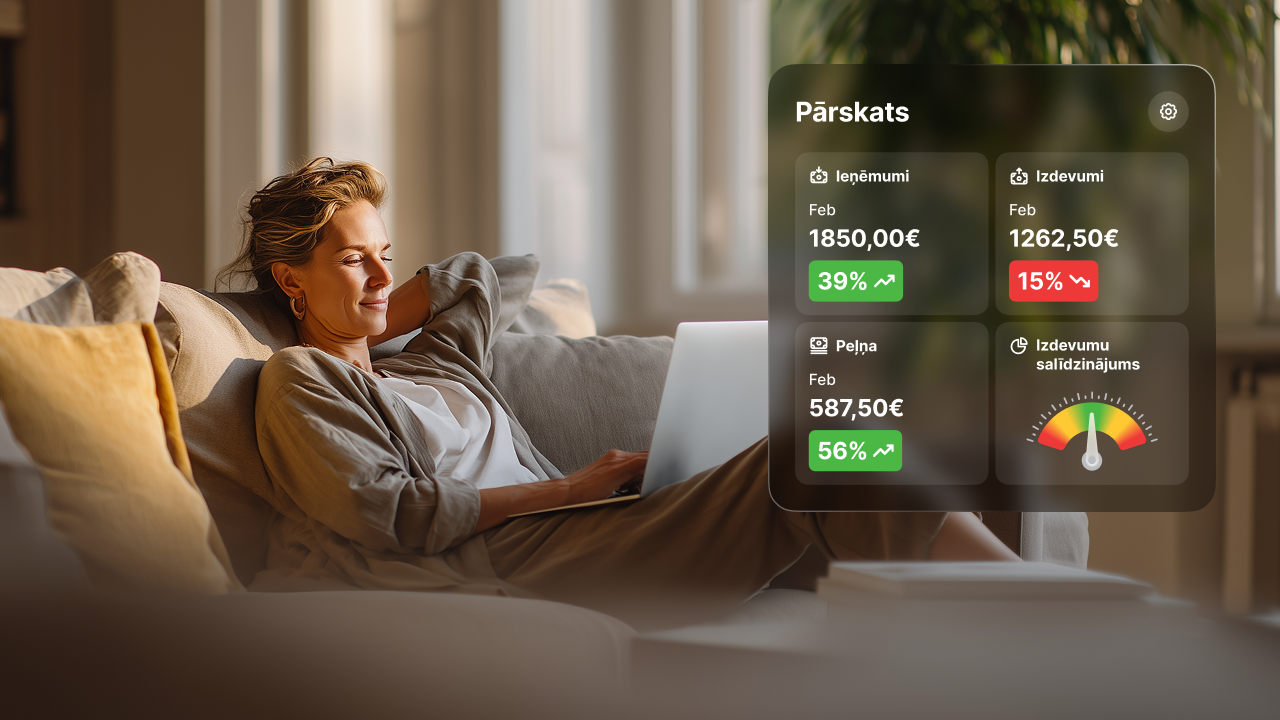

Always see how much you have earned

Income, expenses and profit - visibly presented.

