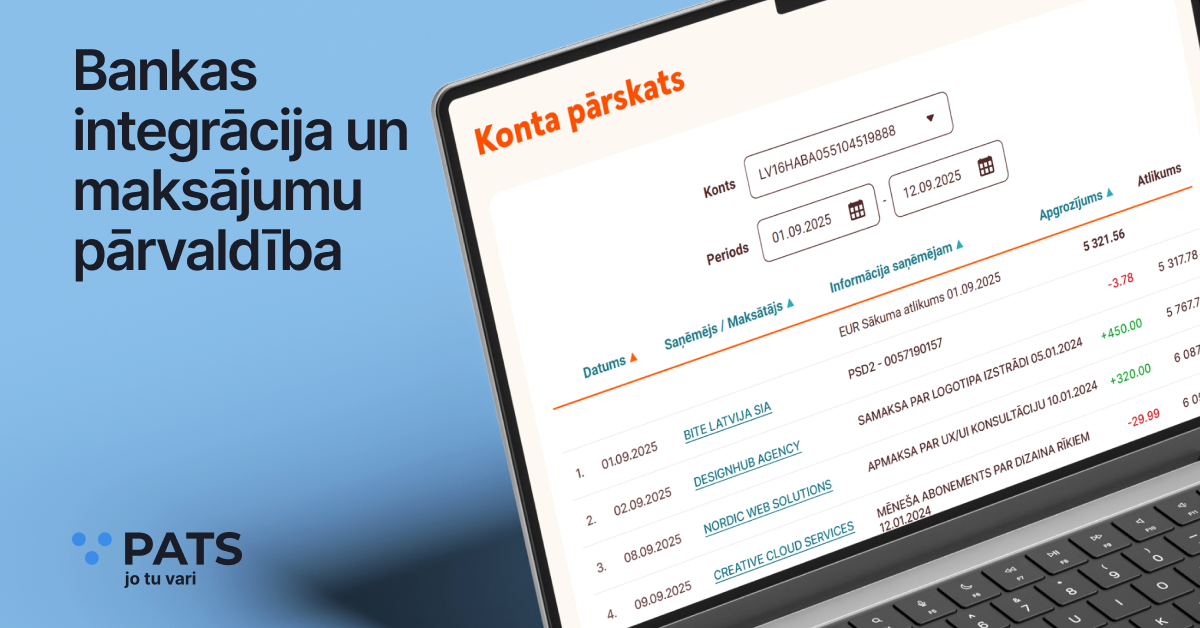

Bank account integration with the accounting system

In modern business, time is one of the most valuable currencies. The less time we spend on routine tasks, the more time we have for business growth. That is why bank account integration with the accounting system has become one of the most important features for small LTDs (SIA) and self-employed individuals to automate accounting.

How does it work?

- A Pro or Premium user adds a bank account in the “Bankas” section by authenticating through their internet bank.

- Once the account is synchronized, all transactions are visible in the system.

- All that’s left is to review and approve the transactions.

By synchronizing your bank account with the accounting system, all income and expenses automatically appear in one place. There’s no need to search for transfers in online banking or enter data manually – the system reads everything itself. All you have to do is approve, and the transaction is recorded.

Main advantages

1. Everyday convenience

- Transactions from the bank are displayed automatically.

- No need to rewrite transactions or upload PDF statements.

- Expense tracking becomes faster and clearer, all receipts in one place.

2. Security without compromise

Integration is done through a licensed PSD2 service provider – this means your login data is never stored and is always safe. All connections are encrypted and only take place through trusted channels.

3. Collaboration with an accountant

If you use the system together with an accountant, bank integration is a huge relief. The accountant no longer has to ask you to send bank statements or even give them access to your account (yes, this practice still exists!). All transactions are immediately visible in the system – safe and convenient for both the user and the accountant. No more reminders, authorizations, or unnecessary bureaucracy.

4. Less manual work, fewer errors

When everything is in one place – invoices, expenses, and bank transactions – it becomes much easier to match them. An issued invoice in the system is immediately linked with the incoming bank payment. An expense receipt? That also appears in the overall records. The result – less manual data entry, fewer errors, and greater time savings.

Bank account integration available in Pro and Premium plans

Bank account integration is available in our Pro and Premium tariff plans. We also recommend using other features included in these plans – for example, receipt scanning and automatic field recognition. Automatic depreciation of fixed assets has also been recognized as very useful by most users.

To raise your customer service level, the Premium plan also offers the option to ask an expert a question, as well as the additional Receive Payments feature – a digital alternative to a POS terminal that allows you to accept payments instantly using a QR code or payment link (button in the invoice), making it easier and faster for your clients to pay invoices.

Why is this important?

If you are already managing your accounting, bank account integration will help you realize how much time and effort you can save when all transactions (income and expenses) are automatically and accurately recorded. A secure and modern approach that reduces errors and makes accounting more transparent.

And if you are only planning to become self-employed or register an LTD (SIA), you can already understand how much simpler accounting can be and how many processes can be automated. Every entrepreneur sooner or later faces the question – how much money do I have available right now? For example, to buy equipment or invest in advertising. How much more convenient it is to see this information anytime instead of calculating manually, computing taxes, comparing with a bank statement, or waiting for an accountant to do it.

If you are only planning to start your business – pats.lv is a reliable partner

If you are only planning to start your business, use the comparison calculator to help choose the most suitable business form and tax regime. In addition, we have prepared step-by-step guides on how to become self-employed or register your LTD.

The first steps are some of the most difficult – pats.lv is a reliable partner. Many of our system’s functions will simplify these steps – from creating and sending invoices to automatic reports based on the income and expenses you enter. Our blog offers a wealth of useful information, including video instructions for each function and text guides both for features and for practical accounting tips.

We will be happy if you register and try all the features. All users are offered a 7-day free trial. Our system is designed to be usable even without prior accounting experience.