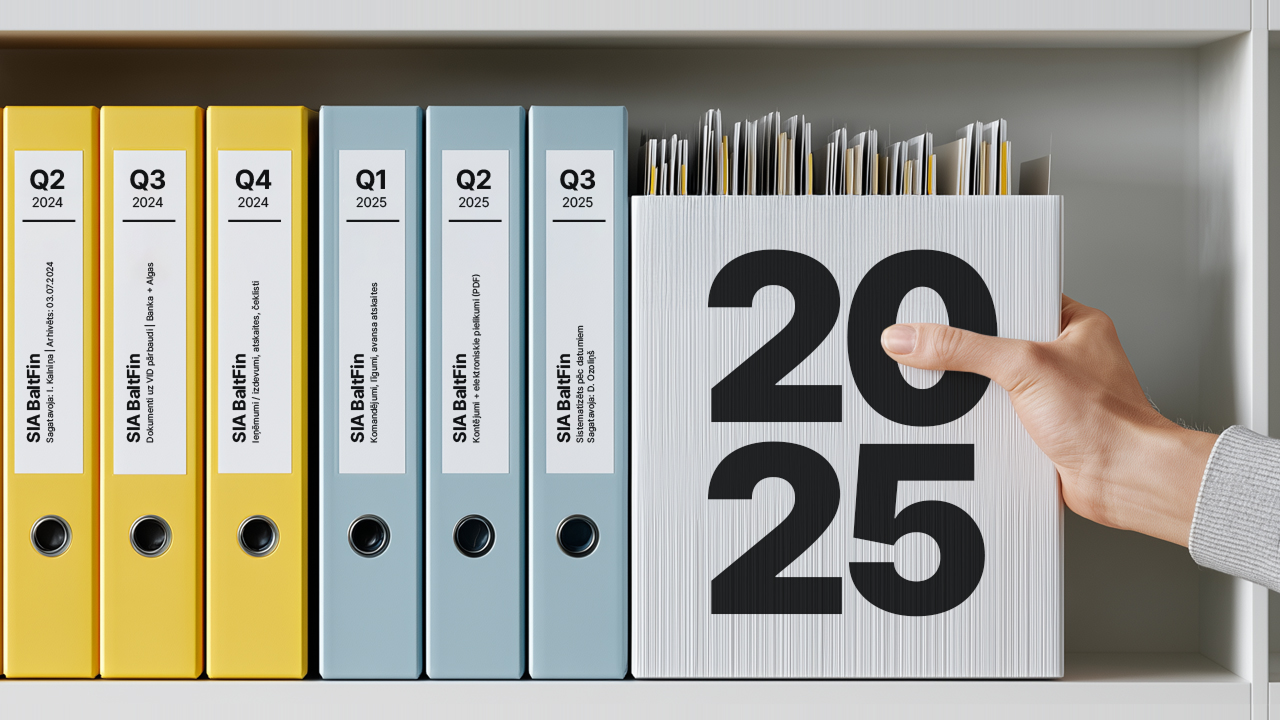

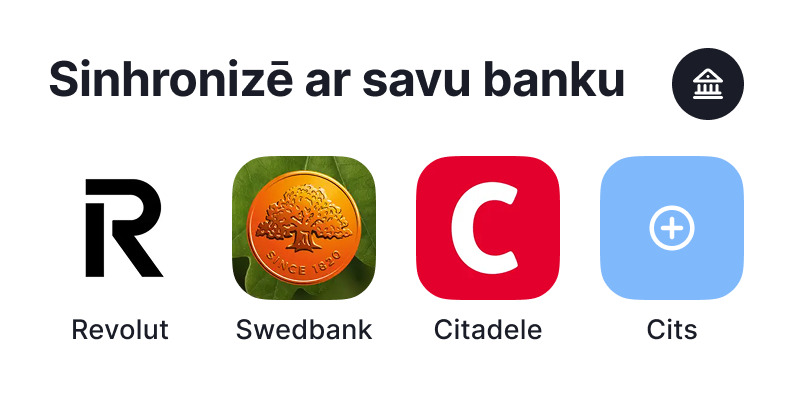

Synchronize your accounting with the bank

All transactions under control - much more convenient to keep records. Less manual work!

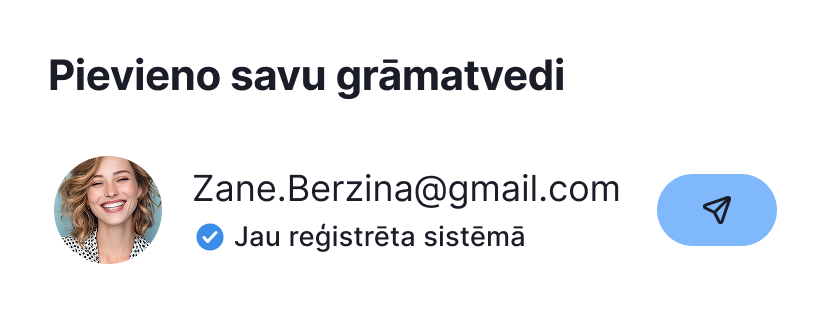

If necessary - add your accountant

The accountant sees transactions, account statements. No need to search for files, no unnecessary communication - everything is transparent.

The salary module is here

Forget about the calculator. Calculate salaries, hours worked and vacations automatically.

Tax deadlines - always visible

Reminders about deadlines. Mark as completed or add to calendar - everything is under control.

Start and feel the difference

From employee to owning your own salon

Invoices, tax calculations, reminders - everything happens automatically. No more Excel or manual work.

From hobby to first orders

See how much you earn and where you spend. Use recommendations based on data of similar users to write off expenses correctly and safely.

Student combines studies and work

VAT, quarterly and other reports are prepared automatically and are available for submission at the required time.

How sewing turned into an international business

Invoices with payment status - see what has been paid, what is overdue and where to take action. No mistakes. No uncertainty.

We work together with market leaders

What customers say

How much does it cost

Functions

- 10 document scans

- Invite accountant

- Catalog of services and products

- Access to documents - 90 days

Invoices

- 10 invoices per month

- Language selection

- Invoice design selection

- Adding your own logo

- Electronic invoice

- Payment button directly in the invoice

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

Get only what matters. Only what you need.

Frequently asked questions

Our team will always support you

Accounting is under control. You’re in the right place.

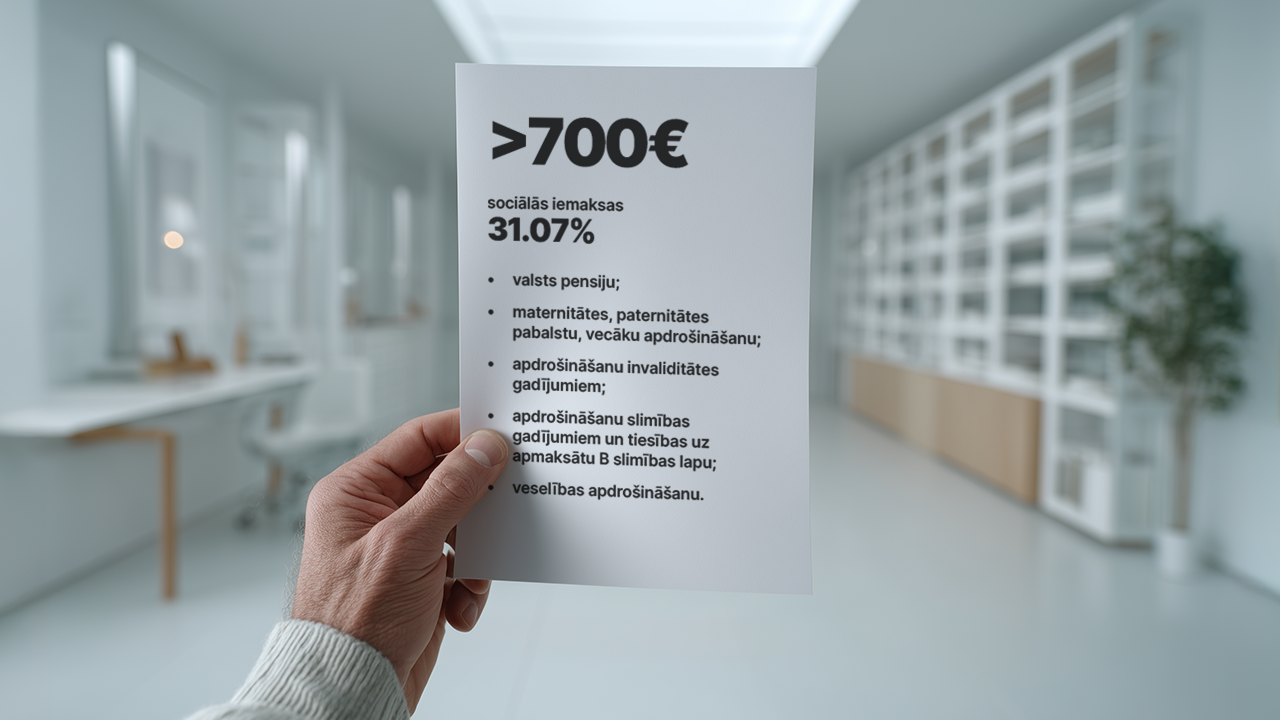

Don't know how many taxes you must pay?

- social tax

- total employer expenses

- Net salary for an employee or self-employed person